I think a lot of what was going on here is a trap to which initially successful entrepreneurs are particularly vulnerable, which I call “confusing luck with insight”. Many ventures that succeed, regardless of how innovative their content and hard-working those that create them may have been, did so in part because they happened to have been started at the right time, often not perceived as so by those involved.

For example, if we had started Autodesk two years before we founded the company in 1982, computers which were affordable by those who ended up buying AutoCAD were far too slow and/or limited in graphics capability to do useful work. The company would have run out of money or been abandoned by the founders as “not going anywhere” before capable machines came on the market. If we’d started two years later, in 1984 or 1985, we’d have been faced with a competitive landscape in which the established mainframe and workstation CAD vendors, including IBM, Computervision, and Intergraph, were launching their PC-based products, and a pipsqueak in Marin County with no money to spend on advertising and promotion wouldn’t have had a chance getting into the market.

AutoCAD became a success because it launched at the time the IBM PC and its many competitors created a market which drove down the price of PC-based graphics, meaning a program like AutoCAD could run on a computer our prospective customers could afford. (When I say “run”, that’s “barely run” for the original IBM PC with a Hercules monochrome graphics card. But its performance was sufficient for the early adopters whose purchases allowed AutoCAD to obtain a leading market share and be perfectly positioned when the IBM PC/AT and the many Intel 80286-based clones came on the market in 1984, which were ideal platforms for AutoCAD 2.0 [later retconned as “Release 5”], which is when AutoCAD really “took off” as a mass market product.)

Now, I’m sure some analysts admired how prescient we were to launch AutoCAD at just the right time in the technological and commercial evolution of the personal computer hardware market. But I was there, and we weren’t. Autodesk was founded and AutoCAD launched at the time they were for entirely different reasons (about which I wrote [or compiled] a whole book), and the fortuitous timing was just that—pure dumb luck, and I’ve always appreciated that and tried to avoid thinking we could “do it again” by pure insight and hard work.

Now, how does this apply to financial blow-ups and FTX in particular? It comes down to another of my favourite aphorisms: “In a bull market, everybody is an investment genius”. FTX and the numerous crypto blow-ups which preceded (and will follow) it “matured” during one of the greatest bull markets in human history: Bitcoin’s run from essentially zero (the first recorded commercial transaction in Bitcoin was on 2010-05-22, when Laszlo Hanyecz bought two Papa John’s pizzas for BTC 10,000) to US$/BTC 69,044.77 on 2021-11-10 was a gale force wind in which even turkeys can fly (for a while). In such an environment, even the most foolish “strategies” involving absurd amounts of leverage, un-hedged risk exposure, and speculation in derivative or copycat “assets” seem to work magically, and the FTX folk, the “smartest people in the room” just like their predecessors at Enron, came to believe the profits were flowing from their genius, not raining into their randomly-placed buckets from a once-in-a-generation bull market. As Warren Buffet observed, “Only when the tide goes out do you discover who’s been swimming naked.” Well, the tide went out on FTX.

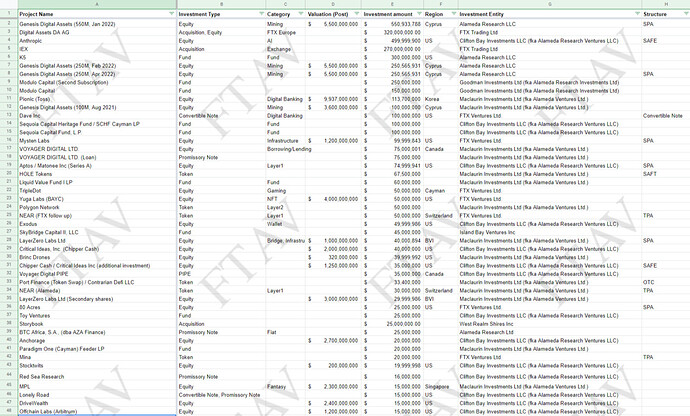

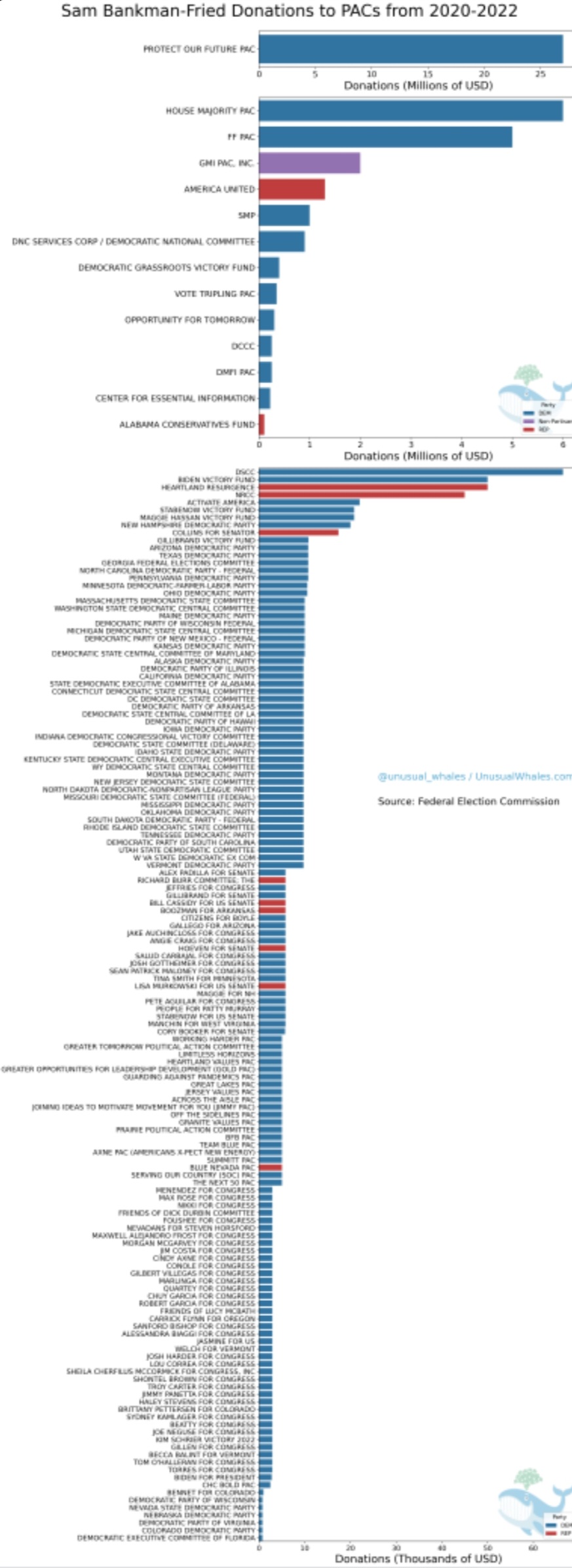

There may have been fraud, security law violations, and other criminality in FTX’s operations, but it is often the case that the venture was not a criminal enterprise from inception, but rather one whose founders believed was built on a firm foundation rather than wafted in the air by a bull market. The criminality often comes later as the tide starts to go out and increasingly desperate measures are deployed to try to paper over the losses and “trade out of the corner”.

Desperation when the market turns against you is enough to make a fellow confuse shrimp with a vegetable.