I’m going to listen to his speech today at the Bitcoin conference. But I don’t understand the phenomenon. I looked it up (again) and confirmed that it isn’t backed by anything of objective value; its value depends on “supply and demand”.

Okay, so— I understand “demand” but: who calibrates “supply”?

And how, exactly is this different from the Beanie Baby craze?

Can one or more of you dear polymaths take a few minutes to give me a “Bitcoin for Dummies” paragraph? Maybe @Citizen_bitcoin , for instance?

Why is Trump backing bitcoin and other cryptocurrency?

My guess is the influence of Vivek R. I think Vivek explained why bitcoin is popular with libertarians and anarchists, how bitcoin was useful for raising money to help the Trucker Convoy in Canada and debunked some of Trump’s misconceptions about bitcoin.

Steve Bannon holds bitcoin as does JD Vance and RFK.

Elizabeth Warren hates bitcoin so I’m sure that was a factor in Trump changing his mind about bitcoin.

Bitcoin super PACs and wealthy bitcoiners have donated to his campaign using bitcoin and USD. Silicon Valley figures such as David Sacks have endorsed Trump and almost all of them hold some bitcoin.

How is bitcoin different from Beanie Baby craze?

The first 50 bitcoin were created on Jan 3, 2009.

The supply of bitcoin is finite, 21 million. My guess is the supply of Beanie Baby is not finite along with Dutch tulips.

Once we reach 21 million bitcoin, no more bitcoin will be minted or mined (estimated year is 2137).

Who calibrates supply? Quick answer is bitcoin miners and nodes on the bitcoin network calibrate supply

Longer answer is:

No single person calibrates supply like Jerome Powell.

Bitcoin is a cryptocurrency associated with no governent or nation state or central bank.

Currently almost 94% of all bitcoin have been mined.

How are new bitcoin created?

Approximately every 10 minutes, 3.125 bitcoin are created in the form of a “reward”.

Bitcoin miners compete with one another to get the “reward” by using supercomputers to guess a number between 1 and a trillion. In other words:

Mining is a giant lottery, where miners guess random numbers and hope that one of those will lead to the outcome of them producing a valid block.

Valid block = reward = lots of money, currently $218,995

A useful way of looking at bitcoin is look at gold or silver.

What attributes of gold make it a ‘strong’ currency or store of value or medium of exchange or maybe a unit of account?

Also, what is money? what is currency?

Why are some currencies strong (Swiss)?

Why are some currencies weak (Argentina peso)?

References:

The bitcoin white paper was published on October 31, 2008. The paper has some technical details but was written for the layperson and it’s only 9 pages long. I usually read it once a year along with the Declaration of Independence.

John Walker has written about bitcoin in the past and I found them very informative. I will look for and post those links.

edit: live stream of Bitcoin Conference speakers in Nashville

added:

Nashville is Central Time Zone

Thank you!

Tell your daughter to buy some bitcoin even a small amount like 100 bucks!

Or MSTR stock which is a pseduo bitcoin ETF

All fiat money has no objective value. It is totally based on faith.

The goldbugs make this argument about cryptocurrency: they say gold has value. It is used in jewelry and electronics, for example. I think this represents about 10% of the gold mined each year. It is reasonable to question gold as having a huge amount of inherent objective value, in my opinion. On the other hand, cryptocurrency has value to people like me. It can be used internationally without paying the banker 10% to 20% for a currency exchange. It can be used to pay people anywhere in the world for services. It allows you to travel without the restriction of having less than a certain amount of money in possession. It cannot be taken by your bank as was done to demonstrators. A tool has value. Microsoft Excel has value, even if it the product itself is not tangible. The difference with cryptocurrency is that it requires people to agree that it has value, which is true of every currency (and gold). There is no getting around the fact that any means of exchange will depend on people believing it has value. Items that have the most tangible value, such as grain, are not durable or divisible and cannot be easily exchanged in order to act as a currency.

This video by Lyn Alden is a good short explanation of money, its history, and various major changes. I think Lyn is a good choice for information. She owns Bitcoin, but she isn’t “selling her book” as they say (no pun intended since she is selling an actual book). Many in the crypto world are pumpers and scammers, but I don’t think she is one of them.

Those who honestly advocate for cryptocurrency believe that if the world would fix the money problem, many of the world’s problems would disappear. I happen to agree with this, and I think it can be demonstrated with a fairly easy calculation.

If money did not depreciate as all fiat money does, what would happen? If money does not inflate, the cost of things will, in aggregate, drop based on productivity. If you take an 18-year-old entering the workforce and assume the median income is 1 Bitcoin and the cost of living at the time is 0.9 Bitcoin, the savings rate is 10%. If each year the cost of living drops 2% due to productivity improvements, that 18-year-old can work until they are 65 years old, saving the difference between cost of living and earnings (which we assume never changes nor the savings invested), retire at 65, live for another 20 years, and have 25 times their cost of living remaining. They could live until 120 without their savings running out at the same living standard as when they retired and when they started working.

If you model retiring and spending about 4% of your savings (adjusted for inflation to maintain the same standard of living), called the 4% rule, and you invest all your saving in a 60/40 portfolio, you supposedly will not run out of money in 30 years. In that case, if the median income is $70,000 USD, that person needs to have saved $1.75 million USD to retire at 65 to maintain the same standard of living. How many people that made median income have that much saved at 65?

To put that in perspective, Social Security (FICA) takes 12.4% of wages and doesn’t pay anyone the median income—not even close. I think the maximum anyone can receive at age 65 is about $46,000. The median income earner will not receive even that. The average is something like $24,000.

Why would anyone agree to have their currency devalue like this? What good is it for the general population?

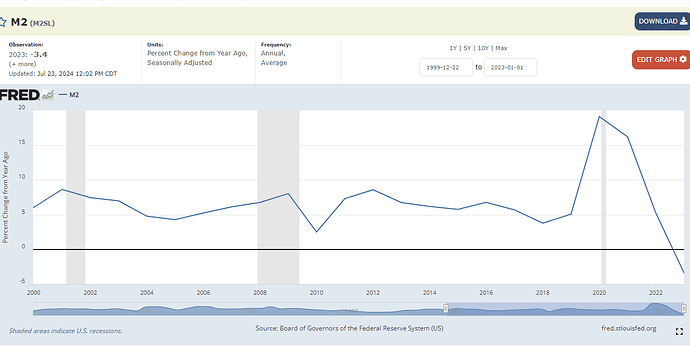

It is one of the most destructive things for a population. They call it a hidden tax. It is definitely hidden, but it is also much bigger than people think. They think the tax is equal to the Consumer Price Index (CPI). If the CPI is running at 2%, what’s the big deal of a 2% tax? The 2% is above all productivity improvement. You should get a 2% reduction in costs and instead get a 2% increase. That 2% is not just on your income but on all your savings being devalued. That isn’t the full story. Inflation in the money supply is most definitely not the same as consumer price inflation. You can see from the graph below that the money supply has been growing at over 6% compounded annually since 2000. Instead of improving by 2% a year due to productivity, you go backwards by 8% a year. In nine years, you end up half as well off as you should have been.

Many people don’t see the impact because asset prices inflate with the money supply. It isn’t a coincidence that the prices of homes, land, and the stock market increase at around the same rate of 6% to 8%.

The question to ask is, if 6% more money is created every year (assuming the Fed isn’t manipulating the calculation, which is not a great assumption), and the guy making a median wage gets a 2% raise, who got the money? It was created. Someone has it. Sure, some of it is dispersed into more bank accounts as the population grows. The population grew at a compounded annual rate of about 0.5% during this time.

Enough money was created during COVID to give every citizen $60,000 USD. Does anyone believe that the citizens equally received this money? Who got most of it? There was a lot of talk about stimulus checks (which I make fun of too), but the reality is the stimulus checks were nothing compared to what a small, select group of people received. That is enough money to pay the average Social Security recipient for three years.

You don’t have to be a communist to understand the problem of giving a massive amount of money to a very small group of people for which they did not provide anything of equal value.

In theory, a Bitcoin system would stop the money depreciation system. It would take it out of the hands of politicians and the oligarchy. It would stop asset bubbles and the destruction they cause to society. It would reduce the probability of war. The list goes on. It basically puts a real tangible control on an uncontrolled government.

![]() Donald Trump 2024 Bitcoin Conference Speech Recap:

Donald Trump 2024 Bitcoin Conference Speech Recap:

• On day one I will fire Gary Gensler and appoint a new SEC chairman.

• Create a US Government strategic national Bitcoin stockpile if elected.

• US Government will keep 100% of Bitcoin it owns

• Bitcoin is going to the moon.

• Never sell your Bitcoin

• Bitcoin will one day probably surpass the market cap of Gold.

• I reaffirm my pledge to commute Ross Ulbricht’s sentence.

• There will never be a CBDC while I am President of the United States.

• Bitcoin and crypto will skyrocket like never before if elected president.

• Bitcoin is not threatening the dollar, the current U.S. government is threatening the dollar.

• The United States will be the crypto capital of the planet and the Bitcoin superpower of the world.

• Bitcoin stands for freedom, sovereignty, and independence from government coercion and control.

• I pledge to the Bitcoin community that the day I take oath of Office, Joe Biden and Kamala Harris’ anti-crypto crusade will be over.

from WatcherGuru

added:

Agreed. She is well worth following on Twitter/X.

Yeah, I think she’s extremely insightful too. What I’m about to say next doesn’t detract from her analysis or otherwise impugn her character…but does anyone think she’s transexual? The first time I heard her voice I was a bit shocked…it was very deep and she sounded like a man.

According to her AMA on stacker news she is a woman who is married with a ‘husband’.

I couldn’t tell either. My friends have also wondered.

She said: Neither a “boy” or a “girl”, I’m a woman in her thirties, happily married to her husband.

Well, I think that pretty much cinches it (transgender) for me. Why not say she’s female and make a light hearted joke about her deep voice (e.g. how people think she’s a man when answering the phone)? On the other hand, I understand why she would want to keep her personal life private and not make it a focal point in her professional work. Either way (whether she’s trans or not), it doesn’t matter to me…it was just a curiosity…the most important thing is that she’s a highly intelligent person who knows what she’s talking about.

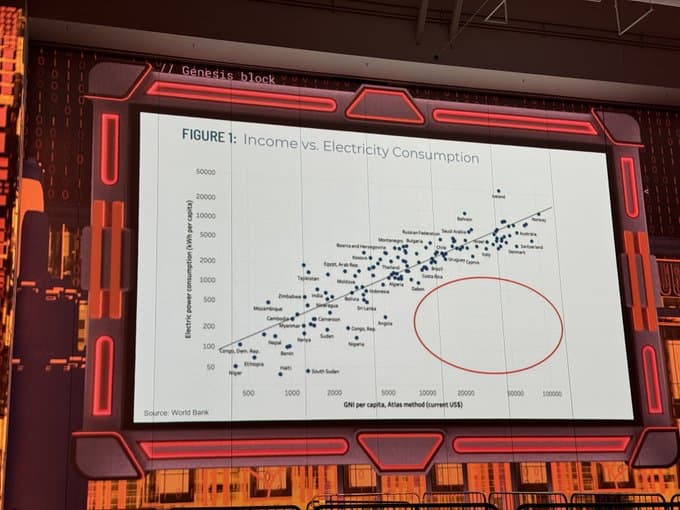

A common criticism of bitcoin (mostly from haters) is that it uses too much electricity/energy

edit:

https://bitcoinmagazine.com/politics/why-did-trump-change-his-mind-on-bitcoin

If there is one man who has contributed more than anybody else to changing Republicans’ mind on crypto, it is Vivek Ramaswamy. The former Republican presidential candidate and entrepreneur is clearly having increasing amounts of influence on the GOP inner circle. At the Republican Convention this month, Donald Trump Jr joked that he would like Ramaswamy to be his running mate in 2036. Indeed, ever since his presidential bid last year, it is clear that he has been one of the leading voices at the upper echelons of the Republicans guiding the party in a more pro-crypto direction.

Ramaswamy made waves in GOP circles when, at the North American Blockchain Summit in Texas last year, he released a detailed and comprehensive plan for the US crypto space.

Texas has become the capital of bitcoin mining in America and possibly the world.

Riot is a large bitcoin miner based in Texas, a public company, ticker is RIOT.

I own Riot stock. Not investment advice but if you are interested in buying bitcoin mining stocks, we should talk.

@Hypatia I realized my initial explanation was convoluted. Here is my second attempt:

Imagine the dollar ![]() is digital.

is digital.

The supply of dollars is fixed at 21 million.

The supply is not manipulated by the Federal Reserve or the Treasury Department or Congress or the President.

Instead new dollars are printed every ten minutes by a decentralized network of computers ![]()

I remember this was my explanation to a security guard at a bitcoin conference I attended last year. Not in Nashville but in Santa Monica.

Eh? You lost me there. If the supply of dollars is fixed, why is there any need to print new ones?

Yes and while he’s at it: who SAYS the supply of bitcoin is limited? Are those just the rules of the game? If so couldn’t they be changed?

Sorry for the confusion…

M2 money stock is approximately 14.7 trillion. Imagine if M2 money supply was capped at 21 trillion.

@Hypatia - 21 million is the limit as defined by the rules of the game, in this case, bitcoin open source code and protocol. Yes, the 21 million cap can be removed but not without starting a civil war within the bitcoin community

Updates can be proposed via BIP or Bitcoin Improvement Proposal. At least 90 or 95 percent of miners have to approve an Improvement Proposal and the software change has to be backward compatible. Any bitcoin node (a user on the network) can reject any change or improvement.

If someone were to propose lifting or changing the 21 million cap, that would be a hard fork which would create a new currency.

Something similar happened in 2015 to 2017: the blocksize war. The point of contention was blocksize and some bitcoin developers decided to implement a bigger block size (a hard fork). At least 90 percent of bitcoin users and nodes rejected bigger block proposal. BCH or bitcoin Cash, a different cryptocurrency, was the result of bigger block hard fork.

It hasn’t hit the limit yet.