…the idea that the official inflation rate is an objective number, impervious to human biases, much in the way that someone’s height or weight can be objectively measured with a ruler and a scale.

This is a poor comparison. Any measurement can be biased or rigged. The expression “putting a thumb on the scale” comes to mind. The trouble is not that there is no reasonable way to compute the inflation rate. Indeed, the article goes on to suggest improvements to make he statistic more representative of reality.

The problem is that governments have many incentives to cook the books and almost no one, especially not journalists, are questioning the numbers. Instead, journos are cheerleaders for the Regime.

I am also skeptical of the explanation for the discrepancy: modification of housing prices and financing costs. It’s hard to believe that this could account for the difference between the mid-single-digit inflation numbers reported by BLS and 18% in the headline: “… a dramatically different estimate of inflation in 2022 and 2023”. Most people aren’t buying a house in any given year or two so their mortgage (financing) costs aren’t changing. Inflation is actually beneficial for those who financed their homes when interest rates were lower because their effective interest rate is now lower, perhaps even negative. It would be just as dishonest to apply the higher cost of home mortgage interest across the board as anything they’re doing now.

There’s no doubt that inflation is being understated by government agencies but it’s important to get the reasons right. ConInc operative Avik Roy should know better but it may not be in his interest to say it out loud. It is surprising to see Summers fronting this narrative.

From article:

Bolhuis et al. then went on to see if they could recalculate the official CPI numbers using a pre-1983-like formula that incorporated the cost of mortgage interest, auto loan interest, and credit card interest on the cost of living. They found three things: first, that the pre-1983-like formula led to a dramatically different estimate of inflation in 2022 and 2023, peaking at 18 percent in November 2022

It’s irresponsible that the prices of food and energy are excluded from CPI.

Consumers buy food and energy. You can’t calculate consumer price index responsibly if you ignore consumer staples and necessities.

The argument for exclusion is that food and energy prices are too volatile. But that’s a lazy argument. We need to see volatility and volatility works both ways: sudden increases and sudden decreases. Further more volatile prices are not the norm in food and energy.

Another way is to look at grocery store prices. Grocery stores can’t be accused of gouging because they have razor thin margins.

Food and energy are not excluded from the CPI. The BLS reports CPI “All items” and CPI “All items less food and energy.” Not only that, but there is a CPI for urban consumers, one for urban wage earners and clerical workers, and several others. The plain, unadorned CPI generally refers to the data series with food and energy.

https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category.htm

In journo parlance, “headline” inflation is CPI-U, while “core” inflation is CPI less food & energy.

After giving the Summers paper (Bolhuis, et al.) a quick read, the main point that stands out is that Americans are heavily reliant on debt. The paper argues for incorporation of debt costs more directly.

For instance, instead of using rents to account for the cost of housing, which the authors admit “has a stronger theoretical justification,” they advocate using the home purchase price (Case-Shiller index) and mortgage interest rates. This is stupid because people don’t buy a new house every year and because they modulate their purchase timing decisions according to fluctuations in rates and housing prices. After all, renting is always an alternative; one can rent while waiting for more favorable conditions.

The real takeaway here is that Americans overuse debt. If they ditched consumer debt (revolving, auto), there’d be little justification for changing the CPI.

The grain of truth here is that the perception of inflation is dominated by quotidian costs such as grocery-store trips, gassing up the car, and monthly utility bills. But it’s also true that these costs, especially food, are a relatively small part of the household budget. The rent or mortgage payment probably didn’t change much but it is still much larger than food & energy combined. Thus, it rightly merits a heavier weight.

There is a disconnect between perceived inflation and reality. The authors of the paper fail to incorporate the lessons of behavioral economics. They need to re-read Tversky and Kahneman.

ShadowSats calculates inflation under old methods on an ongoing basis.

The disconnect is predictable because inflation especially food and energy hurt the lower and working class. For the managerial class or white collar workers, inflation is inconvenient but not painful.

I noticed that transportation services price index is near the top for the last 12 months. I tried to drill down on transportation services but no more detail on the BLS home page.

We also need more visibility on velocity which is approximately GDP/M

High velocity indicates a healthy economy usually.

If I recall correctly, inflation is correlated with a sudden increase in low velocity money.

Interesting - Audrey Tang talked about this not long ago: Podcast Episode: Open Source Beats Authoritarianism | Electronic Frontier Foundation

And that’s exactly how Gov Zero works. In 2012 a bunch of civic hackers decided that they’ve had enough with PDF files that are just image scans of budget descriptions, or things like that, which makes it almost impossible for average citizens to understand what’s going on with the Ma Ying-jeou administration.And so, they set up forked websites.

So for each website, something dot gov dot tw, the civic hackers register something dot g0v dot tw, which looks almost the same. So, you visit a regular government website, you change your O to a zero, and this domain hack ensures that you’re looking at a shadow government versions of the same website, except it’s on GitHub, except it’s powered by open data, except there’s real interactions going on and you can actually have a conversation about any budget item around this visualization with your fellow civic hackers.

And many of those projects in Gov Zero became so popular that the administration, the ministries finally merged back their code so that if you go to the official government website, it looks exactly the same as the civic hacker version.

If you promise to not get obsessed by my use of the word “government”, here’s the way price inflation is defined under the Property Money regime:

The government monitors the cost of replacement reproduction (CORR). Nowadays, CORR is dominated by the amount of money a woman can make by exchanging her most fertile years for gainful employment with the help of birth control and abortion. The more valuable her characteristics to the economy, the higher the CORR associated with her socioeconomic cohort. To sustain intergenerational value, CORR must account for the fact that the economy has a structural bias toward removing from the next generation the characteristics it values in this generation.

Any lesser definition of “cost of living” is a de facto act of genocide by the government against its own people.

Of course, there is much that goes into CORR beyond merely “the economy” such as, for instance, genetic predispositions of the population, the ability of communities to shield their children’s upbringing from virulent “inclusion” of pathogens whether microbial, memetic or human, etc.

“De facto act of genocide”

Dispassionate analysis

Perhaps the point has been made already and it’s very obvious, but in modern popular parlance, “decreasing inflation” actually means the rate of growth is decreasing. Conveniently overlooked from all “good news: inflation drops” headlines and subsequent news reports.

Modern popular parlance is 1984 new speak

Powell also announced that inflation is not under control and rate cuts are unlikely.

I still expect rate cuts in June and September if Biden or his replacement is losing

This is only partially true. People that own assets that inflate with or due to inflation of prices are not as impacted.

This is my hypothesis:

What happens if one person holds all the M. What happens to velocity?

Imagine a company town. The money goes from the company to the employee to the company store. In the US historical economy the money moved from one individual to another to another.

The economic output and incomes of the company town can be increasing (if you keep increasing money supply) but there is shitty economic activity and shitty velocity because the company can vacuum up all the money.

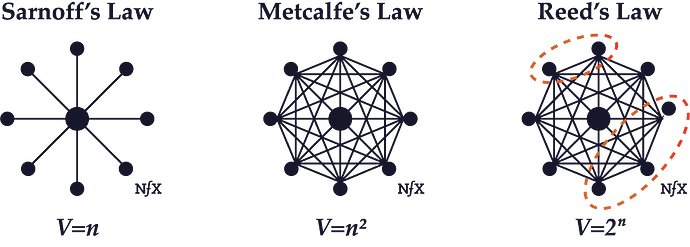

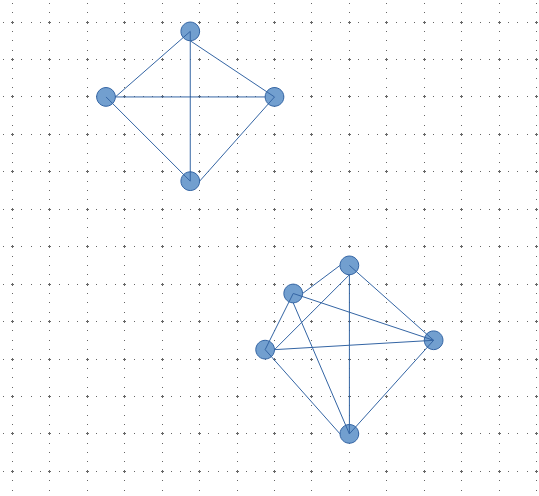

The below sketch helps explain my point. If you have 4 people in an economy and they are all exchanging with each other you get 4 x 3 = 12 transactions. If you add 1 person into that economy you get 5 x 4 = 20 transactions. You added just 25 percent more people, but got over 50% more transactions.

If you now imagine a centralized economy, then the diagram would change to a hub and spoke model. Imagine, in the first sketch, if instead of a fifth person added we added a hub in the center that all transactions start and end. There are less transactions. Velocity is inherently lower in the hub and spoke model versus the distributed model.

In the distributed model, as the people become more productive prices should fall or additional products and services can be added. If you add more money, prices may remain the same and the added money is just saved or prices may rise if everyone doesn’t save the money. In the hub and spoke model, as more money is added the hub can just vacuum it up because the hub doesn’t need any more money for transactions. One entity can “save” all the additional money added and there might not be inflation in prices.

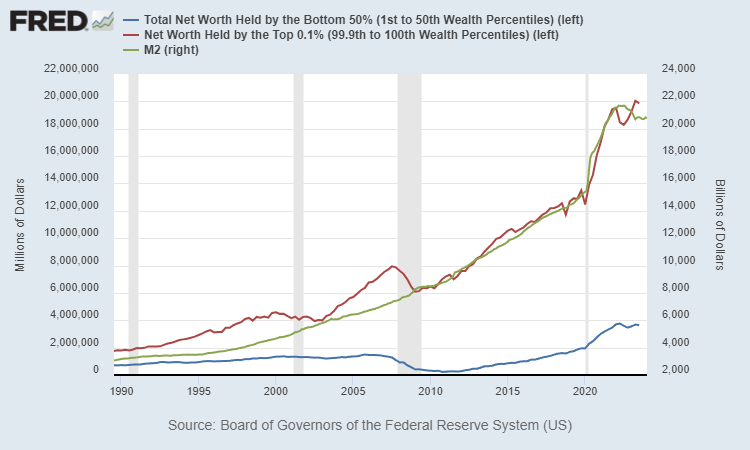

This is especially true with the Cantillon Effect where those closest to the money supply get first dibs and vacuum it up before it can reach any other entity. No inflation in prices. Money supply increases and velocity drops.

This is, no doubt, an over simplification. The key is that an economy that is growing faster than money supply is far superior to an economy that is growing due to money supply.

The US velocity was dropping for a very long time. I think it rose when the free money was sent directly to the population. But that velocity increase is a false signal of improvement because what will happen in the hub and spoke system is that eventually all that money will go to the hub just like it would in a company town. Sooner or later all the money is spent at the company store and the company doesn’t need it for transactions so the company will invest it outside the company town. Outside the company town would be in another country, buy back its stock or in ownership of other companies (stock market activity).

The crony capitalist will be all in on socialism doesn’t work. But they don’t want people to associate bad outcomes with centralization of the economy by a few enormous corporations (controlled by even fewer) or worse still the combination of government and these few enormous corporations working hand in hand which is the most dangerous and is what we essentially have in the US.

Why would ownership of the means of production be bad if the government does it, but good if one corporation does it? The only difference would be the name on the door. Because your title is CEO doesn’t make you different than the person who’s title is General Secretary.

Very cool how you explain the value of a connected market economy over the disconnected central planning. On this note, I’ve recently come across this article:

At the heart of the issue is a misconception that bedevils academics, journalists, and ordinary Americans: the idea that the official inflation rate is an objective number, impervious to human biases, much in the way that someone’s height or weight can be objectively measured with a ruler and a scale."

TFR is objective. That this escapes economists is why the wealthy are subject to mass slaughter from time to time in history – at least the ones that don’t take their money and run to the next civilization to destroy with Mammon worship.

A visualization of the Cantillon effect, whereby the first individuals to receive newly created money can purchase assets before the prices have adjusted to inflation:

… all economic history is the slow heart-beat of the social organism, a vast systole and diastole of naturally concentrating wealth and naturally explosive revolution.

– Will Durant, The Story of Civilization