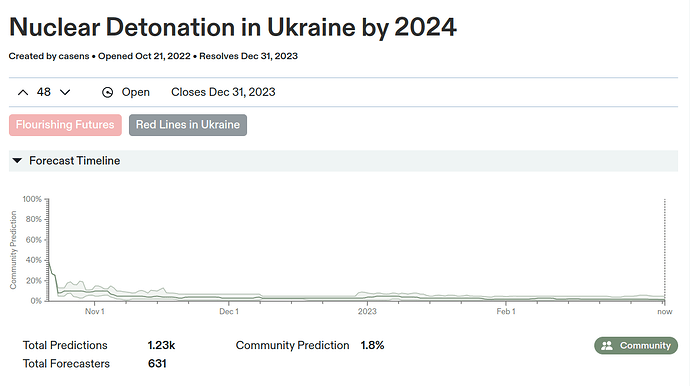

I’ve previously pointed out the fact (and it is an admitted fact – against interest) that the prediction “markets” (at least the ones that aren’t real money markets) fail at the extremes of probability 0 and 1. That said, Metaculus has nearly a 1 in 50 chance of Putin nuking Ukraine this year:

If this is the “true” probability, there is no way the financial markets have discounted this risk of a “black swan” event IN THE NEXT YEAR!!!

Pascal’s Scams, as I’ve also previously discussed, involve extremely low probability events with enormous conditional absolute value – but IF we are going to tolerate enormous concentrations of wealth/power, THEN we must also insist that the fiduciaries possessing that wealth/power perform due diligence to discount those probabilities.

I’m sure that many would say prediction markets that end up with probabilities like 2% for nukes detonated in anger in the next year should not be taken seriously because those prediction markets aren’t designed for black swans.

Very well…

But that leaves the question:

Where is the work on prediction markets that attempts to overcome their weakness at the extreme probabilities of 0 and 1?

Now, I can understand in the case of government concentration of wealth and power since it is that very concentration that results in brain damaging insularity from consequences. There is no hope that the conventional minds ruling the world will be capable of so-disciplining themselves.

However, reading through “The Powers of the Earth” by Corcoran how crucial prediction markets are in the mythos of anarcho capitalists, one should certainly expect anarcho capitalist literature to have addressed this weakness of prediction markets. This is particularly to be expected since anarcho capitalists have no difficulty with enormous centralizations of wealth (hence power), so at the very least there will be fiduciaries answerable to stockholders for such due diligence.

Hello? Is anybody out there?