The World Reserve Currency

Last week (although you’d never know it from his Web site, which does not date the articles it publishes), Doug Casey published a piece on his International Man site, “[T]he Debt Ceiling Farce and Why the US Should Declare Bankruptcy”.

International Man: You have previously stated the US government should default on the national debt.

What are the reasons for that?

Doug Casey: I know it sounds outrageous to propose the US government default on its national debt. Of course, they don’t think it will ever be necessary because, as several high-level government officials have pointed out, they can just print money to pay off the debt.

However, I disagree. What are the reasons for doing something as seemingly catastrophic as defaulting on the debt? I’ll give you at least five. Stick with me. Let’s conduct an outrageous but not unreasonable thought experiment.

First, barring default, future generations of Americans will be turned into serfs to pay off the debt. Profligate people have run up the debt, but everybody’s children and grandchildren are stuck with having to pay it off. That’s simply immoral. If you have any care for the future at all, future generations should be saved from becoming serfs to pay it off.

Second, it would punish the enablers who lend the US government money. People who lend the US government money facilitate it by doing all the stupid and destructive things it does. They shouldn’t be rewarded; they should be punished.

Third, official default is better than the alternative. It’s like a hundred-story building that’s about to collapse. If that’s the case, should you wait until it collapses randomly and unpredictably, or should you have a controlled demolition? It’s not a pleasant alternative, but it’s the better alternative.

Fourth, default would make further borrowing on the part of the US government impossible, at least for a while. It would be exposed as an untrustworthy entity, like the Argentine government, which defaults all the time. People would still idiotically lend it more money, but a default might slow down the rate of increase in the US government’s size.

Fifth, it’s almost necessary that the debt goes away to help de-financialize the US economy. The US is tremendously over-financialized. It’s all about buying, selling, creating, and packaging financial instruments. Government debt, with the help of the Fed, is the actual engine of inflation. Defaulting on the national debt would pave the way for the reinstitution of a sound, redeemable, commodity-based money. People would have to concentrate more on real wealth than phony financial wealth, actual engineering, as opposed to financial and social engineering.

International Man: It’s hard to believe the US government was ever debt-free.

But it happened once—in 1835—thanks to President Andrew Jackson. He was the first and only president to completely pay off the national debt.

Jackson also shut down the Second Bank of the United States, the precursor to the Federal Reserve, the US’s current iteration of a central bank.

It’s unthinkable a modern US president could or would do such things.

It’s also unthinkable that a modern US president could or would engage in deadly duels of honor:

The next 100 times Andrew Jackson should have died were in duels of honor—the old-fashioned variety, where sometimes men fired their pistols into the air and sometimes they didn’t. Often, these run-ins were instigated by talk of Jackson’s wife, Rachel, who’d previously been with an abusive husband. Jackson valiantly rescued her from the nasty situation, yet the finality of her divorce at the time of their wedding was questionable at best. Needless to say, this was a sore spot for Jackson, and he wasn’t afraid to draw his pistol at any mention of it. In fact, things only got worse when he decided to run for president, as it became the topic of a massive smear campaign. Rachel was called a bigamist more times than she could handle, and she died of a heart attack before she could even make it to the White House.

Although not all of Jackson’s duels were near-death experiences, at least two of them were. Once, for instance, he was shot squarely in the chest. Normally, that sort of thing would signal the end of a duel, but Jackson simply staunched the wound with a handkerchief, and then shot and killed his opponent. The bullet, however, was lodged so close to Jackson’s heart that it couldn’t be removed, and he suffered from chest pains and excessive phlegm for the rest of his life. In another fight, two bullets shattered Jackson’s arm and left shoulder. Doctors wanted to amputate, but Jackson refused for fear it would ruin his military career.

So should we consider it any mystery whatsoever that those more likely to utter the phrase “honor culture” in contempt of men like Jackson would refuse to be honest about their failure to honor the debts of the US government by relying on central banking system that sleazes around that failure to honor debts by simply printing more money or, worse, sending young Christian men off to defend the US dollar’s world reserve currency status so as to prop up demand for the USD?

There isn’t a snowball’s chance in Hell that even MAGA Republican controlled Legislative, Judicial and Executive, combined, would do anything to cut off the monetary-drip that has turned the highest median income in the US counties surrounding DC into the moral equivalent of a Fentanyl house.

The closer the U.S. gets to default THE BETTER.

During New York City’s fiscal crisis in the 70’s, much financial and labor reform resulted that paid dividends for decades.

Today, many cities are propped up with the U.S. adventures in financing – SO DEFAULT WOULD REFORM CITIES TOO. Downside is for individuals that would need to move to more fiscally responsible and prosperous places – but long term this is best for all.

Does anyone actually believe the US will pay the debt? What large debt has ever been repaid in the history? A default or inflation are standard. The only question is when will it happen.

Depends on what you mean by “believe”. Although decreasing in number (with notable holdouts like Paul Krugman) there are many adherents to MMT, Keynesian and post-Keynesian ideas that still believe their own material which is basically that government can always end up paying off its debts (without hyperinflation) as long as the rubes just mind their own business and let their betters rape them repeatedly, while on continual Fentanyl drip, for generation after generation.

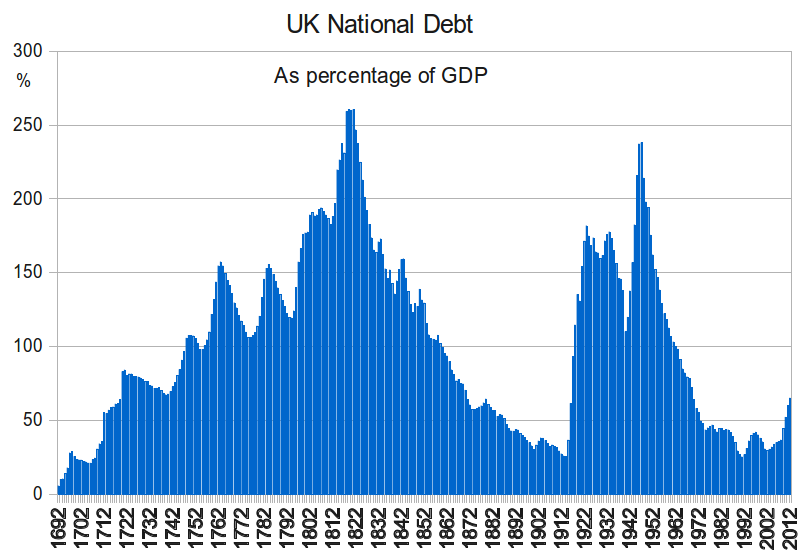

I’m not sure if any major country has ever completely paid off its national debt, but there are examples of countries dramatically reducing their indebtedness through a combination of economic growth and restraint in public spending. Here is the United Kingdom national debt as a percentage of GDP from 1692 through 2012.

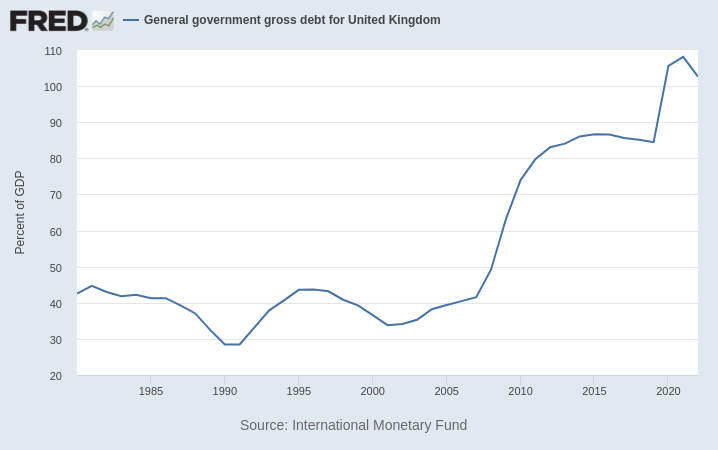

After hitting a peak of more than 225% of GDP during World War II, in the postwar era the debt as a fraction of GDP declined steadily to below 50% of GDP in the early 1970s and remained below that level until the Great Unraveling began in 2008. In the aftermath of that (later than covered by the chart), the debt hovered between 85% and 90% and then took off to above 100% during the COVID madness.

Here is a document from Global Financial Data, “Paying off Government Debt”, which compares the public debt histories of 12 major economies, some of which have substantially paid down their debt before succumbing to the recent insanity.

Most likely in my view is they will “pay off the debt” nominally, in that if your government bond is denominated at $1million, you will get back $1million. You will then be able to purchase 2 loaves of (plastic foam) bread, a jar of organic grasshopper spread, and a soft-serve ice almond-milk cone with it.

Finally, an “influencer” talks about the WRC as the WRC:

My response:

Any “resource” may become a “curse” if the tax base is activity rather than wealth, and that revenue is not distributed to the middle class to support reproduction. That this is so can be easily seen from the way value from positive network externality of civilization falls on resources in terms of demand for them. This is true whether the resource is natural or artificial – especially in the case of the Worst Resource Curse: World Reserve Currency.

The ultimate manifestation of this “curse” is demographic collapse under the weight of an increasingly insular parasitic elite.

“I could stand in the middle of Fifth Avenue and shoot somebody, and I wouldn’t lose any voters, OK?”

Come on… you know in your heart of hearts that everything is so batshit crazy that it wouldn’t take much for Trump to do something so simple, easy and obviously sane that would make everyone feel like they’d just been sent to Heaven. $100k one time for H-1b? Oh, that’s just the tip of the iceberg.

This makes the “King” or “Caesar” or “Messiah” or “Anti-Christ” or whatever extreme centralization of authority plausible. It’s not that others couldn’t pull it off like JD … all it takes is an even slight grip on reality in combination with being in a position to do anything serious with the MAGA movement.

But such an authority still has to deal with the national debt and Worst Resource Curse aka World Reserve Currency.

So, I’m sure I’m late coming to this particular conjecture compared to the Nick Szabos of the world but what does Mr. WRC do?

The WRC (which Trump has openly stated he’ll go to war to retain) and all this talk about a government cryptocurrency to deal with the national debt and secure the WRC misses a pretty important dimension:

Bitcoin is currently in the hands of a lot of “loose canons” around the world. Charlie Kirk, with his talk about young men not being able to afford to form families, was becoming such a loose cannon. These guys simply must be dealt with!

So rather than the ICO being for something like gold reserves, you make it a limited time offer for BTCs – get in on the pump of the ICO all you loose canons!

A new positive network externality is locked in and the loose cannons are locked DOWN.

Very much so. But the terms are set by the market. Until these men you’re trying to reward get their act together and start self-organizing – there’s going to be little movement.

Bootstrapping anything would require either a base of operation sufficiently secluded as to evade detection or resources in combination with intelligence sufficient to over come detection. The BTC whales have quite a number of loose cannons (my prior misspelling was unintentional, but…) that might be able to provide the latter – which is why I brought this up. The IDF could do it and may if the heat keeps rising on Israel. That’s one reason I brought up starting the militia money conflagration by dealing with Hamas in the manner ALL post-Lindbergh Readers Digest article “migrants” should be dealt with:

Arm them to invade their home countries and impose militia.money there – or die (or stick around and be potentially subject to the MM regime’s State of Peace: If Sovereign being required to become so-acquainted with the local ecology that one could prevail in a mutual one-on-one hunt in its wilderness, when challenged as the appeal of last resort in dispute processing).