Here is the Form 8-K filing with the U.S. Securities and Exchange Commission containing the “Entry into a Material Definitive Agreement” [PDF]. Spelled out are the handling of stock options, other equity-based rewards, termination date (2022-10-24), and drop-dead provisions in case of non-consummation of the deal by either party.

In other news from around the Musk Empire, the Los Angeles Business Journal reports “Elon Musk’s Boring Co. Has Moved to Texas”.

Without a formal announcement, Elon Musk’s Boring Co., which develops tunnel systems, recently moved its corporate headquarters from Hawthorne to the Austin, Texas suburb of Pflugerville, according to public documents cited in Texas media reports.

⋮

Boring Co. first entered Pflugerville in late 2020, leasing two commercial buildings on 14 acres and then renovating 40,000 square feet of space in one of the buildings, developments that were first reported by the Austin Business Journal. Then in May 2021, Boring Co. filed with state officials for further renovations on the property. In February, Boring Co. unveiled plans for an 80,000-square-foot warehouse facility in the metro Austin area, again according to the Austin Business Journal. By that time, the company was using Pflugerville as its corporate headquarters address.

SpaceX, Neuralink, and OpenAI remain headquartered in California.

Meanwhile, Texas governor Greg Abbot invites Elon Musk to move Twitter’s headquarters to 100 acres (40 hectares) of free land offered by Jim Schwertner.

https://twitter.com/GregAbbott_TX/status/1519511442378080257

Chron reports, “Texas man offers Elon Musk 100 acres of free land to move Twitter’s headquarters”.

An Austin-area man is offering Elon Musk free land to use for Twitter’s headquarters should the billionaire choose to relocate his newly purchased company from San Francisco to Texas. Twitter accepted Musk’s deal to buy the social media platform for $44 billion on Monday, which prompted Gov. Greg Abbott to invite the richest man in the world to move its headquarters to the Lone Star State and join three of Musk’s other companies.

Now Jim Schwertner, president and CEO of Schwertner Farms, is making his own offer to Musk. “Elon Musk, Move Twitter to Schwertner, TX. 38 Miles North of Austin in Williamson County, and we will give you 100 Acres for FREE,” Schwertner wrote on Twitter Tuesday.

Schwertner oversees farming and ranching on 20,000 acres of land just north of Georgetown, according to Austonia’s Andrea Guzmán. He said that the move would be a “win-win for everybody,” adding that a business like Twitter would bring a lot of jobs and boost the economy.

This discussion in the leaked video makes clear that there are remaining many steps over many months to wind up the current company and take it private. They cite regulatory and financial steps. Since there was no video to show winks and nods, none could be seen, but I cannot help but suspect they were there - i.e. hope that the deal eventually fails with help of lefty fellow travelers in the regulatory and financial establishments. The long march through these institutions was undertaken for just such eventualities, after all.

The hypocrisy of the statements were really breathtaking. The CEO, who said Twitter’s role was to control who is heard, uttered all the expected pieties as to the importance of free speech. Again, no video, but he is surely sufficiently practiced to say them with a straight face. The hubris is overwhelming. Here’s hoping Nemesis comes in the form of Musk and the deal goes through. IIf it does, I will still withhold judgment before declaring victory for freedom of speech.

Addendum: The chairman of the board, I think, said, in effect: “We didn’t really want to do this, but had no choice given our fiduciary duty and a perfectly- priced buyout figure. We still have hopes that having covered our asses legally insofar as our fiduciary duty, the deal may still fail in the end”.

Well, I have now become convinced that Musk’s purchase is actually a good sign because the reaction by the Security State has been to become its own censoring arm of the Federal government. Recall that with that broad lawyer and Subcontinental millenial twit-wad, the censoring on behalf of the Intell State was done by them. Well, it looks like that is going to change:

https://investor.twitterinc.com/financial-information/financial-releases/default.aspx

This will bring up the 10Q when available:

https://www.sec.gov/edgar/search/#/dateRange=all&ciks=0001418091&filter_forms=10-Q

Twitter earning press release [PDF]:

Musk Tesla trades

Update (2022-04-29 19:17 UTC): Three additional Form 4 insider trading reports were filed on Friday the 29th, disclosing additional sales of Tesla stock which occurred on 2022-04-28, prior to the tweet at the bottom of this post. I have updated this post to include these additional sales.

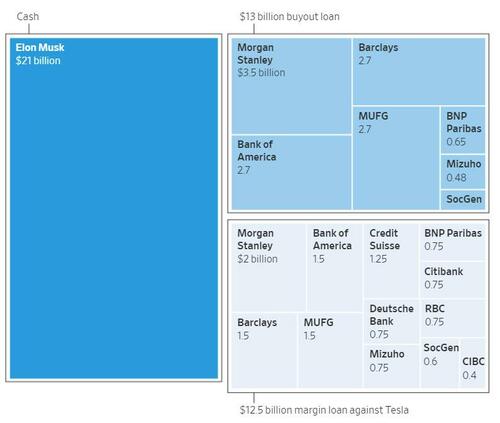

The total number of Tesla shares sold by the Elon Musk Revocable Trust, which held them, was 9,633,139 (based on starting and ending beneficial ownership reported), which, at an average price of US$ 900 per share (which I eyeballed, not wishing to compute precisely), comes to US$ 8.67 billion.

Here is an infographic from the Wall Street Journal posted on ZeroHedge showing the source of funds for the Twitter acquisition.

Elon Musk tweeted on 2022-04-29:

Note that while some sales were reported to the SEC on April 29th, the tweet is saying “no further sales” did, in fact, appear after the final sale made on the 28th.

Update (2022-04-29 19:17 UTC): Three additional Form 4 insider trading reports were filed on Friday the 29th, disclosing additional sales of Tesla stock which occurred on 2022-04-28. I have updated this post to include these additional sales.

I thought I’d work out the tax bite on Musk’s liquidation of around US$ 8.7 billion in Tesla stock. Assuming the basis on the stock is essentially zero (which would be the case for founder stock), then the entire proceeds are considered a long term capital gain. This will be taxed at the top bracket of 20%, plus the 3.8% “Net Investment Income Tax”, which was part of the “Affordable Care Act” and is often called the “Medicare Tax”. Musk’s shares were sold by his revocable living trust, and it took me a while to figure out whether trusts are subject to this tax, but according to the IRS “Questions and Answers on the Net Investment Income Tax” they are, since as we all know, trusts are eligible for Medicare when they retire. This brings the total tax rate to 23.8%, so Musk owes US$ 2.07 billion in federal capital gains tax on the sale.

As a resident of Texas, which has no income or capital gains tax, he owes no state taxes on the sale. If he had remained domiciled in California, there would have been an additional 13.3% bite from the California Tax Nazis for US$ 1.16 billion, bringing the total tax rate on the sale to 37.1%.

I hope Elon has good lawyers, because if my experience in 1991–1993 is any guide, California is certain to come after him with a claim that for some reason or another (for example, owning three companies domiciled in the state), he has not broken his personal domicile and remains a California taxpayer until the end of time.

So, Musk’s sale of Tesla stock ends up putting US$ 2.07 billion the the federal piggy bank. The U.S. federal budget for fiscal year 2022 [PDF] estimates spending for 2022 as US$ 6.011 trillion. so Musk’s “contribution” will fund federal expenditures for around three hours.

A good point for him to make when he is summoned to testify before Congress.

This is true. They are relentless and my take is it will be litigated.

Not to help CA, but let’s offer some ridiculous reasons for them to use.

For example, Musk may have deposits in CA sperm banks:

Interestingly, as far as the SEC is concerned, Musk’s main profile lists him as Californian, using Tesla Palo Alto as his address:

https://www.sec.gov/cgi-bin/own-disp?action=getowner&CIK=0001494730

but his individual recent filings use Tesla Austin:

https://www.sec.gov/Archives/edgar/data/0001318605/000089924322015989/xslF345X03/doc4.xml

According to CNBC on 2020-12-08, “Elon Musk confirms: ‘Yes, I have moved to Texas’ ”. If the move occurred some time before the end of 2020, he should have filed a partial year California tax return for 2020 and would not have filed for 2021. But California is not obliged to act quickly in bringing a claim of domicile. I left in May of 1991 and, as I recall, it was not until some time in 1992 that they began to go after me in earnest and the issue was not resolved until 1993.

The viciousness of the Franchise Tax Board cannot be underestimated. When Carol Bartz, who became Autodesk CEO in 1992, was at Sun Microsystems, she was reassigned from headquarters in California to an office in Texas and filed a partial year return when she left. After a couple of years, she returned to a job at headquarters and California immediately went after her for taxes during her absence, claiming “the domicile had not been broken”. This battle went on for years, like mine, and at one point they made her produce invoices from her cat’s veterinarian to prove that her cat was with her in Texas. She eventually “won”, as I did, but the battle was painful and exhausting.

Painful & exhausting for the human being asserted to be liable for the tax – but a full time job (with excellent medical & pension benefits) for the bureaucrat pursuing the case.

Indeed, the more such cases that can be tossed up, the more bureaucrats will be required – and the greater the promotion prospects for those bureaucrats that are already there (higher pay, higher pension, conferences in exotic locations).

After the Revolution (or, more realistically, after Biden’s WWIII), we will need to change a lot of rules about “public servant” bureaucrats. No pensions and no security of employment, for a start. And a tax inspector who launches a case which the State eventually loses is immediately terminated, and has to repay all that she earned while the case was ongoing.

SDNY maintains SEC Twitter babysitter rule on Musk:

Meanwhile, Musk prevailed regarding the Tesla acquisition of Solar City:

https://courts.delaware.gov/Opinions/Download.aspx?id=332290

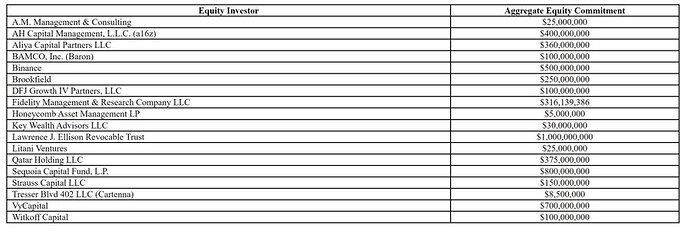

Here is a current list of equity partners joining Elon Musk in the Twitter buy-out.

This list does not include Saudi prince Alwaleed bin Talal Al Saud, whose Kingdom Holding Company has now said, after originally rejecting the deal, that it will retain its US$ 1.9 billion equity stake in Twitter.

There are some heavy hitters among these investors: “AH Capital Management” is Andreessen Horowitz, better known for early stage venture investments, and Fidelity, putting in the precisely calculated US$ 316,139,386, is an establishment Wall Street funds company. Larry Ellison of Oracle is putting up a cool billion of his own fortune. Interesting is the half billion from Binance, a cryptocurrency exchange headquartered in the Cayman Islands and Seychelles, not known for private equity deals—perhaps preserving Twitter as the preeminent marketing vehicle for crypto and NFT scams is considered a prudent strategic investment.

Or they intend to help Musk with his plan to rid Twitter of scam bots. If Musk succeeds, hopefully that will put pressure on Facebook and Google.

One hypothesis is that there is a huge amount of capital seeking places to hide. Stock market going down, bond prices going down. Strong incentive to be among the early investors/speculators to run for the exits. But then what to do with the resulting cash?

If that hypothesis is correct, then there could be buy-out plans for other companies bubbling under the surface. Of course, the question is whether moving from equity & bonds to buy-outs would actually preserve those past financial gains?

Historically, companies going private through buy-outs is not something that happens much near market tops, which is where we appear to be now based upon price to earnings ratios, but rather near bottoms or during long periods of trendless market churning. The usual financial motivation for a buy-out (which doesn’t apply to Musk/Twitter, which appears to be based mostly upon ideology and strategy) is the belief by those mounting the take-over attempt that the public market undervalues the company and/or that the current management is not acting to maximise shareholder value. Often, as in the leveraged buy-out boom of the 1980s, this results in issuing a large amount of junk bond debt secured by the assets of the company, then breaking up the company and selling pieces to competitors at a premium, using the proceeds to retire the debt and end up with a nice profit for the raiders. This helped to get rid of a number of the pointless conglomerates put together in the 1960s that consisted of a motley collection of unrelated businesses none of which were leaders in their sectors.

I wrote about this in Theme 1 of “The New Technological Corporation” in 1988, where I called leveraged buy-outs “the elbow of the invisible hand”.