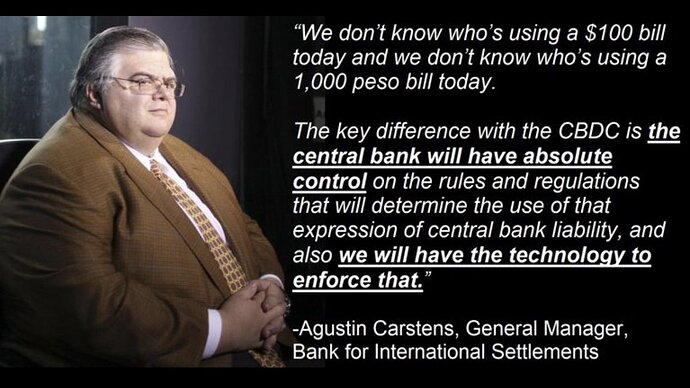

Here is Jabba the Central Banker on the promise of Central Bank Digital Currencies (CBDC—“Slave Money”):

Agustín Carstens is General Manager of the Bank for International Settlements (BIS) and was previously governor of the Bank of Mexico, which issues that country’s prestigious currency. Of course, he is a member of the World Economic Forum.

The passage quoted is from a panel discussion on 2020-10-19 by the International Monetary fund, “Cross-Border Payments—A Vision for the Future”. The video cannot be embedded here, but may be viewed at the link; the quoted text appears at the 24:00 mark.

Carstens has written a great deal about CBDCs in recent years:

- “Digital currencies and the future of the monetary system” [PDF]

- “Central bank digital currencies: putting a big idea into practice” [PDF]

- “Agustin Carstens on Central Banking in Emerging Markets, the Distributional Footprint of Monetary Policy, and Central Bank Digital Currency”

- “A Foundation of Trust”

In March, 2023, the BIS issued a report on “Project Icebreaker: Breaking new paths in cross-border retail CBDC payments” [PDF], in collaboration with the central banks of Israel, Norway, and Sweden.

Many central banks are exploring retail central bank digital currencies (rCBDCs). Some of these projects are at the proof-of-concept (PoC) stage, while others are in pilot trials and a handful have reached more mature phases. The requirements for interlinking these (domestic) rCBDC systems to support cross-border payments should be considered at the outset so that cross-border payments can be enabled when appropriate.

Project Icebreaker explores a specific way to interlink rCBDC systems (the hub-and-spoke solution) with several additional features that would allow the Icebreaker model to be readily scaled up. In addition, these features would promote simplicity and interoperability, reduce settlement risk, and foster competition and transparency for cross-border rCBDC payments.

This, of course, has nothing to do with conspiracy theories about “one world slave money” circulating among prickly enemies of globalisation. Here is a BIS promotional video for Project Icebreaker.

What’s going on in the “land of the free”, you ask? Well, have you heard about Executive Order 14067, issued on 2022-03-09 by “president” Joe Biden, “Ensuring Responsible Development of Digital Assets”? Here are a few excerpts:

The United States derives significant economic and national security benefits from the central role that the United States dollar and United States financial institutions and markets play in the global financial system. Continued United States leadership in the global financial system will sustain United States financial power and promote United States economic interests.

Sovereign money is at the core of a well-functioning financial system, macroeconomic stabilization policies, and economic growth. My Administration places the highest urgency on research and development efforts into the potential design and deployment options of a United States CBDC. These efforts should include assessments of possible benefits and risks for consumers, investors, and businesses; financial stability and systemic risk; payment systems; national security; the ability to exercise human rights; financial inclusion and equity; and the actions required to launch a United States CBDC if doing so is deemed to be in the national interest.

A United States CBDC may have the potential to support efficient and low-cost transactions, particularly for cross-border funds transfers and payments, and to foster greater access to the financial system, with fewer of the risks posed by private sector-administered digital assets. A United States CBDC that is interoperable with CBDCs issued by other monetary authorities could facilitate faster and lower-cost cross-border payments and potentially boost economic growth, support the continued centrality of the United States within the international financial system, and help to protect the unique role that the dollar plays in global finance. There are also, however, potential risks and downsides to consider. We should prioritize timely assessments of potential benefits and risks under various designs to ensure that the United States remains a leader in the international financial system.

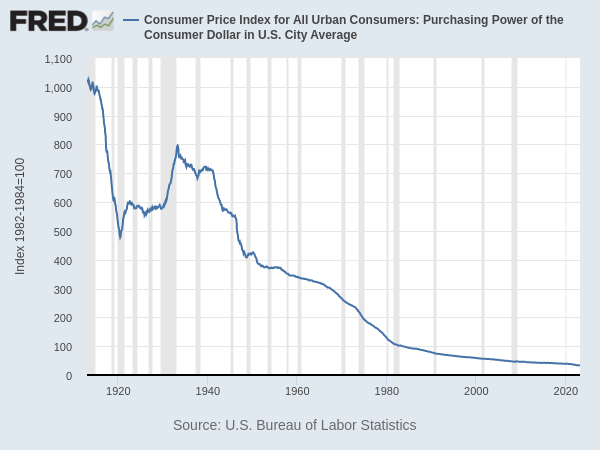

Just in case you’ve been wondering why the US$ has recently dropped to 0.000033 Bitcoin per dollar… (quote as of 2023-04-16 at 14:45 UTC): “Sovereign money is at the core of a well-functioning financial system”. After I stopped laughing, I grudgingly acknowledged that sovereign money is at the core of the current financial system, but which only the clinically delusional would qualify as “well-functioning”.