Financial regulators have closed Silicon Valley Bank and taken control of its deposits, the Federal Deposit Insurance Corp. announced Friday, in what is the largest U.S. bank failure since the Global Financial Crisis more than a decade ago.

The collapse of SVB, a key player in the tech and venture capital community, leaves companies and wealthy individuals largely unsure of what will happen to their money.

As of the end of December, SVB had roughly $209 billion in total assets and $175.4 billion in total deposits, according to the press release. The FDIC said it was unclear what portion of those deposits were above the insurance limit.

SVB was a major bank for venture-backed companies, which were already under pressure due to higher interest rates and a slowdown for initial public offerings that made it more difficult to raise additional cash.

The closure of SVB would impact not only the deposits, but also credit facilities and other forms of financing. The FDIC said loan customers of SVB should continue to make their payments as normal.

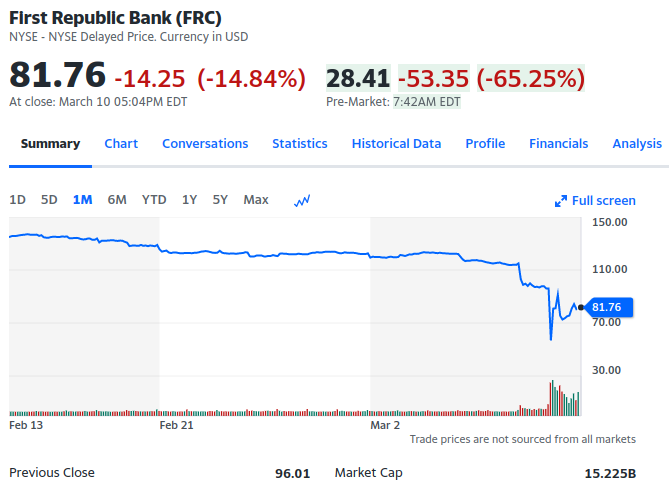

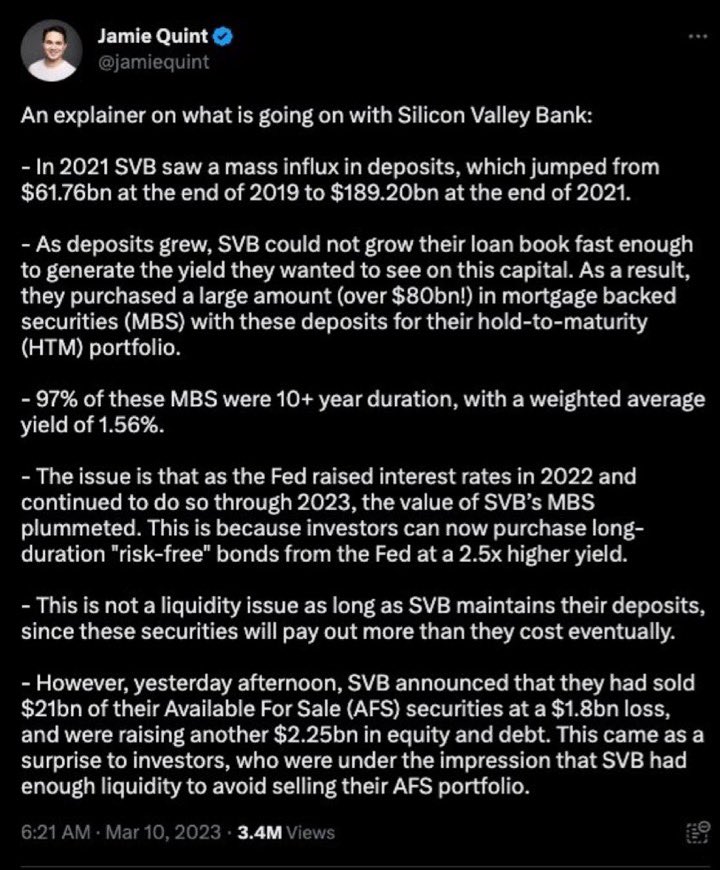

The move represents a rapid downfall for SVB. On Wednesday, the bank announced that it was looking to raise more than $2 billion in additional capital after suffering a $1.8 billion loss on asset sales.

The shares of parent company SVB Financial Group fell 60% on Thursday, and dropped another 60% in premarket trading on Friday before being halted.

This is the official announcement of the failure from the Federal Deposit Insurance Corporation, “FDIC Creates a Deposit Insurance National Bank of Santa Clara to Protect Insured Depositors of Silicon Valley Bank, Santa Clara, California”. The Washington Post is calling this the second-largest failure of a federally-insured bank in U.S. history, after Washington Mutual in 2008, “Silicon Valley Bank closed in second-biggest bank failure in U.S. history”. Here is a story from yesterday, 2023-03-09, with more background on the troubles leading up to today’s collapse.

According to SVB’s mid-quarter update, one of the primary problems the bank faces has to do with the amount of money its customers are spending. Total client funds have fallen for the last five quarters, as cash burn has continued at a rapid pace despite the slowdown in venture investing.

“Client cash burn remains ~2x higher than pre-2021 levels and has not adjusted to the slower fundraising environment,” SVB said.

In January, SVB expected average deposits for the first quarter to be $171 billion to $175 billion. That forecast is now down to $167 billion to $169 billion. SVB anticipates clients will continue to burn cash at essentially the same level as they did in the last quarter of 2022, when economic tightening was already well underway.

Silicon Valley Bank was founded in 1983. Around 1984, people from the nascent bank came to visit Autodesk, prospecting for business. It was clear they didn’t really understand how a company had managed to become the leader in its industry sector with no venture capital and just US$ 59,030 in money put up by its founders. When I asked what Silicon Valley Bank could do for us that our existing bank, First Interstate, could not, they basically said that if we deposited money there, they’d be happy to loan it back to us. We never heard from them again.

![Queen - Another One Bites The Dust [Lyrics]](https://scanalyst.fourmilab.ch/uploads/default/original/2X/d/df34b81cb469bbf0dab8278675c69c1849a38ee6.jpeg)