Biden responds: “Hold my beer!”

It couldn’t be that historically unprecedented money printing leads to depreciation of the currency being printed. Why, that would contradict theory !

To be fair to Krugman, he doesn’t think much of MMT or the MMTers. This may be one of the few place I agree with him.

Running on MMT (Wonkish), Trying to get this debate beyond Calvinball.

When Do We Need New Economic Theories?

Suffice it to say that I consider MMT the cryptocurrency of macroeconomics: It sounds edgy and forward-looking, but when you press its devotees on what exactly is its point, what it can do that you can’t do better using more conventional approaches, the response is a lot of bombast but no clear answer.

As James Kunstler points out: Bonds are Loans. The interest rate reveals the faith in the lender.

Yep—it’s just that simple.

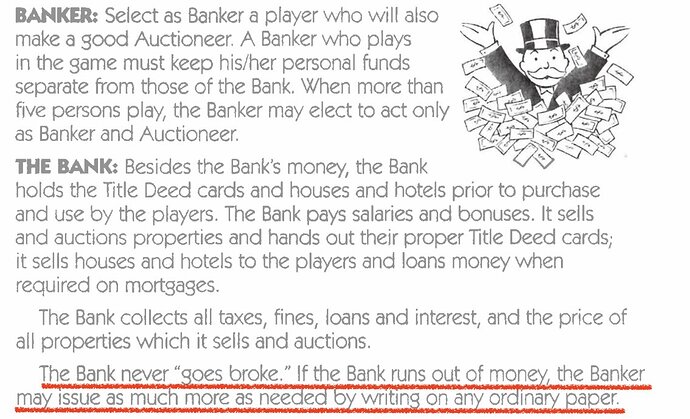

Today, 2022-09-28, the Bank of England has capitulated to the collapse of the U.K. government bond (“Gilt”) market and will resume bond purchases (a.k.a. “quantitative easing” or money printing), issuing a news release, “Bank of England announces gilt market operation”.

As the Governor said in his statement on Monday, the Bank is monitoring developments in financial markets very closely in light of the significant repricing of UK and global financial assets.

This repricing has become more significant in the past day – and it is particularly affecting long-dated UK government debt. Were dysfunction in this market to continue or worsen, there would be a material risk to UK financial stability. This would lead to an unwarranted tightening of financing conditions and a reduction of the flow of credit to the real economy.

In line with its financial stability objective, the Bank of England stands ready to restore market functioning and reduce any risks from contagion to credit conditions for UK households and businesses.

To achieve this, the Bank will carry out temporary purchases of long-dated UK government bonds from 28 September. The purpose of these purchases will be to restore orderly market conditions. The purchases will be carried out on whatever scale is necessary to effect this outcome. The operation will be fully indemnified by HM Treasury.

On 28 September, the Bank of England’s Financial Policy Committee noted the risks to UK financial stability from dysfunction in the gilt market. It recommended that action be taken, and welcomed the Bank’s plans for temporary and targeted purchases in the gilt market on financial stability grounds at an urgent pace.

These purchases will be strictly time limited. They are intended to tackle a specific problem in the long-dated government bond market. Auctions will take place from today until 14 October. The purchases will be unwound in a smooth and orderly fashion once risks to market functioning are judged to have subsided.

“[T]emporary … targeted … strictly time limited”—yeah, right.

OK, right! The risk to “market functioning” is that the Brits have run out of greater fools to whom to sell their IOUs. That makes the Oxbridge graduates in the Bank of England the last & greatest in the long line of greater fools.

The BoE is looking a bit like the Reichsbank circa 1922. BoJ ditto. Maybe Oct will be the ECB’s time to shine.

War is the final option to save democracy/the political class. So comforting that they have been thinking ahead.

Cryptocurrencies let you buy electricity using a non-convertible currency, use that electricity to mine coins, then transfer those coins to a different currency. For the people who buy coins, it’s a burning match.

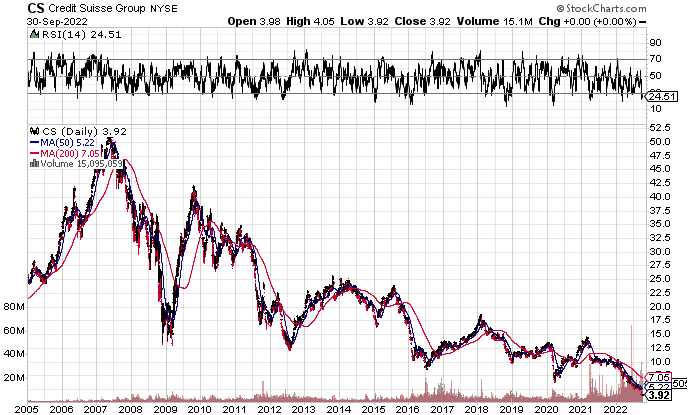

This is a stock chart, from StockCharts.com, for Crédit Suisse Group, the second-largest Swiss Bank, from 2005 through yesterday, 2022-09-30.

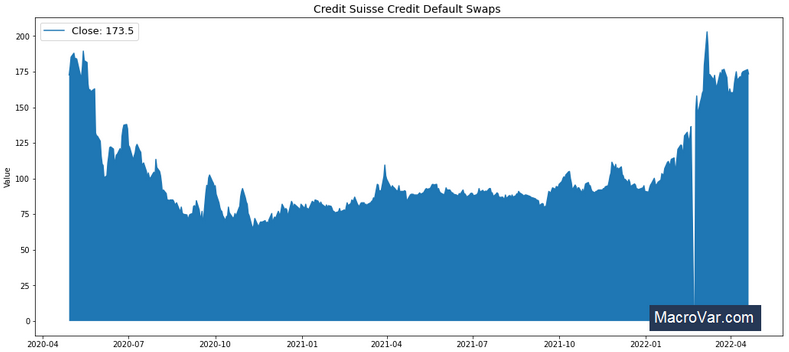

Here, from MacroVar.com, is a chart of the price for credit default swaps on the debt of Crédit Suisse.

The Financial Stability Board has designated Crédit Suisse a “systemically important bank”.

An interesting question is – When the price of Credit Suisse stock dropped by 90%, was any real “value” destroyed?

The plutocrat might argue – Yes. 15 years ago, he could have sold his stock and bought a top-of-the-line superyacht, complete with a helideck. Today, he could sell that stock and buy a used dinghy.

Some of the rest of us might say – No. A stock certificate is merely a piece of paper until the holder decides to sell it and exchange it for something real. Value lies in the “something real”. The unrealized price of a financial asset is a little like the score part-way through a sporting match – interesting, but not a guarantee of the final result. The nominal price of a piece of paper is simply an ephemeral accounting entry.

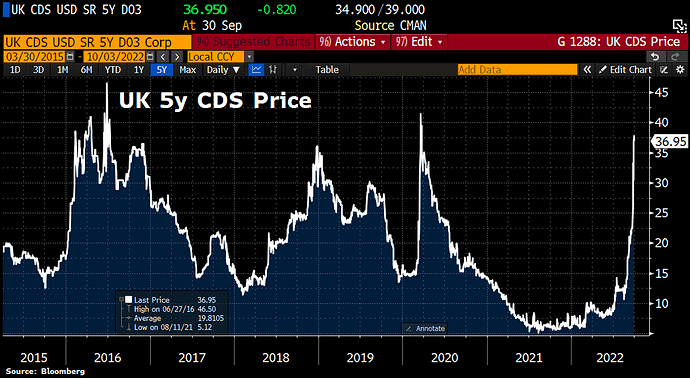

The Wall Street Journal reports on 2022-10-01, “S&P Lowers Outlook on U.K. Debt”.

Standard & Poor’s Global Ratings changed the outlook on British sovereign debt from “stable” to “negative” while maintaining its present “AA” rating. A change in outlook to negative is a warning that a rating downgrade may occur in the future.

Meanwhile, here is a chart of credit default swaps on U.K. 5 year sovereign debt. A credit default swap is essentially insurance against a borrower defaulting on interest or principal repayment of a bond.