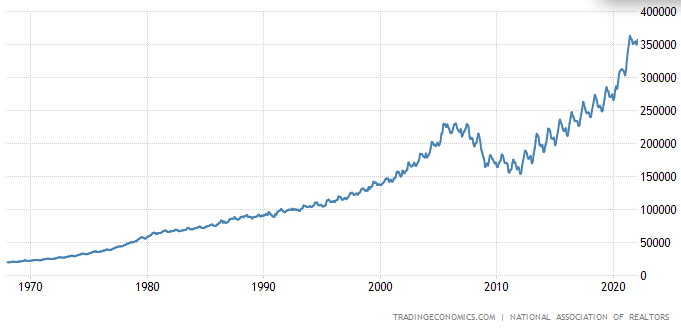

What triggered this was a headline on Fox Business this morning: “Mortgage interest rates SOARING to 5%! “

And, the hot housing market is not a matter of speculation: people are “desperate” to buy a “nice” “home”, a place to live, not a place to flip.

When I was practicing in the early 80s, mortgage interest rates were always about 9%. Doesnt anybody else remember that? If so, how can 5% be “soaring”?

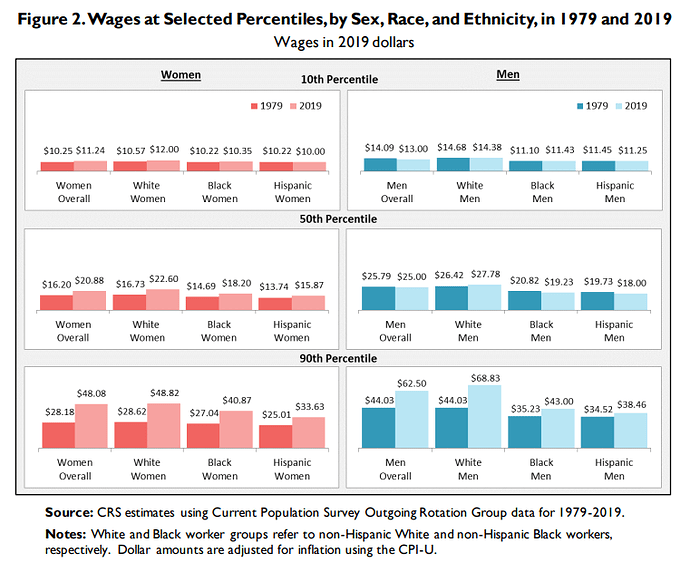

You wanna talk “soaring”? Howzabout 16-18%? That’s what happened in the mid 80s, but it wouldnta been so bad if, right before that, a buncha people with 9% first mortgages hadnt taken out second mortgages at adjustable rates:( ARMs: adjustable rate mortgages.). “We’ll never see 9% again”, people used to opine, as rates rose, then doubled, at the same time as we were having a divorce extravaganza AND unemployment was high. In Pa, some representatives actually proposed giving people a “right” to their jobs::in addition to unemployment comp, a new tribunal would be created to determine whether any firing was …idk, “legal”? While in the meantime I reckon the employer wouldn’t be hiring any replacement…it was madness, but people were desperate.yeah, things really weren’t SO great during the first few years of Reagan’s first term.

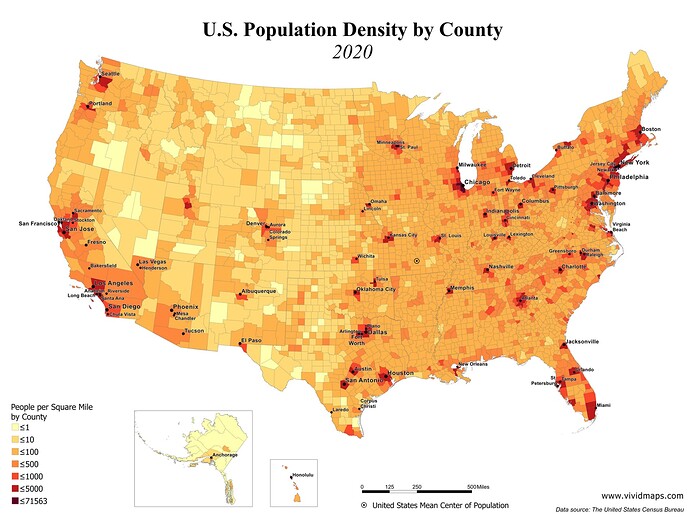

The second point I wanted to note is that people seem to want to pay just about anything for a nice single family house. And I’ll betcha a lot of those homes, both existing and new, are located in deed-restricted planned communities; it’s very difficult nationwide to but a home independent of such plats. How does that tie in with Bygone-Hapless’ plan to federalize zoning and eliminate single-family residential districts? Is that over, now that Build Back Better didn’t pass? They were gonna condition housing and even transportation federal grants to a municipality’s willingness to eliminate single family zoning, which OlJo[k]e referred to as “exclusionary zoning” regardless of lot size. My article “Deed Men Walkin’” which will be in the next issue of “The Pennsylvania Lawyer” magazine, is about whether or not the deed-restricted residential communities can save single family residential areas.

I wasn’t able to reach a conclusion as to that; maybe the short term lure of making more intensive and lucrative use of their large lots will be so attractive to landowners that nobody sues to enjoin the incursions.

But that brings me back to the question of what the people paying exorbitant prices for “homes” at the present time really want: do they envision an orderly Euclidean community of family dwellings, or are they offering these exorbitant prices even though they contemplate high-rises being erected right next door?

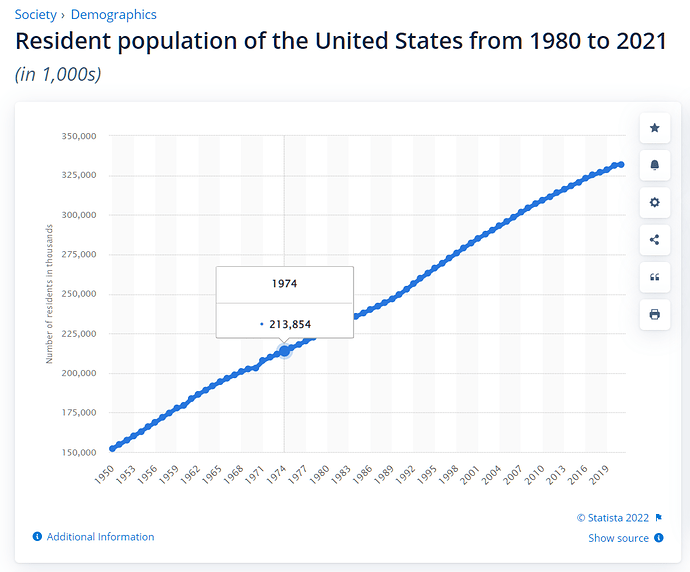

John Updike, who wrote about US life in the 70s and beyond, referred to himself as a “time traveler”. I now know what he meant—-except that, although Ive been awake and aware during the entire journey, I’m still mystified as to exactly how we got to the world were in now—and how easily and abruptly our collective memory seems to have been erased.