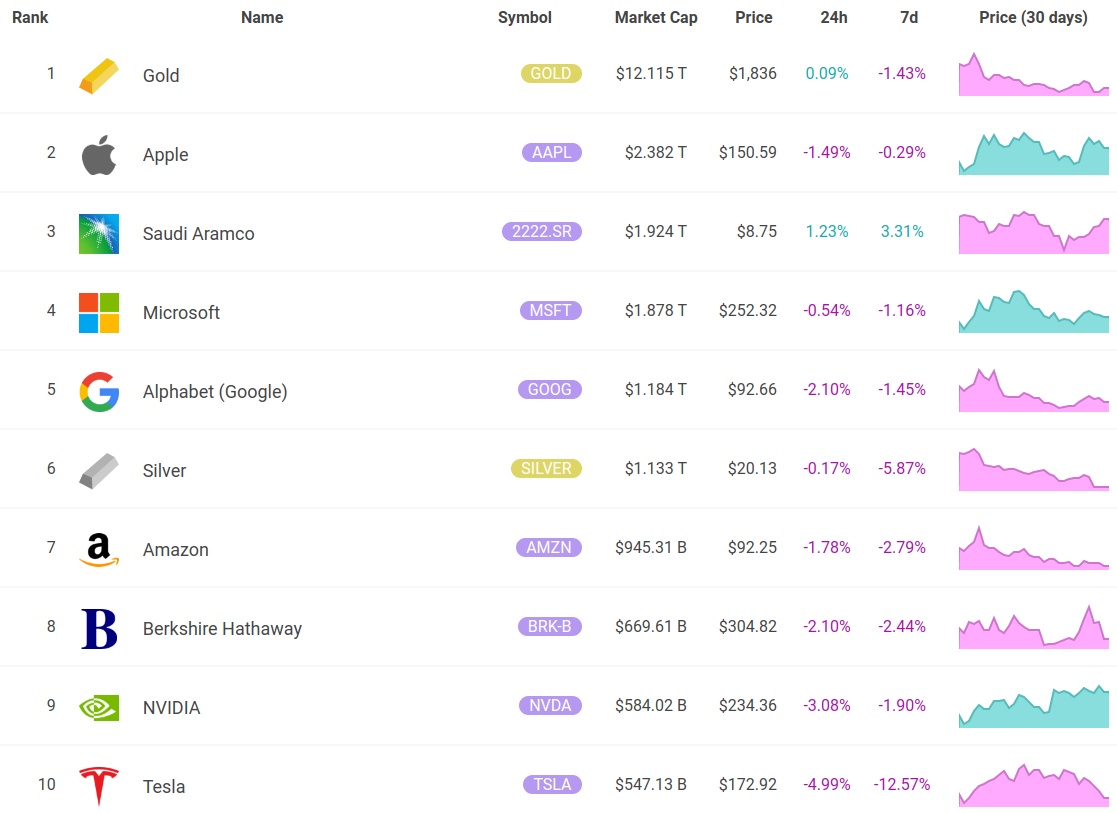

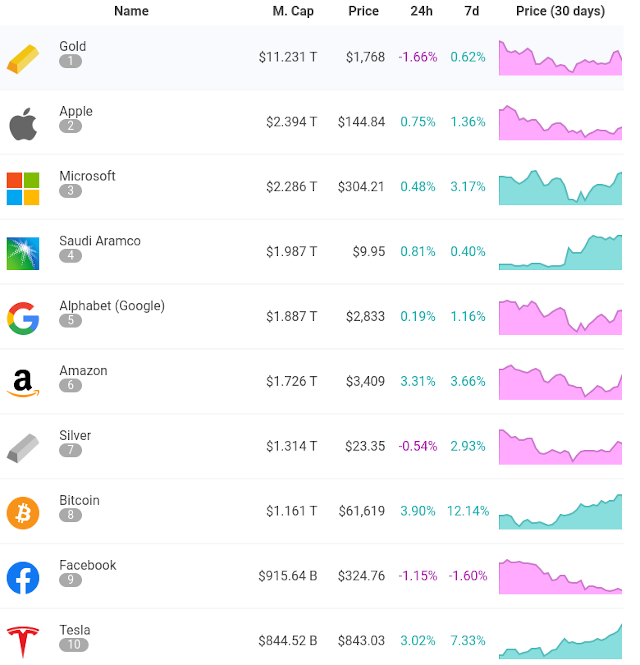

The Infinite Market Cap Web site ranks more than 13,000 assets by market capitalisation, which is defined for various assets as follows.

- For precious metals the Market Cap is calculated by multiplying the its price with an estimation of the quantity of metal that has been mined so far. These estimations are updated annually.

- For stocks it is calculated by multiplying the amount of outstanding shares with the current share price.

- The Market Cap of cryptocurrencies is calculated by multiplying the circulating supply with the coin's price.

One can quibble with these definitions: for example, silver, ranked as the 7th largest asset, is an industrial metal which is consumed in many of its applications, so there is a large gap between the total amount mined over history and the existing above-ground supply. For cryptocurrencies, estimates are based upon circulating supply in public hands, excluding funds believed to be lost, some of which might reappear in the future. Obviously, all of these asset prices are volatile and this ranking represents their valuation as of the date of this post.

A few observations: it is stunning to observe that, among companies in the top ten, only Saudi Aramco is not a technology company, and is the only one founded prior to 1975. We often think of Big Oil and Big Banking as archetypes of corporate wealth and power, but only one oil company and no bank made the top ten. The highest ranked bank, JPMorgan Chase, came in at 16th, just before the Ethereum cryptocurrency at 17th. The largest traditional industrial company (but with a strong presence in technology as well) was Samsung at 22, and brick and mortar retailing leader Walmart ranked 23.

The total valuation of the top ten assets combined was US$ 25.7 trillion, which is less than the U.S. national debt of US$ 28 trillion and change.

Autodesk ranks number 306, with market cap US$ 64 billion, beating out Northrop Grumman at 307 and US$ 63.3 billion and Ford Motor Company in 312th place at US$ 62.7 billion. Also in the cheap seats are Federal Express (322), UBS (324), General Dynamics (341), and Honda (381).

Dogecoin is hanging in there at 705th with market cap US$ 31.5 billion.