Goldman notes,

One failsafe gauge of global systemic risk is the price of gold, and especially the price of gold relative to alternative hedges against unexpected inflation. Between 2007 and 2021, the price of gold tracked inflation-indexed US Treasury securities (“TIPS”) with a correlation of about 90%.

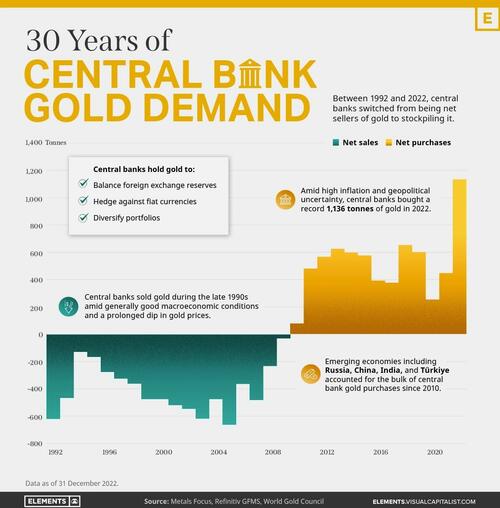

One of the reasons for the breakdown in this long-standing correlation between TIPS and gold is demonstrated by the following chart.

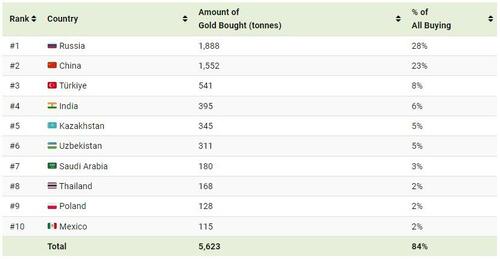

Through the 1990s and until 2008, central banks around the world were net sellers of gold, dumping the asset Keynes called a “barbarous relic” in favour of interest-bearing reserves in currencies such as the U.S. dollar. The financial collapse of 2008 represented a phase transition in the behaviour of central banks. In every year since then, central banks have been net purchasers of gold, with most of the buying coming from “emerging economies” such as Russia, China, the Turkey, and India. Here are central bank purchases from 1999 through 2021. (These are self-reported figures, and some believe that China may have added substantially more to its reserves from domestic production and off the books purchases.)

Based upon official reports, Russia dropped out of the buying binge in 2022, while China bought another 60 tonnes.

However, note that of the total 1136 tonnes bought in 2022, 741 tonnes—65%—were “unreported”: nobody knows who’s buying.

It seems to me that what’s happening is a general and growing mistrust of all fiat currencies. Here is the price of gold in many of the major trading currencies—note the similarity. (These charts cover available data, and hence the time axis differs among them; the U.S. dollar chart covers 1935 to the present, while the Chinese yuan chart only goes back to 2011.)

Details vary, but what is obvious is that all of these currencies, regardless of their fluctuations against one another, have been depreciating against gold. If you were a central banker, which would you want to hold? (Well, that’s a bad way to phrase it, because if you were a central banker, you’d be an idiot, tool of your political masters, and evil as well, so you probably wouldn’t draw the obvious conclusion.)

James Rickards, author of Currency Wars and The Death of Money, has described the U.S. dollar’s dominance in international trade and central bank currency reserves as in part a historical legacy from the postwar Bretton Woods system and the dollar’s being “the best horse in the glue factory”. As the aftermath of the 2008 financial crisis continues to percolate through the system (in particular, the financial repression that drove interest rates in most major currencies to near zero for more than a decade, destroying the advantage of holding these fiat currencies as reserves), central bankers may be increasingly looking outside the glue factory for alternatives.