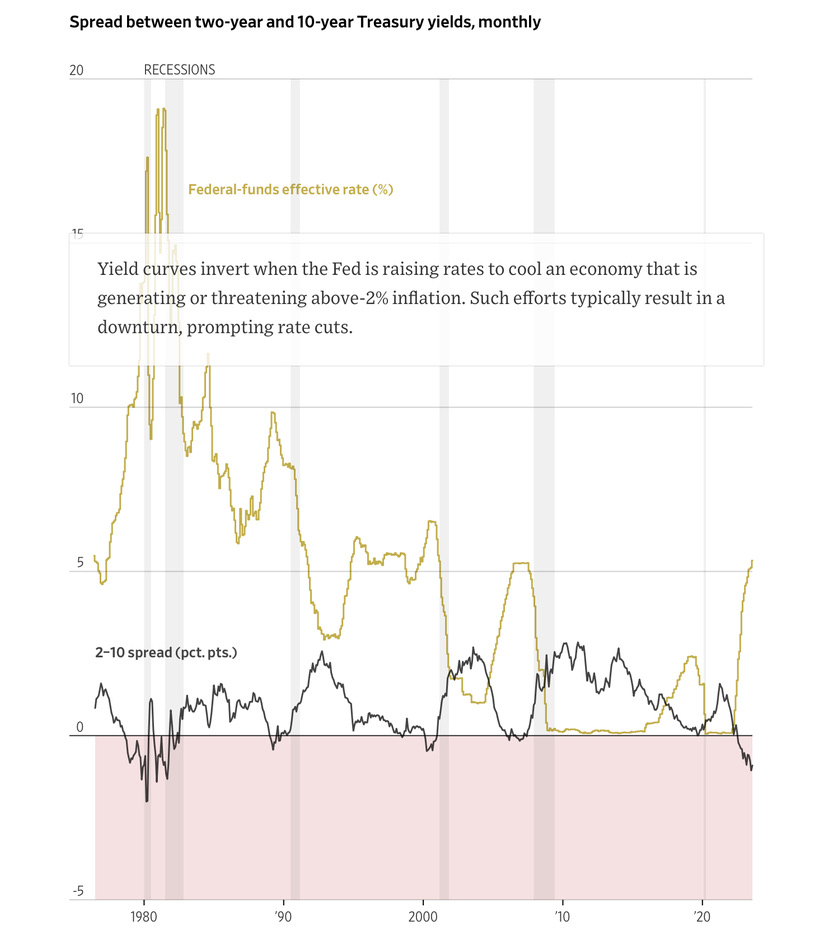

Today, the yields on U.S. Treasury bonds with maturities of 5, 10, and 30 years all spiked upward more than 5% to yields in excess of 3%. As recently as July 2020, yield on the 10 year Treasury was as low as 0.536%. As of November, 2021 [PDF], the average interest rate on U.S. federal debt outstanding was less than 2%. As this debt is rolled over at the now-prevailing interest rates, interest paid to service the debt will rise, further increasing the deficit. This is how a “debt spiral” gets started.

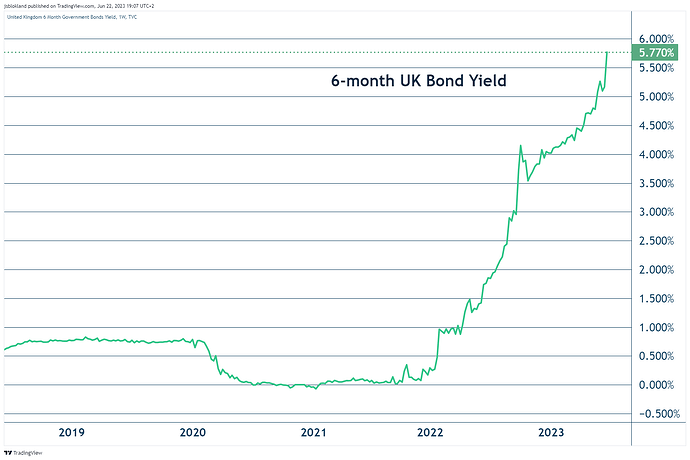

On 2023-06-21, the UK Office of National Statistics released the May 2023 consumer price inflation numbers for the UK.

- CPIH Annual Rate: including housing, up 7.9%

- CPI Annual Rate: excluding housing, up 8.7%

So this means that somebody who buys the short-term, "risk-free” (Hey, where’s the risk—they can always print the money to pay you off!) UK government bond will be paid back less interest for loaning their money to the Westminster wealth shredder for six months than their “pounds” depreciate in purchasing power during that time (Hey, they can always print the money to pay you off. And while they’re changing the picture of the sovereign on the banknotes, why not tack on a zero or two to the denomination?).

Consider that around 70% of Treasurys held by private investors must be rolled over within five years. Say you added just 1 percentage point to the average interest rate in the CBO’s forecast and kept every other number unchanged. That would result in an additional $3.5 trillion in federal debt by 2033. The government’s annual interest bill alone would then be about $2 trillion. For perspective, individual income taxes are set to bring in only $2.5 trillion this year.

Compound interest has a way of quickly making a bad situation worse—the sort of vicious spiral that has caused investors to flee countries such as Argentina and Russia. Having the world’s reserve currency and a printing press that allows it to never actually default makes America’s situation far better, though not consequence-free.

Just letting rates rise high enough to attract more and more of the world’s savings might work for a while, but not without crushing the stock and housing markets. Or the Fed could step in and buy enough bonds to lower rates, rekindling inflation and depressing real returns on bonds.

More in The Scary Math Behind the World’s Safest Assets - WSJ

My apologies, I have never really understood the games Our Betters play with (non-market) interest rates. To a person of small brain, such as myself, it appears axiomatic that one person’s debt is another person’s asset.

So if the Powers That Be increase the interest rate, the borrower has to pay more interest (reducing the net income she has to spend on other things). That supposedly “cools” the economy.

But at the same time, the lender receives more interest payments (thereby increasing the income he has to spend on other things, in exactly the same amount as the borrower suffers reduced disposable income). Thus, the distribution of total income changes when they play with the interest rate, but the amount of the total income does not change.

It makes one wonder if perhaps economists with their complex economic models are misrepresenting the effects of interest rate changes. They may be playing with a dial that does not do what they have convinced themselves it does.

What makes analysis of the effects of interest rate changes on the economy is the lag time between an interest rate change and its impact on the cost structure of borrowers and their spending plans. An instantaneous change in the interest rate has an immediate effect on overnight borrowers (such as banks lending to one another or borrowing and placing reserves with the Federal Reserve), but for longer term debt (for example, corporate bonds), it has no immediate effect other than changing the valuation of the debt instrument held by the owner. The borrower will have to pay the current rate if the debt is rolled over at maturity, but if maturities are relatively long the short term effect may be limited.

The greatest immediate effect is on corporate lines of credit that are tied to the prime rate, which closely tracks the Fed funds rate. This increases companies’ interest expense, which causes them to cut back spending and “cool” the economy.

A lot of the argument about manipulating the economy through interest rates is based upon the Keynesian macroeconomic theory of the “multiplier”, where borrowing and other forms of money creation creates economic activity (“aggregate demand”) some factor larger than the creation of credit. If this was ever true, the theory was developed at a time where levels of debt were far lower than they are today, and there is evidence the multiplier decreases as the amount of debt increases.

Indeed! But then those higher interest expenses are additions to someone else’s income stream – which might logically be expected to “heat” the economy as the recipient spends or invests the extra income. Distribution of income is being changed by the interest rate, not the economy’s productive capabilities.

The real world is clearly much more complicated than economic theories. Based on experience, I suspect that excessive regulations and the depredations of Big Law have a much more profound effect on business investment decisions than interest rates.

Since the companies are likely “to cut back spending”, whether the “someone else’s income stream” actually increases is debatable.

In process understanding sometimes called statistical quality control or Six Sigma methodology and probably several other equivalent names, there are a couple simple principles. One is the process needs to be stable. The definition is argued about, but it typically means the process is predictable … often defined as having results that fall within plus or minus 3 standard deviations. The second principle that is easily illustrated is that if the result is within 3 standard deviations, making an adjustment based on the result will lead to increased standard deviation. Not to mention the issues with processes that have lag.

Is the economic process stable? No

Is it predictable? No. This is shown over and over. Most recently the Fed with all its supposed predictive models thought inflation was transitory.

Is there significant lag? Yes and even the time period of lag is probably not stable.

Pascal’s marble run or a Galton board with modification can easily illustrate making an input change when the result is not outside of statistical control leads to more variation. The Galton board is modified so the pins are in a square not a triangle such that the marble can be dropped from multiple starting spots.

I am betting you could show this illustration to the thousands of PHDs at the Fed and they would say “I get it, but we know interest rates can be used to influence the economy”.

Money circulates! If a company cuts back spending, it has to do something with the cash it did not spend. If it leaves that cash in a bank (or some similar action), that cash is then available to be loaned to some other entity which will spend it. Worst case – the company puts the money into T-bills, which means FedGov has to print less fiat, causing benefits which ripple through the economy.

Mettelus makes a great point about time lags in the economy. Changing the interest rate probably has more immediate impact on speculators & traders than on actual investors in the Real Economy – but that is what we should expect in a de-industrialized financialized economy. To refer to another item, China has two hundred times (200 *) the shipbuilding capacity of the US – talk about “de-industrialized”!

When a loan is created new money is created (out of thin air) by the commercial banks. The loaned amount is not someone else’s money. It is new money. The loan goes on the commercial banks balance sheet as an asset and the cash is deposited into the barrowers account and recorded as a liability. Therefore, any economic activity driven from a loan does not happen if people do not barrow.

Money Creation In The Modern Economy is from the Bank of England, but the explanation of how money is created applies to the US.

One of life’s basic rules is Never Ever Trust Perfidious Albion. ![]() Strange that the BoE manages to write all those words without mentioning fractional reserve banking. I suspect their write-up is accurate but misleading – obviously, banks first have to have capital. That is why we don’t all start our own banks and create money by lending it.

Strange that the BoE manages to write all those words without mentioning fractional reserve banking. I suspect their write-up is accurate but misleading – obviously, banks first have to have capital. That is why we don’t all start our own banks and create money by lending it.