The New Technological Corporation is a magnificent, prescient piece - as, indeed is The Autodesk File. These works ought to be required reading for anyone who wants to be an MBA. If you hope to start/run a successful new company, these tell how to do it.

That certainly has been the historical experience. The question is whether, at this strange juncture in history, past is prologue?

Clearly Musk’s interest in Twitter is not primarily financial – though presumably he is not intending to lose money on the deal. Some of the financial companies on that list of equity partners have no interest in free speech ideology – and may even be “woke”. Why are they buying high to take Twitter private?

Just speculation on my part – maybe they are desperately seeking places to stash the cash they will have from selling stocks & bonds before/as the market goes down? If they hold traded assets, many of them will likely have to recognize paper losses as the public prices of those assets go down. If they hold privately-owned non-tradable assets, they may not have to admit to paper losses.

Maybe the underlying driver is some of the smart money have realized that the unsustainable debt spree of the last several decades is going to crumble, and they need a different approach from what worked in the past?

Delaware suit against the acquisition:

Elon Musk cameo appearance in Iron Man 2 (2010)"

Larry Ellison, who is making a US$ 1 billion equity investment in the Twitter buyout, also has a cameo in this movie.

Reality is stranger than fiction!

As a shareholder of Twitter, my opinion regarding the lawsuit from plaintiff ORLANDO POLICE PENSION FUND, is to tag all associates with fund, and lawyers handling their case, with the following warning on all their future tweets:

High-profile short-seller and vulture capitalist research firm Hindenburg Research tweeted today (2022-05-09):

The linked article, “Significant Risk That The Twitter Deal Gets Repriced Lower”, enumerates the reasons that Twitter’s valuation today may be as much as 50% below current levels assuming the deal closes, which may give Musk and other equity investors who intend to remain shareholders an incentive to threaten to walk way and pay the termination fee unless the Twitter board reprices the deal at a lower level. Since the Twitter board, with the exception of Homeless Jack, owns a negligible amount of Twitter stock, they have little incentive to resist such a move. Repricing the deal will leave the post-deal company with less debt, giving it more flexibility in changing its policies even at the cost of a near-term hit to revenue and earnings.

Hindenburg is the firm that blew the whistle on electric vehicle bubble blowers Nikola and Lordstown Motors, among other turkeys flying high in the everything bubble.

An hour after the Hindenburg tweet, Elon Musk commented on it:

Tesla is down 20% since Musk made the offer.

Talking about aging… funny how the good prince has now reconsidered. In the 6th amendment to the 13D SEC filing published on May 4, Elon Musk disclosed that HRH Prince Alwaleed Bin Talal Bin Abdulaziz Alsaud (Kingdom)

“has committed to contribute to Parent, at or immediately prior to the closing of the Merger and subject to the conditions set forth in the Co-Investor Equity Commitment Letters, existing shares of Common Stock held by such Equity Investor in the amount set forth opposite such Equity Investor’s name in the following table (valued at $54.20 per share) in order to retain an equity investment in Twitter following completion of the Merger in lieu of receiving Merger Consideration in the Merger”

Matt Levine reported (sorry for paywalled link) that Alwaleed’s stake in the future private entity has actually gone up to approx. 5.7% from the 4.6% he currently controls. Win-win?

Musk Twitter will be much more levered than public Twitter, so Alwaleed won’t just roll over to owning 4.6% of the new company. Figure that the total equity check for this buyout is $33.5 billion, consisting of (1) Musk’s personal equity commitment, (2) the equity commitments from his co-investors and (3) Musk’s margin loan (which is equity as far as Twitter goes). Then Kingdom’s $1.9 billion is about 5.7% of the equity.

The Twitter saga gets better and better…

The Twitter saga gets better and better…

The metaphorical ink barely dried on these words and WSJ reports

A management question: Once Musk owns and is CEO of Twitter, he can certainly reverse the ban on President Trump; but is that the right answer?

Would it be better for future-CEO Musk to identify everyone in the chain who took the decision to ban President Trump and who was involved in implementing the decision and fire them with as much prejudice as can be managed?

After all, President Trump is far from being the only person who has had the distinct honor of having been “Banned from Twitter”. Maybe that weed needs to be pulled up by the roots.

Would it be better for future-CEO Musk to identify everyone in the chain who took the decision to ban President Trump and who was involved in implementing the decision and fire them with as much prejudice as can be managed?

Small ball.

Announce headquarters are moving to rural Texas (he has plenty of land near McGregor) and anybody who does not wish to relocate can accept a 90 day termination package. That will clear out most of the pink hairs and dumbeards. The techies will probably move, which is fine.

Replacing them with hires from Texas or willing to move there will be a useful

filter from then on.

Texas man offers land to Musk for Twitter

This is a practical version of the Coinbase gambit.

Creon Levit, 32 year veteran of NASA Ames and now director of R&D for imaging satellite swarm company Planet Labs has posted on Substack, “Why Elon really bought Twitter”.

I believe Elon has a much deeper vision about twitter than most of the existing commentary suggests. I think he bought Twitter because his agendas and portfolios are aligned with a vision of long-term flourishing for humanity: e.g. sustainable transportation (Tesla, Boring Co.), sustainable energy (Tesla), universal access to the internet (StarLink), space settlement (SpaceX), and mind-enhancement via brain-computer interfaces (Neuralink).

Now, after witnessing years of social-media-led censorship, cancellations, and the resultant rush towards dumbing-down of the public discourse – tilting towards authoritarianism and rollback of the constitution – Elon realized that twitter could be extremely high leverage in righting the ship: Restoring free exchange of ideas, open dialogue, the first amendment, and frankly our collective intelligence, analysis, and creativity.

⋮

Basically (educated guess) Elon recognizes that an ultimate tool for human super-intelligence is exchanging and refining ideas through collective collaboration and debate. And he (and we) choose a collective which is organized organically, bottom-up, with decentralized “authority”. Earned authority rather than mandated authority.

Twitter can now turn into this and more. It will be a grand experiment.

I don’t really believe Musk cares about free speech or has a broader philanthropic vision (he’s quite demonstrably not an absolutist). To quote myself:

Elon desperately wants to be accepted into the US oligarch class, but he doesn’t own a media company, doesn’t have strong ties to military, intelligence, or politics, and he’s generally despised by the 4th estate. The solution is to buy Twitter, a media company integral to the US intelligence propaganda machine, and where all the journos hang out.

It’s a hot take without any nuance, but about as plausible as any other I’ve seen.

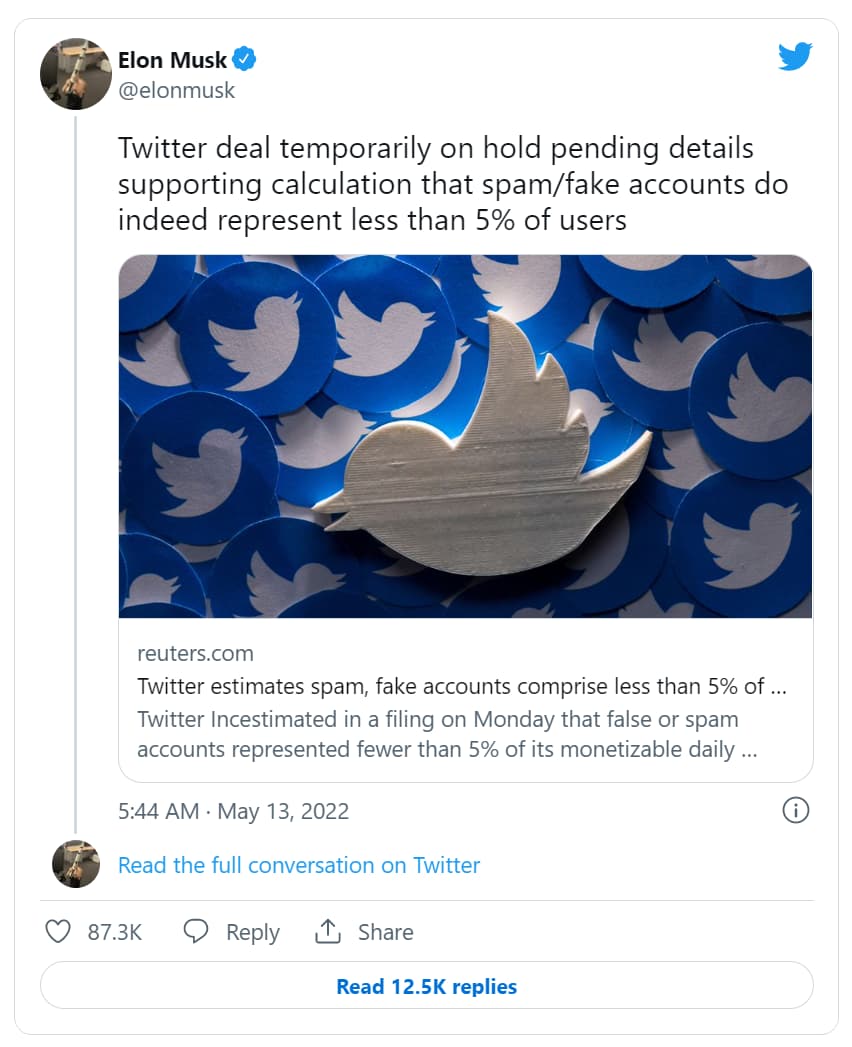

And then, two hours later…

I repeat what I said earlier:

This discussion in the leaked video makes clear that there are remaining many steps over many months to wind up the current company and take it private. They cite regulatory and financial steps. Since there was no video to show winks and nods, none could be seen, but I cannot help but suspect they were there - i.e. hope that the deal eventually fails with help of lefty fellow travelers in the regulatory and financial establishments. The long march through these institutions was undertaken for just such eventualities, after all.

The hypocrisy of the statements were really breathtaking. The CEO, who said Twitter’s role was to control who is heard, uttered all the expected pieties as to the importance of free speech. Again, no video, but he is surely sufficiently practiced to say them with a straight face. The hubris is overwhelming. Here’s hoping Nemesis comes in the form of Musk and the deal goes through. IIf it does, I will still withhold judgment before declaring victory for freedom of speech.

Addendum: The chairman of the board, I think, said, in effect: “We didn’t really want to do this, but had no choice given our fiduciary duty and a perfectly- priced buyout figure. We still have hopes that having covered our asses legally insofar as our fiduciary duty, the deal may still fail in the end”.

Interesting possibilities if deal falls through.

Will leftists beg Bezos or Zuck to buy Twitter? Zuck should be out on antitrust grounds, but Garland might not object if he thinks it advances leftism.

Assuming the fake account numbers are high, will there be shareholder suits? Will Musk be a plaintiff in such a suit?