On 2022-08-08, the U.S. Treasury “Office of Foreign Assets Control”, which administers sanctions, has sanctioned Tornado Cash, a privacy-protecting smart contract system that runs on the Ethereum blockchain, making its use by any U.S. person a criminal offence. This appears to be the first time a piece of software as opposed to an individual or organisation has been made subject to sanctions, and it created a precedent for arbitrarily banning any piece of software the U.S. considers “might” be used for purposes of which it disapproves.

Earlier today, 2022-08-12, Dutch authorities arrested a 29 year old man in Amsterdam “believed to be a developer for the crypto mixing service Tornado Cash, which the United States put on its sanctions list this week”. “The Dutch public prosecutor’s office for serious fraud, environmental crime and asset confiscation (FIOD) said Tornado was suspected of having laundered more than $7 billion worth of virtual currency since it was created in 2019.”

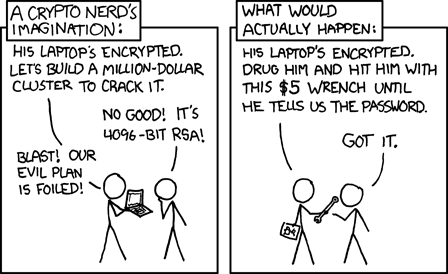

Now, notice, what the developer (who has not been named) did, was to write a piece of software, namely an Ethereum smart contract, make the source code freely available, and post the contract on the Ethereum blockchain where anybody can use it. He was not a party to any of the transactions which may have used it, and had no control over who might use it. This creates a precedent for criminalising software development if some subsequent user of the software uses in a way governments disapprove.

In addition, GitHub has deleted the source code repositories for Tornado Cash and reportedly deleted the personal accounts of some people who contributed to the project. This is a precedent for prior restraint against the publication of software based upon its content and allegations of potential for mis-use by unrelated third parties.

As Yoda would say, “Begun, the Crypto wars have”. Now is the time at which the battles over whether “Code Is Speech” will directly affect the rights to privacy and free expression of billions of people around the world. We now know on which side the United States stands in this conflict.

Here is a talk by Peter Van Valkenburgh of Coin Center on 2022-08-09 at Zcon3 on the imposition of sanctions against Tornado Cash and its legal implications.