Intel held their fourth quarter 2022 and fiscal year 2022 earnings call yesterday, 2023-01-26, with Intel CEO Pat Gelsinger summarising the results, market conditions, strategy, and expectations for the future, and CFO David Zinsner presenting the financial results, such as they were.

The term of art on Wall Street when a company screws the pooch is “disappointed”. Well, these results were more than disappointing, especially to Intel shareholders and those hoping the vendor would make a turnaround.

You’d think that being a leading chip manufacturer during a time of severe shortages in the chip business would be a pretty good thing, but apparently not if you’re Intel. Their business is mostly high-end chips destined for desktop, workstation, and notebook computers, and higher-end chips for data centres and supercomputers, not the more generic chips for applications such as the automotive industry which are in short supply. On the PC side, Intel took a blow when Apple abandoned their processors in the desktop and notebook lines in favour of Apple’s own ARM-based M1 systems-on-a-chip, and elsewhere by generally weak demand for PCs. In the server market, Intel has been losing share to Advanced Micro Devices (AMD), whose processors now power two of the three fastest supercomputers in the world and have been increasingly adopted by cloud computing vendors. In addition, competition from ARM processors and the open source RISC-V architecture is eroding the once overwhelming dominance of the x86 architecture in all markets, from microcontrollers to supercomputers (the second fastest supercomputer, Fujitsu’s Fugaku, is ARM-based).

Here is the entire earnings call including question and answer session at the end. YouTube has apparently “improved” the way they generate URLs for recordings of live streamed events in such way as they may not be directly embedded here. Click the link below to view in a separate tab/window. The Intel presentations are accompanied by slides in the video.

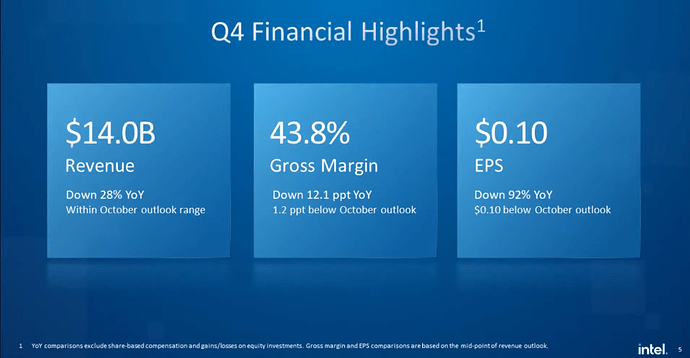

Here are some highlights (or, perhaps I should say, lowlights) of the financials. These are overall results for the fourth quarter (Q4) of 2022.

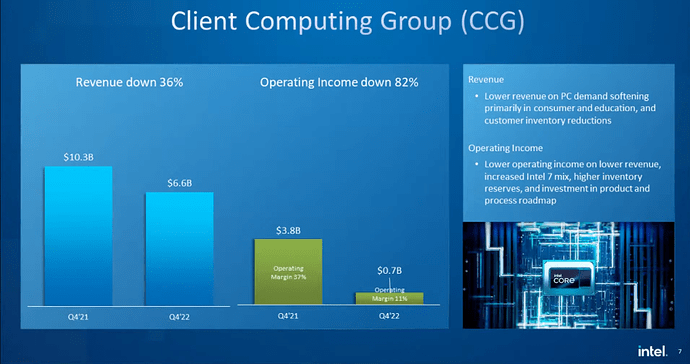

That’s right, a 28% drop in total revenue compared to Q4 of 2021, and a 92% drop in earnings per share. Next, let’s look at “Client Computing”, which is primarily desktop and notebook machines.

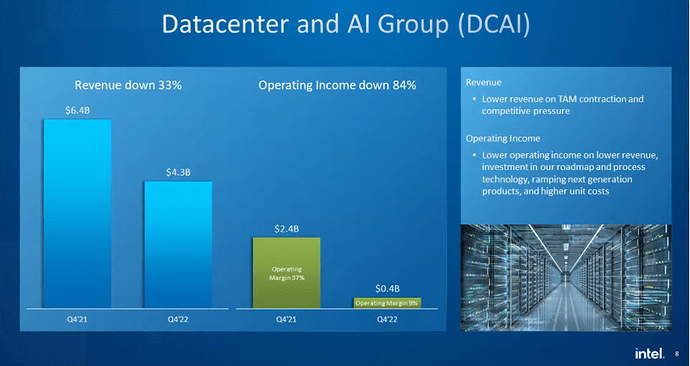

Oof! How about the high-end server and supercomputer segment?

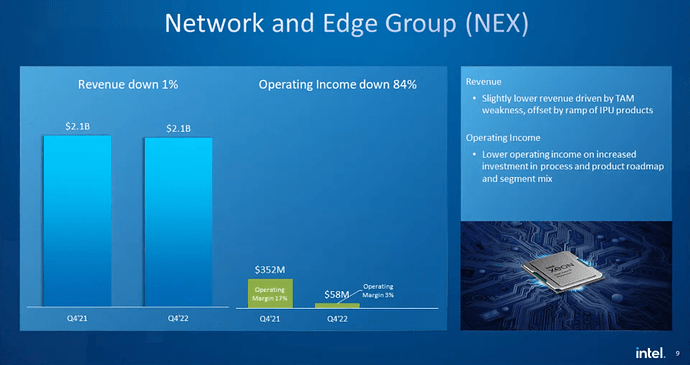

And in the world of networking?

Revenue essentially flat, but profits down 84%.

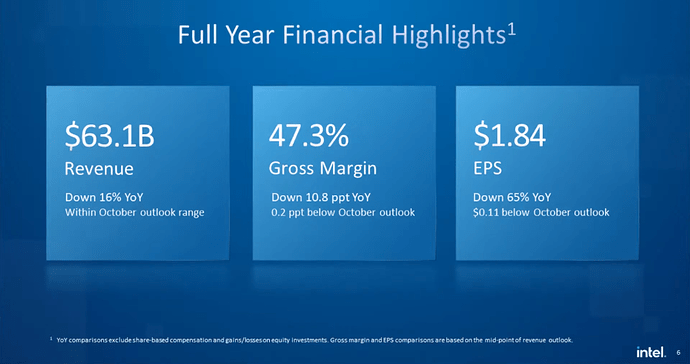

Q4 winds up the full year, so what’s the outcome for 2022 as a whole?

Well, it’s more like 2022 as a hole: 16% fall in revenue, 63% drop in earnings.

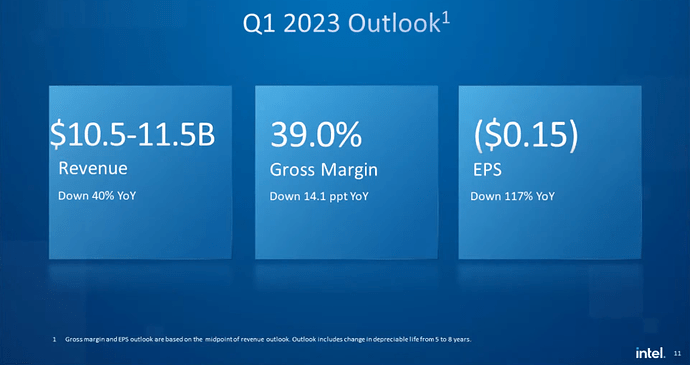

How do things look, as the MBAs say, “going forward”? Here is Intel’s “guidance” as to their expectations for the first quarter of 2023, now underway.

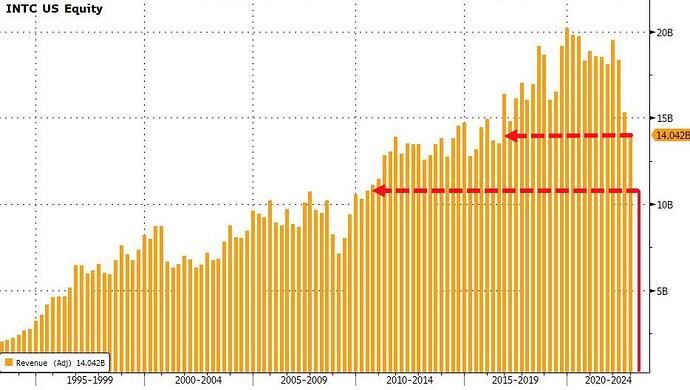

To put the shock this forecast created among the audience into perspective, the revenue estimate was around US$ 3 billion below the analyst consensus of US$ 13.96 billion and the loss per share of US$ 0.15 far below analyst expectations of a profit of US$ 0.25 per share. If Intel’s sales come in at the low end of the Q1 forecast revenue, this would the lowest quarterly sales reported by Intel since 2010.

Shortly after the market opened on 2023-01-27, Intel stock (INTC) was trading down more than 10% from the close before earnings were announced.