I am no fan of NPR but this episode was entertaining and informative

So the economists’ six policies are 5 fiddles on the tax code (including a hat tip to the ClimateScam) plus a call to legalize marijuana – presumably the drug that economists seem to be taking!

Their major change would be to replace most taxes with (effectively) a Federal sales tax on top of State sales taxes – but designed to protect the poor … in some unspecified way. That is merely the economists’ Euro-envy of the immensely complex and intrusive Value Added Tax which has done so little to promote growth in Europe.

It is hard to see how any of this would result in the necessary increased production of real goods & services, as opposed to stimulating further zero-sum financial games and yet more unsustainable imports.

Well, many of us had a low opinion of economists before this. As that famous saying goes – Say nothing, and be presumed to be a fool; or open one’s mouth, and remove all doubt.

A couple good ideas:

Eliminate income tax and payroll tax

Eliminate corporate tax

That is only half an idea. Eliminating those taxes would obviously reduce FedGov income substantially. The essential other half of the idea would have to be how to compensate for that loss – borrow more money from Russia & China? print more money? eliminate the military? end social security? impose substantial tariffs on imports?

A meaningful good idea has to address both sides of the coin.

It would be a great start to eliminate inflation (= deficit spending via money creation out of thin air by the fed). That is actually one helluva stealth tax on the most productive members of the middle class (where the state steals most of the tax in the first place.

We don’t have to compensate for the loss. We can spend less. The real tax is what government spends not what it collects.

But let’s pretend there is a shortage. We could borrow in the short term but long term we would have to cut programs. We could eliminate or privatize social security. Maybe cuts in military but not eliminate. Maybe cut every department except for 5

The corporate tax in particular is a waste and a double tax. Businesses are less likely to move overseas and foreign companies are more likely to set up a shop here. It would be the opposite of outsourcing overseas.

For example most Honda and Hyundai sold in America are assembled in Tennessee and Alabama

Spending is the biggest problem. Biden latest proposal is 8 trillion dollars, which is insane and unconscionable

There is no reason why we can’t return to pre COVID level spending which was already too high.

Exactly! That is how a rational government would compensate for the loss of revenue. It is what any citizen has to do if his income drops for any reason.

FedGov is already vastly overspending – spending something like $3 for every $2 it takes in. Simplifying taxes and outright eliminating them is definitely an important part of a realistic long-term solution – but there is no point in proposing cuts to FedGov revenue before first getting agreement on cuts to FedGov expenditure.

What one person views as wasteful FedGov expenditure, another person views as her dependable income – whether she is CEO of a Big Bank, a big military contractor, a government bureaucrat, a senior citizen, or a ghetto mother. There are some guesses that the majority of the US population is now directly or indirectly dependent for its income on FedGov spending.

A lot of people are going to have to endure a lot of suffering just to bring government spending down to the point where it matches current government income – and then when we cut the tax burden, even more will suffer.

The current situation is unsustainable. If those economists were not functionally on the government teat, they would admit that. As for the rest of us, Collapse is unfortunately inevitable. What is worth thinking about is the lessons we need to convey to our children & grand-children to help them rebuild from the wreckage. Constraining government spending is certainly one of those key lessons!

It’s a catch 22. Do you cut revenue to force budget cuts or do you agree to a smaller budget then cut taxes?

I think you have to cut taxes first and force a smaller budget because it’s almost impossible to agree on cuts to expenditure

I think Singapore would be an example where you do not have to compensate for a loss due to zero corporate tax because there is a gain in tax revenue from the stimulated growth in business.

Multiple times in the last 20 years of my work, I worked on source of supply analysis for manufacturing. The number one reason it pays to offshore manufacturing is tax. It is so large a benefit that it offset any argument. “You mean you cannot overcome that issue with $100 million?” Hmmm, for $100 million I can pay US engineers to run the machinery. I guess my argument about unskilled labor just went down the shitter.

Do not complain about the lack of US manufacturing capability and then argue against zero corporate tax. The tax competitiveness is the reason without a doubt in my mind. The other option is Biden’s plan to make all countries have a minimum corporate tax to level the playing field. Even the Democrats now know it was tax policy, they just cannot tell their voters.

Even the EU knows. They allow corporations to take advantage of the Swiss corporate tax. It was 3% the last analysis I did in 2019. All a corporation has to do is put up its EU headquarters in Switzerland and the corporate tax from stuff made in your shiny new German factory is 3%.

With respect, that statement in fact proves the need to compensate for a revenue loss from one form of taxation.

The argument is that – after passage of enough time to build factories, mines, etc – reducing corporate tax will increase economic activity and thus increase tax revenue from (e.g.) personal income tax. The loss of one form of tax revenue in that case is indeed compensated by an increase in another form of tax revenue.

That is a good theory – but it misses an important part of reality. The US business benefitting from lower corporate taxes will still face endless regulatory & legal delays in building any new factories in the US – and will end up building them overseas instead. Unless the US hangs lawyers, fires bureaucrats, and rolls back regulations simultaneously with cutting corporate taxes, the benefits of the tax cuts will accrue outside the US and FedGov’s unsustainable budget deficit and trade deficit will get worse.

I am all in favor of simplifying, reducing, and eliminating taxes – but those actions would have to take place in the context of other more significant changes.

Yes, indeed! As a tiny example, 12 years ago we formed a family limited partnership (FLP). It must file its own tax return each year, federal and state, running to > 80 pages each. It has exactly one investment - happily offshore. Our joint personal returns - showing income ONLY from the FLP and Social Security add around another 60 pages each. This stunning amount of non-productive (actually inhibitory of production and entrepreneurial activity at every level) activity is baked into the entire increasingly-lopsided, soon to fall in, cake. This is hardly a secret and all deep state führers, apparatchiks and especially so-called “elected” officials just either sit back and watch or add yet more off-center-axis torque to the RUD (is it really “unplanned”?) of the house of cards in a tornado - which is our social structure and economy.

I agree with you about the crushing effects of over regulation but tax policy and rates matter.

We don’t have to reform regulations and tax policy at the same time. We can do it piecemeal.

Eliminating corporate taxes is a step in the right direction regardless of the regulatory environment.

Same goes for payroll tax elimination.

Replacing income tax with a federal tax on consumption is a step in the right direction. People will be encouraged to save more and invest and spend less.

As far as replacing corporate taxes, excise taxes on luxury items on private jets and yachts and fancy cars. Essentially a tax on rich people with expensive tastes.

Milton Friedman supported 5 of the 6 proposals including drug legalization.

He supported a tax on effluent. I am not sure if that is the same as a carbon tax.

Many economists are wrong about almost everything. Milton Friedman was an outlier. He was rarely wrong.

That is a fair point – we can make changes one step at a time. But which changes should come first?

For that, we have to go back to basics – Production Precedes Consumption!

The priority changes should be those that encourage increased production of real goods & services within an economy. That means rolling back regulations and firing government regulators. In terms of taxes, it means imposing tariffs on imports. Of course, those tariffs are going to be passed on to the domestic consumer … but in tandem with reducing the regulatory burden they will also encourage domestic production, employment, and tax revenues.

Those steps will be painful, but necessary. Cutting taxes & spending will be even more painful. However, we all know that the intestinal fortitude to incur any pain does not exist in today’s West. Instead, economic collapse is unavoidable.

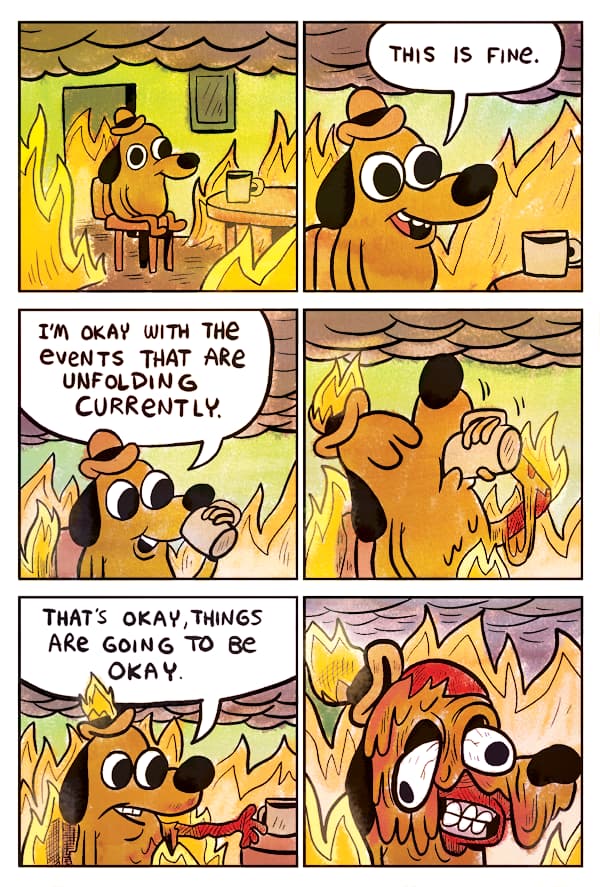

There is probably a meme like this that has the frog in the pot with the temperature going up and saying something like we really need to work on the decorations around here.