Suppose you finally succeed in accumulating enough money after taxes that you can invest some of it in the hope of a comfortable retirement or giving your children a leg up in the world. What do they call you—“responsible”, “prudent”, “provident”? Well, in the eyes of the Washington regime in the age of Biden, “sucker” is closer to the mark.

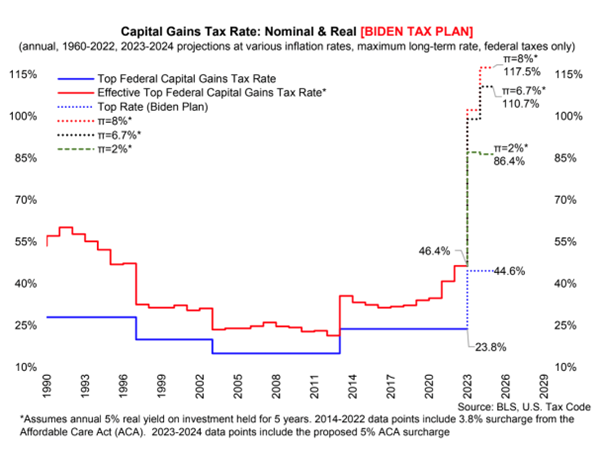

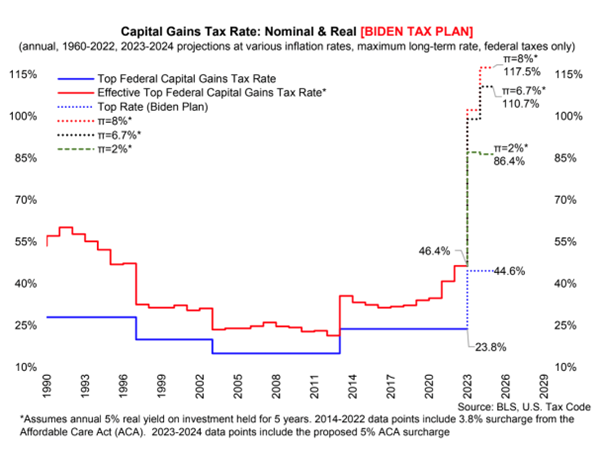

Biden is proposing to increase the top Federal capital gains tax rate, which is currently 20%, to 39.6%. When you include the 5% surcharge imposed by the Obamacare “Affordable Care Act”, increased from the current 3.8%, this raises the effective top rate to 44.6%. Now of course a central part of the “capital gains” tax scam is that the “gain” which is taxed is not corrected for depreciation of the dollars (“inflation”) between the time the investment was bought and sold. Arthur Laffer’s company calculated the real capital gains tax given these changes for an investment bought, held for five years, given an annual real appreciation of 5%, assuming annual inflation rates of 2% (the presently-stated Federal Reserve target), 6.7% (recent figure), and 8% (last year’s peak).

With an inflation rate of 2%, the real capital gains marginal rate is 86%, because the appreciation of the investment is reckoned in dollars depreciating at that rate during the time you held it, but taxed on the entire nominal gain. With 6.7% inflation, the capital gains tax rate is 110.7%, exceeding the total real appreciation, and with 8% inflation, it increases to 117.5%.

If the real return on the investment is less than the rate of inflation, the effective tax rate is infinite,

For example, if you buy a stock for $100 a share and then it rises to $120 per share five years later, but the accumulated inflation rate over that period was, say, 24%, then you lost money owning the stock after adjusting for inflation. But, you would still owe Uncle Sam a 40% tax on the phantom “gain” of $20 per share. This is sheer idiocy.

This is federal tax only. When you add in state and local taxes, it gets even worse. In California, the top marginal capital gains rate would be 56.7% neglecting inflation, while residents of New York City, whacked by federal, state, and city taxes, would pay 58.2%.

Here is a list of capital gains tax rates for countries around the world.