I consider such an outcome to be highly improbable, as in the long history of hyperinflations (here is the Hanke-Krus table of 56 world hyperinflations [PDF] from 1795 through 2012 courtesy of Cato Institute, sorted by daily inflation rate at the peak), only rarely did the societal infrastructure collapse in the absence of a simultaneous war causing physical damage. Generally, people and businesses muddle through as best they can, exchanging depreciating paper for hard assets as quickly as possible. See Adam Fergusson’s When Money Dies for a realistic account of what it was like to live through the great Weimar inflation in the 1920s.

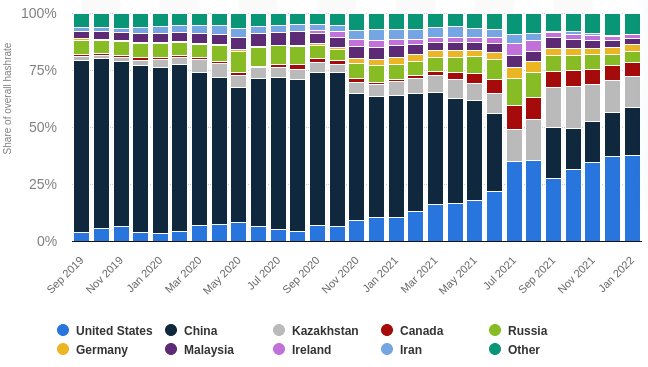

But even if the U.S. grid goes down, only about a third of bitcoin mining (transaction clearing) is in the U.S.

If that portion of the Bitcoin network goes down, transaction fees will increase, and miners in non-dollar regions will have an incentive to expand their operations. This will probably be accelerated by an increased demand for Bitcoin as a hedge against the depreciation of other fiat currencies and a means of clearing cross-border transactions.

Balaji moved from the U.S. to Singapore in 2020 (“get your ass and assets out while you still can”), so he would not be directly affected by events there.