Could Korea be a special case, with the chance that the crazy fat boy could invade or lob a few nukes at any time?

Illya is almost there. We shall see if he can put 2+2 together assuming he doesn’t succumb to CrimeStop.

Musk isn’t even in the running to seriously address macrosocial causality – not even if he focused xAI on plummeting TFR in the developed world, if the posts I see of his employees that he’s hired there are any indication. Given that he apparently couldn’t hire Illya it’s too bad he didn’t hire me when I applied.

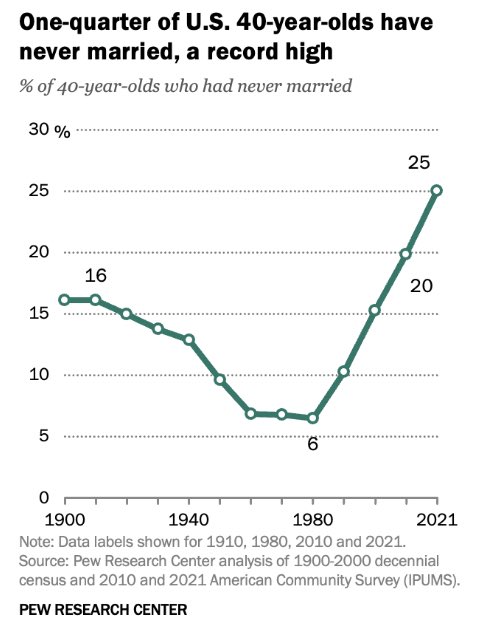

Things aren’t going so well in the US either.

The root causes of this talent outflow are systemic. South Korean universities suffer from frozen tuition fees, stagnant faculty salaries and a rigid seniority-based pay system.

While public and private universities struggle to maintain competitive compensation, top global universities are actively headhunting Korean talent. A professor making around 100 million won ($73,000) in Seoul may receive an offer of over $330,000 abroad.

“With a salary gap of over four times, considering the benefits of doing research with abundant resources and receiving support for housing, there is really no reason to turn down a really good offer,” an assistant professor researching in AI who wished to be anonymous told The Korea Herald.

edit:

South Korea’s maximum inheritance tax rate is 50%, the second-highest among OECD countries after Japan’s 55%, and double the OECD average of 25%. In comparison, the U.S. offers a substantial unified credit for inheritance and gift taxes, allowing a couple to receive a deduction equivalent to approximately $26.22 million (35 billion won). This makes the U.S. an attractive destination for those looking to minimize their tax burdens.

add:

add:

From co-pilot…

Key Property-Related Taxes for Investors in South Korea

Key Property-Related Taxes for Investors in South Korea

- Acquisition Tax: Ranges from 0.6% to 4.6% of the purchase price. Higher rates apply if you’re buying multiple homes or luxury properties.

- Annual Property Tax: Levied by local governments, typically 0.5% to 4% of the assessed value. Again, the rate increases with the number of properties owned.

- Comprehensive Real Estate Holding Tax: This is where it gets steep. For owners of high-value or multiple residential properties, this additional annual tax can push the total burden significantly higher.

- Capital Gains Tax: If you sell a property, expect a progressive tax based on how long you held it. Short-term sales (under 2 years) can be taxed at up to 70%, while long-term holdings get deductions up to 30% after 10 years.

- Rental Income Tax: Ranges from 6% to 42%, depending on income level. There are two methods for calculating taxable rental income, but both can be complex and offer limited deductions.

Why the System Feels Tough on Investors

Why the System Feels Tough on Investors

- The government has used tax policy as a tool to cool speculative demand and stabilize housing prices, especially in Seoul.

- Multiple-home owners are targeted with higher rates to discourage hoarding and flipping.

- Foreign investors face the same tax rates but must also navigate additional reporting requirements under the Foreign Exchange Transactions Act.

And again I’m here to point out that the most politically divisive thing anyone can do is conflate wealth and income. It is so utterly moronic to conflate a function with its first derivative that one can only conclude the economics profession is a deliberate fraud.

To the best of my knowledge* I am the only person who has ever studied extending the Georgist single tax on land value to all assets liquidation value**.

* and I have been looking for over 30 years.

** let alone defining that as the monetary base.

I agree and I did not mean to conflate income and wealth, clearly net worth is more important than income

I apologize if I gave the wrong impression

NP You just gave me an opportunity to get on my hobby horse and do a lap.

And by the way if anyone wants to help Musk actually win an election with the American party they should encourage him to take a look at my 1992 proposal to privatize delivery of social goods through a single tax on liquidation value of net assets (if not militia.money). I did after all come up with that after testifying before Congress about privatizing space launch services as an alternative to war.

If nothing else it should flush the rent seeking parasites that have infested the US nervous system from India.

Really? Net worth is an estimate of what someone else will pay for whatever asset an individual claims to have. The only time “net worth” becomes real is when an individual liquidates his assets. Then that individual actually knows what his net worth was at the point in time when he wanted to (or was forced to) sell.

To point to an example – Bezos has a very high net worth, based in large part on his ownership of large amounts of stocks in companies. The price of a stock certificate might be $x today – but if Bezos tried to sell all his stock at once, supply of that stock on the market would greatly exceed demand, and the price of the stock would collapse. So what is Bezos real net worth?

Income is real – today. But there is no guarantee that tomorrow’s income will match today’s, for a myriad of reasons.

Real wealth is the capacity to grow/make products and deliver services for which there is genuine continuing demand from other productive citizens – and even there changes in technology & politics can destroy real wealth very quickly.

Hence the need for another monetary system in which net worth is assessed by high bids and escrow for both assets and liabilities: ruthless mark-to-market.

The 1992 paper did mention a market mechanism for liquidation but it was only in passing and not well thought out.

See “property money” thence militia.money as the sexual crisis manifest in total fertility rate collapse became paramount.

Bezos stock is ownership of just such a business.

Supply and demand drive price of oranges, screw drivers, houses as well as publicly traded ownership of a business. Therefore you are correct that the pace of selling assets when you have a large portion could impact the price and therefore the net worth, but I think this only means that we don’t know the exact net worth because it is based on how the future plays out.

Speculation plays a part in business ownership because the value of the business is based on the net present value of the future cash flows. Since we can only speculate on the future, net present value is a speculative calculation.

Net worth and income are intimately related. Just as the net present value is dependent on future cash flows, net worth is dependent on future income that the net worth can provide.

For an employee, the asset is the job and the income is the cash flow provided by the asset.

I would rather have my income be 100 million this year than to have 10 million in stock, property etc. on the other hand I would rather have 10 million in assets than 100,000 in income guaranteed for 10 years.

An aside: Since a job isn’t really an asset but provides an uncertain cash flow like an asset, what would happen if an employee owned that job asset? The employer would have to buy them out to get the asset back. Offshoring would be a bitch. The employee could sell the job asset to whomever he or she liked and that person would get the job. A college grade would need to come up with a couple million for a good job or the old man would have to give his job to the kid or sell it so the kid could get a job. If the business goes under the job asset is worthless.

The way I dealt with that in the 1992 paper was the standard that asset exemption being defined by chapter 7 bankruptcy protection of homestead as house and tools the trade being immune from collection, updated for the modern world where quantities are median capitalization of a job and median price of a home.

Of course there’s no reason to guarantee any employee ownership of their job just as there is no guarantee that a homeowner owns it free and clear. On the other hand that’s where the citizens dividend comes in to privatize delivery of social goods.

The late Randall J Burns did a related article for the also late VDARE on the financial value of citizenship in the US and how immigration erodes that asset value. A citizen’s dividend has the advantage that it exposes the dilution of citizenship’s financial value in the same sense as handing stock out to employees.

I agree and was just having fun with an idea.

What did you buy on Prime Day 2?

I am considering titanium cutting boards and a new toaster (but I digress…)