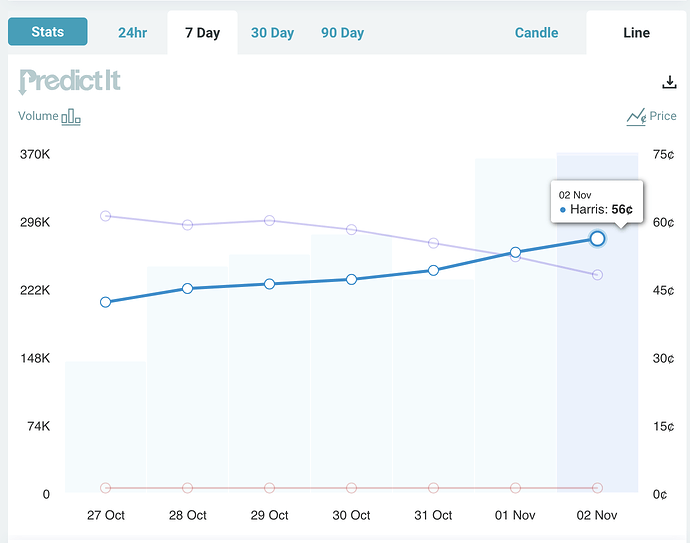

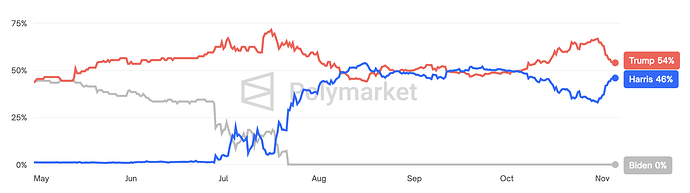

I trust Polymarket more than Predict It

Polymarket is bigger but all non-US. The latter may be a bonus.

OTOH, why would you trust a bunch of people who think gambling is a good life choice.

Trust is the wrong word. Polymarket is a bigger betting market than Predict It despite being non-US.

Polls have become more biased and unreliable. Polymarket ‘appears’ to be a more reliable snapshot than polls or Predict It. But I am also biased.

Betting or prediction markets got it wrong in 2016: Brexit and Trump.

Okay, then, trust the judgement. Why would I trust the judgement of a bunch of people who think gambling is a good life choice? If you are looking to betting markets for guidance, you are trusting the judgement of the participants. Making a bet is making a judgement about probability.

Polymarket is a bigger betting market than Predict It because it is non-US.

FIFY

Why trust these odds?

Studies find that political prediction (betting) markets tend to be better at predicting elections than polls. Some reasons:

- Bettors take into account important factors besides polls. In 2020, for example, the virus, mail-ins, and “shy voters” shook things up in unpredictable ways.

- Unlike pundits, bettors put their money where their mouths are.

- People involved in the event might trade before news breaks publicly

- The “wisdom of crowds”.

The wisdom of crowds is largely mythological. As a counterpoint, consider the madness of a mob. Crowds can be irrational — irrational exuberance in the financial markets, as Alan Greenspan would have it.

Today’s collapse in global markets illustrates the phenomenon.

Maxim Lott, who runs electionbettingodds.com with John Stossel, did a detailed comparison between betting election predictions and 538’s predictions. Their performance was almost indistinguishable. Curiously, both exhibited similar underdog bias.

It’s striking how similarly accurate the sites are, even though they often make quite different predictions. On a scale of “perfect” to “coin toss” their difference is barely visible.

There was one subtle difference:

Nate Silver’s site is worse than bettors at predicting Republican wins, and better at predicting Democratic wins.

Pollsters ask who will you vote for. Sometimes they ask who do you think will win.

Bettors only ask themselves who do I think will win.

Nate Silver is no longer affiliated with 538, the company he created.

Edit: Predict It right now has Walz leading, 58 - 43, 11:44 PST.

Polymarket has Shapiro with a tiny lead, 50 - 48

added: Shapiro has the lead in every betting market. 1:34 PST

I already placed a bet on Predict It that Shapiro will be the nominee.

Payout is 94 cents on a 43 cent bet.

Update: 10:08 PST Walz is the pick. I lost 43 cents on Shapiro.

The comparison indicates that the betters are fairly accurate. Isn’t that the opposite of you not trusting the judgement of gamblers?

Event betting is different from betting on games of chance with defined odds.

It’s reasonably accurate if all contest are included, from dogcatcher to president. The results are less impressive for important ones, where there tend to be more shenanigans.

Furthermore, the winner often switches just before the election. Brexit was a good example of that. Predicting a result 12 or 24 hours ahead is not that useful or that great a trick.

November 5, 2016: Hillary at 88 percent

November 2, 2020: Biden at 64 percent

update:

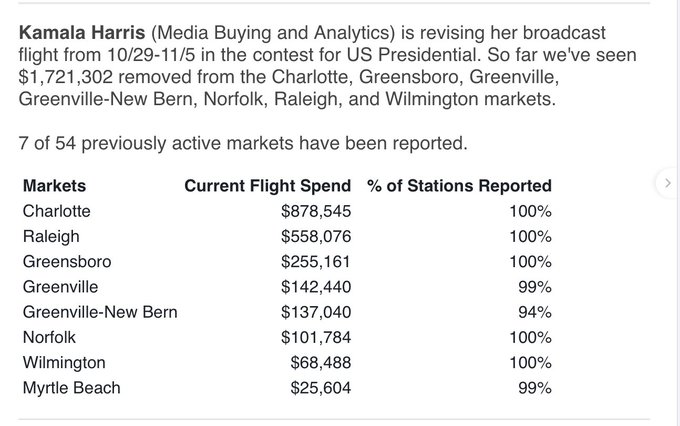

Democrat presidential nominee Vice President Kamala Harris is waving the white flag in North Carolina, surrendering the state to former President Donald Trump as her campaign withdraws nearly $2 million in planned ad buys from television stations statewide one week before the election.

A snide remark from a Democrat:

Now that the prediction markets are getting close to having to be paid out, the oh-so bullish Trumpers are saving as much of their money as they can, and selling Trump.

The spreads are massive, and there could be arbitration going on:

What do you think?

Betting markets are poor predictors of final results. They failed miserably in 2016 on Brexit and Trump/Clinton. Betting markets also predicted Republicans would take the Senate in 2022.

This analysis has many problems. Chief among them is that Friedman assumes that the person trying to change the odds by making a large bet holds the position until the bet is settled, i.e., the election is over. Another problem is the assumption that the large bet does not influence other participants to make the same bet, thereby driving the price even higher. The person making the large bet can sell his position after others have joined in.

The pump-and-dump strategy violates both of these assumption and is routinely used in equities markets. Why not also apply this to the more thinly traded election betting markets.

More broadly, efficient-markets theory doesn’t have a good track record of explaining the movement of equities markets. Robert Shiller is closer to the mark. He showed that real markets do not operate as efficient markets. The behavioral economics work of Kahneman & Taversky and Nassim Taleb provide insight on why this is so. Human beings do not make decisions in the way efficient-markets theory assumes.