Here is the SEC Schedule 13D/A Amendment 2 announcing the offer.

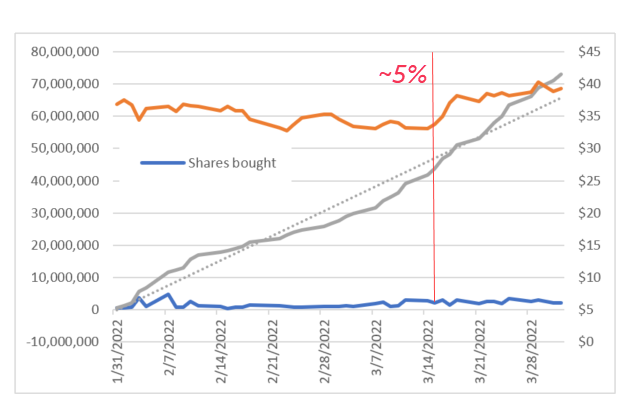

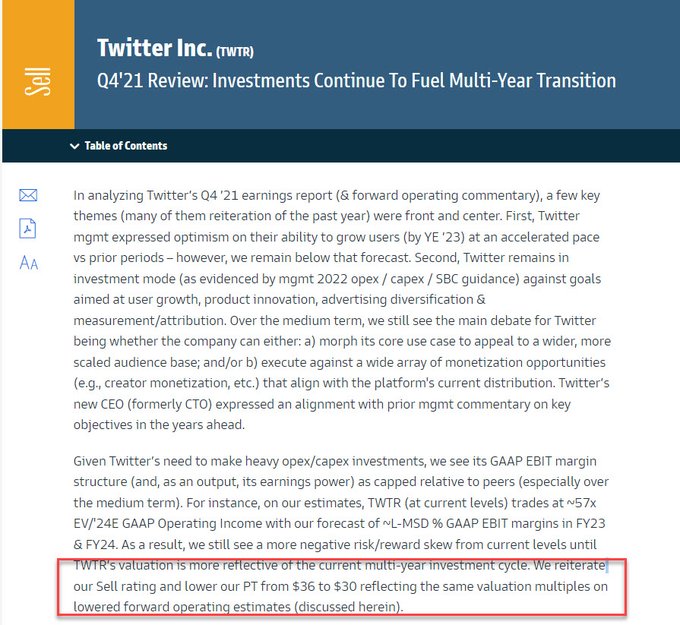

On April 13, 2022, the Reporting Person delivered a letter to the Issuer (the “Letter”) which contained a non-binding proposal (the “Proposal”) to acquire all of the outstanding Common Stock of the Issuer not owned by the Reporting Person for all cash consideration valuing the Common Stock at $54.20 per share (the “Proposed Transaction”). This represents a 54% premium over the closing price of the Common Stock on January 28, 2022, the trading day before the Reporting Person began investing in the Issuer, and a 38% premium over the closing price of the Common Stock on April 1, 2022, the trading day before the Reporting Person’s investment in the Issuer was publicly announced.

The Proposal is non-binding and, once structured and agreed upon, would be conditioned upon, among other things, the (i) receipt of any required governmental approvals; (ii) confirmatory legal, business, regulatory, accounting and tax due diligence; (iii) the negotiation and execution of definitive agreements providing for the Proposed Transaction; and (iv) completion of anticipated financing.

There can be no assurance that a definitive agreement with respect to the Proposal will be executed or, if executed, whether the transaction will be consummated. There is also no certainty as to whether, or when, the Issuer may respond to the Letter, or as to the time table for execution of any definitive agreement. The Reporting Person reserves the right to withdraw the Proposal or modify the terms at any time including with respect to the amount or form of consideration. The Reporting Person may, directly or indirectly, take such additional steps as he may deem appropriate to further the Proposal.

If the Proposed Transaction is completed, the Common Stock would become eligible for termination of its registration pursuant to Section 12(g)(4) of the Securities Exchange Act of 1934, as amended, and would be delisted from the New York Stock Exchange.

Here is the letter Elon Musk sent to Twitter chairman of the board Bret Taylor.

Bret Taylor

Chairman of the Board,

I invested in Twitter as I believe in its potential to be the platform for free speech around the globe, and I believe free speech is a societal imperative for a functioning democracy.

However, since making my investment I now realize the company will neither thrive nor serve this societal imperative in its current form. Twitter needs to be transformed as a private company.

As a result, I am offering to buy 100% of Twitter for $54.20 per share in cash, a 54% premium over the day before I began investing in Twitter and a 38% premium over the day before my investment was publicly announced. My offer is my best and final offer and if it is not accepted, I would need to reconsider my position as a shareholder.

Twitter has extraordinary potential. I will unlock it.

The letter quoted the following “Script” of a conversation, presumably with Taylor.

[SEND VIA TEXT]

As I indicated this weekend, I believe that the company should be private to go through the changes that need to be made.

After the past several days of thinking this over, I have decided I want to acquire the company and take it private.

I am going to send you an offer letter tonight, it will be public in the morning.

Are you available to chat?

[VOICE SCRIPT]

-

Best and Final:

a. I am not playing the back-and-forth game.

b. I have moved straight to the end.

c. It’s a high price and your shareholders will love it.

d. If the deal doesn’t work, given that I don’t have confidence in management nor do I believe I can drive the necessary change in the public market, I would need to reconsider my position as a shareholder.

- i. This is not a threat, it’s simply not a good investment without the changes that need to be made.

- ii. And those changes won’t happen without taking the company private.

-

My advisors and my team are available after you get the letter to answer any questions

a. There will be more detail in our public filings. After you receive the letter and review the public filings, your team can call my family office with any questions.

Twitter has around 800.16 million shares outstanding. Subtracting the 72.7 million Musk already owns, at the offer price of US$ 54.2 per share, the total value of the buy-out is US$ 39.43 billion.

Musk has retained Morgan Stanley to advise in the transaction.