How many baby boomers need to sell to extract equity (= dollars which buy some small fraction of the ones with which they purchased that house) for retirement? Are there really going to be enough buyers for those houses?

(FORTUNE Magazine) – JOE KENNEDY, a famous rich guy in his day, exited the stock market in timely fashion after a shoeshine boy gave him some stock tips. He figured that when the shoeshine boys have tips, the market is too popular for its own good, a theory also advanced by Bernard Baruch, another vested interest who described the scene before the big Crash:

“Taxi drivers told you what to buy. The shoeshine boy could give you a summary of the day’s financial news as he worked with rag and polish. An old beggar who regularly patrolled the street in front of my office now gave me tips and, I suppose, spent the money I and others gave him in the market. My cook had a brokerage account and followed the ticker closely. Her paper profits were quickly blown away in the gale of 1929.”

Are we at the same fatal stage in the market today, when people who aren’t expected to have stock tips have stock tips, including hot dog vendors, shoeshine boys, the homeless, pedicurists, barroom dancers, toll takers, and the trumpet player at the racetrack? Will stock prices fall off the cliff under the weight of enormous popularity?

Since shoeshine boys are scarce at the moment, I guess we have to use other indicators. Possibly we could use idiot journalists as a substitute.

I just had a long discussion with a friend who sells pre-manufactured homes. He says that industry has kept raising prices and that was fine as long as retirees were selling their big houses in order to downsize. But now that’s coming to an end.

Seems to me there’s one big issue with this article: who’s gonna buy? The combination of high prices with high(er)* interest rates puts a “starter” home out of the reach of most young people. And I asked my friend why that is? I mean, there’s a need for affordable housing, so why isn’t anybody building it? Why isn’t anybody stepping into Levitt’s shoes? Is it the cost of materials? He said no, lumber has never been cheaper.

I don’t WANT to read that the U.S. real estate market is “hot”. We used to talk about the “property ladder”, young people would buy a small inexpensive home and keep trading up. And up. It was a surefire way to accumulate wealth long-term.

Thing is, now, the first rungs of the ladder have collapsed. They can’t get on at the bottom.

Sump’n’s gotta give.

(*Again, doesn’t anybody else remember, I reckon during Reagan’s first term, when interest rates went to 18%? Yes 18%. Before that, for years, mortgage interest rates were always around 8-9%. I could a tale unfold about practicing “family law” in THAT era…)

I’m not sophisticated enough to connect the dots, but…Ol’ Jo[k]e ran on wanting to eliminate single family zoning. Thats the old American dream, y’know, your own little house and yard. So I bet the Dems feel it’s just GREAT that young people can’t afford houses. That’s what they want,: to force everybody onto the collectives.

According to this article from 2022, the median retirement savings of Americans in the 55-64 age range was $89,700.

The Fed reports a median retirement accounts balance of $185,000 for the same year and age range.

That is a Vanguard report, which suggests it probably refers to the subset of the US population which has a retirement account. The report apparently also states:

“However, most people likely have much less: The median 401(k) balance is just $35,345.”

Which again raises the issue of what percentage of the population has a 401(k)? If most Americans are one paycheck away from penury, as Hillary! Clinton reportedly said, the answer is – not enough. And if a significant proportion of the population with 401(k)s also will go into retirement still carrying a student loan balance (as had been bruited), then the net savings of most people is going to be small – except for any real estate equity.

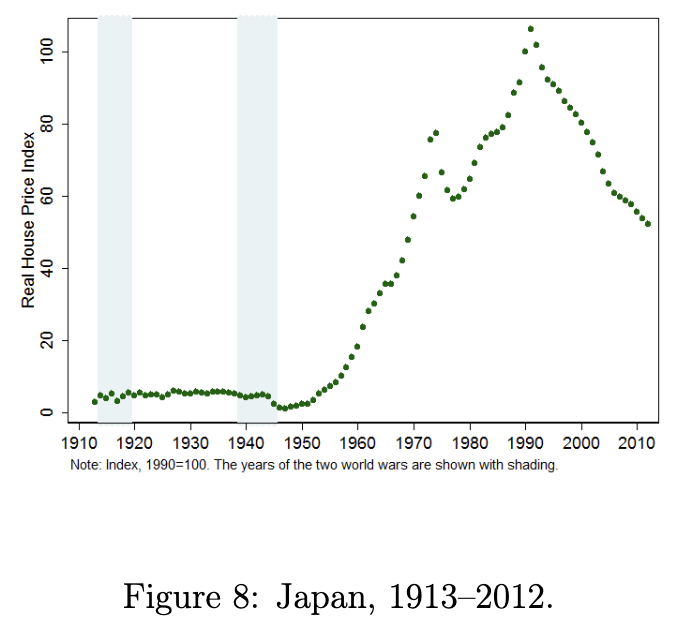

That is the issue some economists were pointing out decades ago – when the Baby Boomers want to sell their homes and downsize to access that equity, the price of large homes will decline and the price of downsized homes will increase. Supply & demand.

Indeed. Here is one estimate:

According to U.S. Census Bureau data, 50% of women and 47% of men between the ages of 55 and 66 have no retirement savings.

I thought the $185,000 and $89,700 figures were bad enough.

For comparison, investing $300 each month, compounded annually over 40 years at 8% interest, would result in a balance of $932,603.47.

I wrote an article about Bygone’s avowed attempt to get rid of single family zoning. Now it occurs to me: they don’t have to outlaw it; it’s becoming unaffordable. Is this by design,mor just good luck for the Dems?

I think this, too, goes back to Obama. I guess (to the extent any memory function remains) he may have need to recall his quote “we’ve got the fighter jets…”. [INTERESTING - when I tried to search that quote, nothing showed up! As I ?recall?, there was a bit of a stir at the time he blurted it; now memory - holed, I guess].

Definitely Obama

The plan is to eliminate zoning so there will be no rich neighborhoods and all neighborhoods will be equally poor. The goal is to section 8 every neighborhood

Yes, it is. And I thought they were planning to do it by enticing local governments to change their zoning ordinances to eliminate residential districts by dangling fed funds. They ARE doing that, but at the same time single family dwellings are becoming unaffordable, anyway.

The goal is to tear down single family homes and replace with large affordable housing buildings

California is forcing cities and towns to build section 8 housing in affluent neighborhoods like Del Mar in San Diego