Last Thursday, Aswath Damodaran published his updated valuation for Twitter, using financial data as of April 4, when Musk announced his initial position.

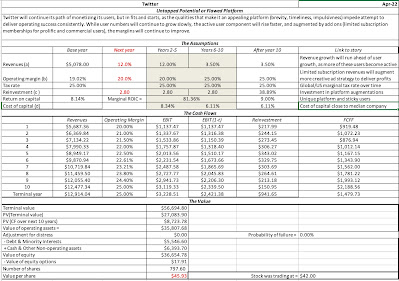

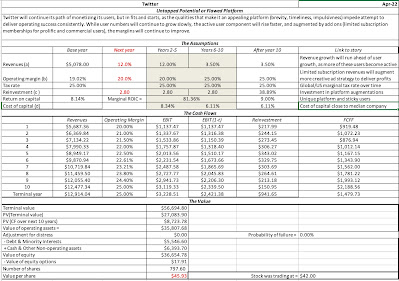

I valued Twitter on April 4, at about the time that Musk announced his 9.2% stake, updating my story to reflect a solid performance from the company in 2021, and with Parag Agrawal, its newly anointed CEO:

Spreadsheet with Twitter Status Quo Value

In my story, which I view as upbeat, given Twitter’s inability to deliver on operating metrics in the last decade, I see continued growth in revenues, with revenues reaching almost $13 billion in 2033, and a continued increase in operating margins to 25%, not quite the levels you see at the dominant online advertising players (Facebook and Google), but about what you would expect for a successful, albeit secondary, online advertising platform. (Note that I am capitalizing R&D expenses to give the company healthier margins right now, to begin my valuation). The value per share that I obtained was about $46, $ 4 higher than the prevailing stock price, but below Musk’s acquisition offer of $54.20.

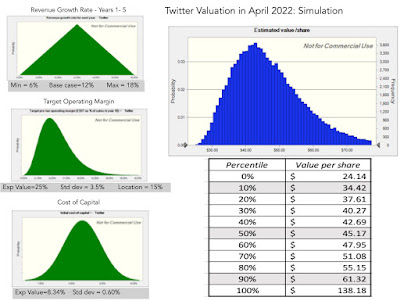

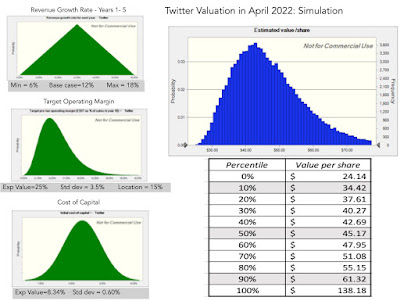

To the critique that revenue growth could surprise and that margins could be higher, my answer is of course, and to incorporate the uncertainty in my inputs, I fell back on one of my favored devices for dealing with uncertainty, a Monte Carlo simulation. I picked three variables, the revenue growth over the next five years, the target operating margin and the initial cost of capital, to build distributions around, and the results of the simulation are below:

The median value in the simulation is $45.17, close to the base case valuation, but at least based on my estimates, Musk’s offering price is at the 75th percentile of value. It is possible that the value could be higher but making that is not a particularly strong argument to make, if you are Twitter’s board.

If I am reading this correctly, Musk’s offer is on the high side if one considers only the underlying financials of Twitter along with other generous assumptions. In his post, Damodaran goes on to reflect on other factors.