JUST IN: ![]() Senator Ted Cruz says he purchased 3 Bitcoin miners that started mining in Texas

Senator Ted Cruz says he purchased 3 Bitcoin miners that started mining in Texas

@WatcherGuru

JUST IN: ![]() Senator Ted Cruz says he purchased 3 Bitcoin miners that started mining in Texas

Senator Ted Cruz says he purchased 3 Bitcoin miners that started mining in Texas

@WatcherGuru

The State of Wisconsin Investment Board’s (SWIB) initial investment of $164 million in spot bitcoin exchange-traded funds (ETFs) like BlackRock’s iShares Bitcoin Trust (IBIT) and Grayscale’s Bitcoin Trust (GBTC) is likely just a trial phase, according to David Krause, a finance professor at Marquette University.[1][3] Krause believes the SWIB, known for being innovative, is testing public reaction and assessing potential resistance to owning bitcoin.[1][3] He expects the SWIB to increase its bitcoin ETF holdings, as the current investment is negligible at around 0.1% of its $156 billion portfolio.[3][5] Krause views this as a “toe in the water” approach, anticipating the SWIB to gradually raise its bitcoin exposure to 1-2% of its portfolio.[1][2]

Sources

[1] Wisconsin Pension Plan Likely to Invest Much More in Bitcoin ETF, Marquette Professor Says Bitcoin ETF (BTC) Purchases for Pension Funds Just Getting Started

[2] BREAKING: Wisconsin Pension Plan Poised for Larger Bitcoin ETF … https://cryptoadventure.com/breaking-wisconsin-pension-plan-poised-for-larger-bitcoin-etf-investment-can-it-propel-btc-price-to-new-ath/

[3] Wisconsin Pension Plan Likely to Invest Much More in Bitcoin ETF … Yahooist Teil der Yahoo Markenfamilie

[4] Wisconsin pension fund now includes bitcoin - WPR Wisconsin pension fund now includes bitcoin - WPR

[5] Wisconsin Pension Buys $160 Million in Bitcoin ETFs Wisconsin Pension Buys $160 Million in Bitcoin ETFs | Chief Investment Officer

[6] David Krause on WRS investing millions into a Bitcoin ETF https://pbswisconsin.org/news-item/david-krause-on-wrs-investing-millions-into-a-bitcoin-etf/

I recommend everyone should have one percent bitcoin allocation in their portfolio.

Strike app is an easy cheap way to buy bitcoin.

Another way to get bitcoin exposure is fidelity ETF or micro strategy MSTR. I prefer MSTR over bitcoin ETF.

I personally own a lot of MSTR in my Roth IRA because setting up a bitcoin retirement account is a pain.

To summarize: one percent bitcoin or MSTR allocation

I have a friend whose allocation is 90 percent bitcoin and 10 percent cash. He rebalances this portfolio once a month.

I don’t recommend a 90 percent allocation. My friend has a high tolerance for volatility. He is a software engineer who paid off his mortgage in 15 years. He lives in Texas which is now the hub for bitcoin mining in USA.

I live in California where it’s annoying to be a property owner. I have thought about selling my real estate investments and buy more bitcoin. But I am crazy and can stomach volatility. Ever since the dot com crash in 2000 and the great financial crisis in 2008. Plus the crazy volatility of bitcoin since inception

This is not investment advice.

This is a friendly recommendation.

Feel free to direct message me if you have any questions

My friend in Argentina can confirm almost everything Devon wrote

Page 9, Champion Innovation

JUST IN: ![]() Donald Trump’s Vice President JD Vance previously disclosed Bitcoin holdings up to $250,000.

Donald Trump’s Vice President JD Vance previously disclosed Bitcoin holdings up to $250,000.

WatcherGuru

edit:

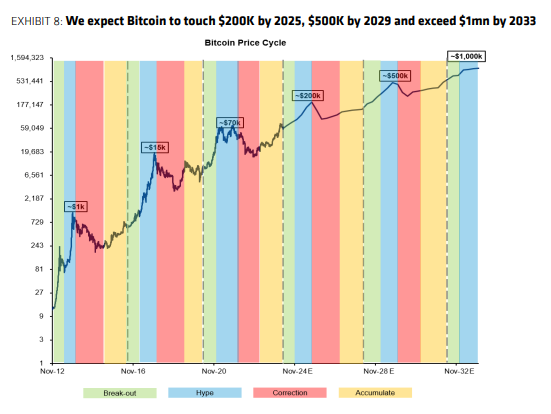

Alliance Bernstein analysts predict:

We’ll see.

One thing is certain: The supply of dollars is increasing at a much faster rate than the supply of bitcoin.

A maximum of 21 million bitcoin can be created, of which approximately 1 million are believed to be owned by Satoshi Nakamoto and 4 million or more are estimated to have been lost, leaving the effective maximum supply at 16 million bitcoin. Owning 1 bitcoin means you own at least one sixteen-millionth of the total bitcoin that will ever be in circulation. How many dollars would you need to possess to have one sixteen-millionth of the total supply of dollars? The U.S. government reportedly holds around 200,000 bitcoin. What other asset could you own a larger fraction of, relative to the U.S. government’s holdings?

My prediction for Dec 31, 2024 is $85,000

edit:

Bernstein:

The analysts also initiated coverage on MicroStrategy stock with an outperform rating, targeting a price of $2,890.

I have never heard that. In what way or account? The US treasury has purchased bitcoin?

Law enforcement confiscation

Like DEA confiscating mansions and Ferrari during the 1980s from cocaine dealers

Edit:

They have had auctions to sell bitcoin in the past. That’s how Tim Draper purchased most of his bitcoin.

added:

When you hear tptb talk about crypto being used to sponsor terrorism or criminal acts, just ask yourself if they respect the bill of rights that they took an oath to uphold?

They somehow know a person is a criminal without trial. How does that work? That is how they confiscate property. Of course crypto is used and so is every currency and gold. So what is different? Bitcoin cannot be confiscated without trial. They cannot trace it as easy. Tracking people’s money is unconstitutional and I don’t give a crap what judges or Yale law professors say. It is far more invasion of privacy than caring about what goes on in someone’s bedroom.