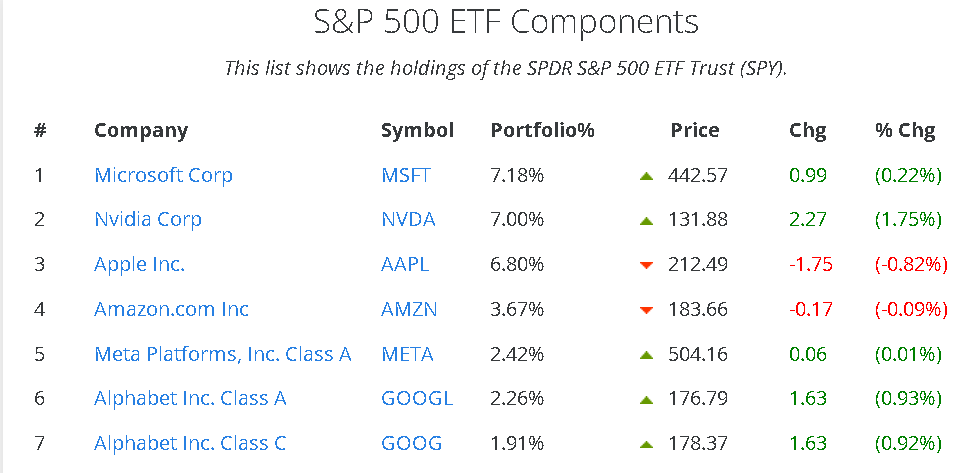

Top six weighted companies in the S & P 500 Index account for 31.5% of the portfolio. I dub these companies “The PSYCHO 6”. To speculate on potential downdraft in market, on Friday I started a very small put option on the S&P 500 ETF (SPY) 'til Aug 31st (only God and members of the U.S. Deep State can time the market). See below for names and numbers. Source of financial data is S&P 500 Companies by Weight

Is it too risky to buy the top 6 stocks and ignore 494 stocks in the 500 index?

No short term risk of the top 6 going to zero

Depends on whether one is investing or merely day-trading/speculating (i.e. gambling).

Investing not day trading

Adjust portfolio once a year

They are real companies that provide valuable goods and services so they will not go to zero, but they could drop in price by 50% relatively quickly. I guess one could argue this is true of the entire S&P 500.

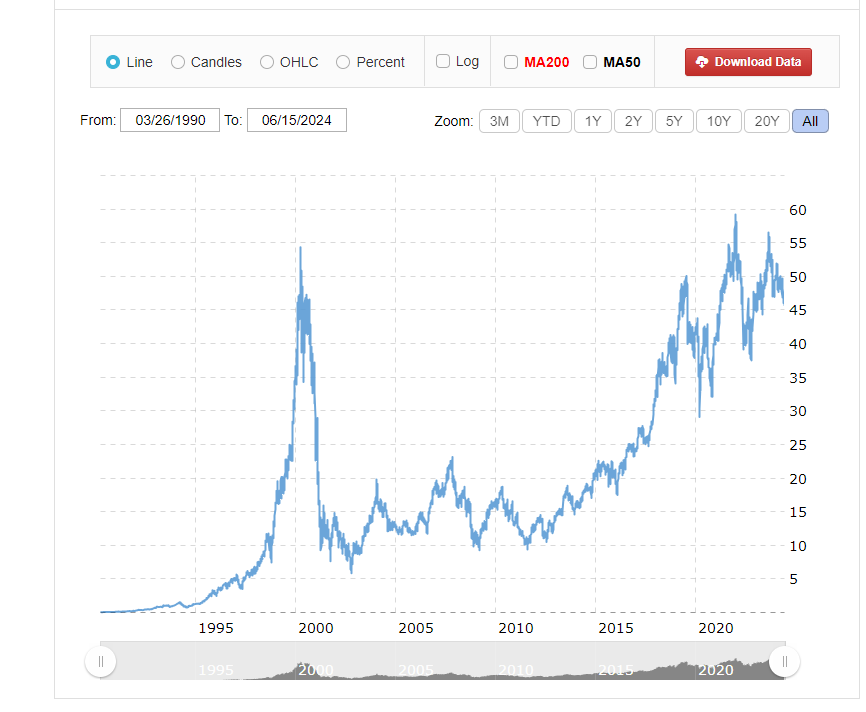

But the difference is that NVIDIA could be a CISCO and you could catch it at the top and be underwater 24 years later.

The coolest thing about the Psycho Six is that fully one third of them add virtually zero value. If they disappeared from the face of the Earth, it would hardly be noticed after a brief period of adjustment. Arguably, if META and GOOG(L) vanished, the world would be a better place. A convincing argument could be made for some of the others.

Agree 100%, this is speculating.

“Hard knocks” tuition is 0.1% of portfolio. If value of put option goes to zero, that is the most I would lose.

One day in, it is a bad position, losing 21% of its value.

Did I mention these “best” companies are:

chock full of DEI hires

pumped up in price by the AI hype.

Who knows, one or more of these companies may trade similar to CSCO in the year 2000 during the Internet hype era. ( Mettelus read my mind).

25 days in and this has been MY WORST TRADE OF THE YEAR.

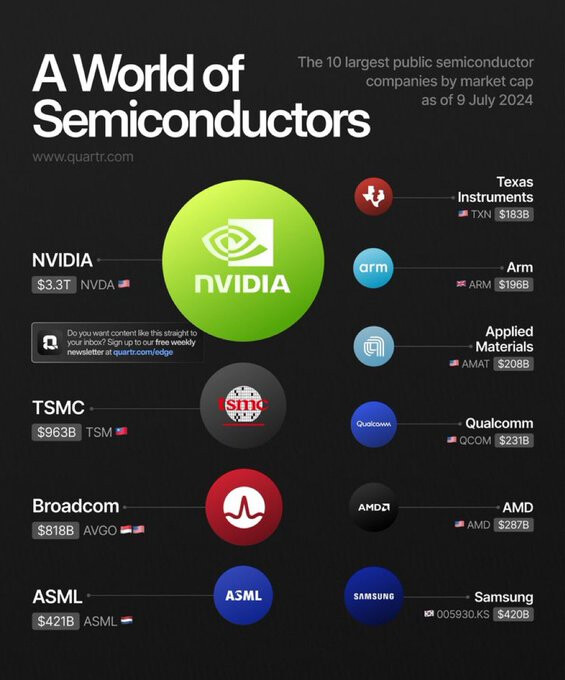

Thankfully I have a very very small position, and my BEST TRADE OF THE YEAR [SHOC (STRIVE U S SEMICONDUCTOR ETF)] is a bigger position and up, up, up … as of this writing.

I am considering adding to my “PYCHO 6 TRADE” w/ a bit more than 0.1% of portfolio. As of this writing, I am only down 19.7% on my test balloon trade, which expires at the end of August 31st.

SPY puts are losers until they hit big.

I wrote this the day you posted, but didn’t post it. I was thinking at the time, this is a good time for PUTs. The vol is extremely low again and the market is very high. I wish I would have laid it on that day. Vol is up 36% since then.

I hope the markets pop a little tomorrow so I can get a discount on a SPY put.

I recommend Mark Spitznagel’s book.

The Dao Of Capital. He lays on the Put 30% out of the money 90 days until expiration and rolls it every month when the market is over valued according to Tobin’s Q. It is a lose a little consistently until it hits strategy. This is the basic idea, I am sure he actually uses a much more sophisticated strategy.

Thank you, Dao of Capital is on my reading list! I am long term bullish on the market as a whole, but it is important to understand that yesterday’s winners may become today’s losers.

Do all those companies manufacture chips or do some just design them?

ASML are suppliers to the fabs. Everyone depends on them.

BAM!

At the moment my SPY PUT Option is up 118%!

Should I sell and lock in the profit?

70% of my portfolio is in the market is down 2.7% today. Does any rational human, think the next 100 days will be a walk in the park?

Do you have the put on as a hedge or to make a return? If it is a hedge, I would let it run a bit. If it is just a trade, I would take at least some profits.

Advice from @Mettelus was timely!

Any inside info from 3M?

JUST IN: ![]() Over $879 billion was wiped out from the US stock market today.

Over $879 billion was wiped out from the US stock market today.

WatcherGuru