We need squatter assassins

So do you think your first paragraph explains why Atlanta has the most squatters?

Senator Warnock is a slumlord.

Atlanta has a large black population. I think whites are a minority in Atlanta and possibly Fulton county

It is odd that people in Big Law can’t see that the law has to be “blind”, as they used to say. An offence against the law is an offence, regardless of who the offender is. If the denizens of Big Law don’t like the outcome, then go through the democratic process (such as it is) and change the law … for everyone.

Otherwise, we find the whole society sliding down the slippery slope to a nasty place where the so-called “Law” depends on who did it, not what was done. A place where a candidate for President can be hounded through the courts for no good reason, and public libraries become unusable because they are filled with the “homeless” (i.e. drunks and drug addicts) staying out of the rain.

That last one really annoys me because the prosecutors who fail by refusing to do their jobs and the judges who fail by throwing out cases to clean up libraries are hurting the young (and not so young) people who could otherwise use the facilities of the libraries to improve themselves. But judges & prosecutors who live in big houses in gated communities defend the right of a junkie to stink up a public resource, and ignore the right of a poor citizen to have useable access to a resource he is paying for with his taxes.

Kinda an Inspector Javert vibe goin’ there for a moment, Gavin!

I wasn’t aware that we’re #1 in squatters, but Google confirms it, and by more than a factor of two more than #2, Dallas-Fort Worth. I suspect that the rapidity of decline in housing affordability relative to income is mostly to blame, but there also may only appear to be so many more squatting cases because Georgia’s eviction process has been so streamlined and inexpensive, whether for tenants with leases or without. The new law lets landlords get eviction within 3 days on the mere allegation of squatting.

My main point was that the landlords are racketeers – along with the banks for which they front, let me add – and the exploitative businesses that pay below-subsistence wages, as well. They aren’t legally allowed to maintain interests in any property through their racketeering, doing so is an additional crime. They have no legitimate interests, their wealth is forfeit.

Further, they are not only criminals, their souls are stained with the gravest sins, the “sins that cry to heaven for vengeance”: 1. Murder 2.Sodomy 3. Oppression of the poor 4. Holding back wages of laborers. They are doing all four. (I’ll leave the arguments for these as an exercise, but for #2: Ezekiel 16:49–50 “This was the guilt of your sister Sodom: she and her daughters had pride, excess of food, and prosperous ease, but did not aid the poor and needy”.)

It would be wrong to allow them to continue to impoverish and dispossess the populace.

I would have guessed Houston instead of Dallas Fort Worth.

Houston has more diversity, not a compliment

Albanian Americans are new at being landlords here. They do business with a handshake, help one another with interest-free loans, often live in their buildings, act as their own superintendents and get relatives to handle maintenance. This do-it-yourself spirit has won admiration in some cases but brought on controversy in others.

The office has received many complaints from tenants of Albanian landlords carrying guns and even making physical threats, but these could not be confirmed, he said.

‘‘They bring the clan in and try to patch things up with scotch tape,’’ a retired accountant who is a tenant of the building complained, referring to the general Albanian practice of doing their own maintenance to cut costs.

Jewish tenants are complaining about their Albanian landlords.

The irony made me laugh out loud literally

Albanians are funny. Well, John Belushi was, anyway.

A couple of weeks ago I would have vehemently disagreed with you, but after reading the article, How Not to Build a Country: Canada’s Late Soviet Pessimism, brought to our attention by @jdougan (thank you, @jdougan!), my view has changed 180° (I add this to a long list of beliefs I once held, but have changed over the past couple of years). I reproduce the relevant section for your convenience here (bold italics are mine):

Rent-seeking, Or How To Destroy The Wealth Of Nations

It was a meeting I had while working in mainland China that hammered home events in Canada. G——— had become a venture capitalist through pure grit. Like many foreign entrepreneurs in China, he had that weathered look about him and made it a matter of principle never to mince words. In middle age, he looked more like a rockstar than an investor—sporting a man-bun, a deep tan, and ripped jeans. He was always flanked by pretty assistants. You would never catch him in a suit, even at more formal events, among Chinese salarymen and party officials. “Welcome to Shanghai!” he exclaimed. “You made it to the center of the fucking universe, and if you want to survive here, you have to learn quickly and see the big picture.”

His advice for foreign entrepreneurs wasn’t some canned platitude about never giving up or how hard work paid off, but rather to read a specific book. “You want to understand what’s happening here? Go pick up Adam Smith’s The Wealth of Nations.” The down-to-earth entrepreneurs think it’s a waste of time to read a tract three centuries past due, and the university-educated economist scoffs at reading quaint theory over the econometrics papers pumped out daily. But reading Smith to understand the crazy world of Chinese growth wasn’t about economic theory or its applications. It was about intuition.

That’s what innovators do. When the world around them goes crazy, they step back and look. When empty lots sell in the several millions of dollars, when shoddy rentals begin taking above 50% of the incomes of ordinary citizens, when 36,000 homes sit empty while offshore fortunes are laundered through them, it’s time to rely on intuition.

Smith, revered by deregulation proponents, understood that rent-seeking was a hindrance and imposition on productive activity. In his attempt to intuit the relationship between farmers and landowners in his 18th century Scotland, he devised the following relationship:

The rent of the land, therefore, considered as the price paid for the use of the land, is naturally a monopoly price. It is not at all proportioned to what the landlord may have laid out upon the improvement of the land, or to what he can afford to take; but to what the farmer can afford to give.

Smith uncovered the dynamic rent-seeking imposes on productive activity. Although many think of landlords as providing a service at a price determined by market forces, the reality is that they are barely providing a service at all, but merely extracting the largest possible share of tenant income by exploiting a geographic bottleneck. This is missed by the rhetoric surrounding the housing crisis. Landlordism in cities is (correctly) blamed for a worsening of income inequality. What’s ignored is the effect rent-seeking has on productive economic activity, and that the causes of income inequality lie in the crushing of productivity gains by such activity. Rent-seeking isn’t just a transfer of wealth from Millennial renters to Boomer landlords, but also a transfer of wealth from the productive segment of society to the unproductive.

There is a very simple way of looking at this transfer: wealth creation is making things.

When innovative companies begin making decent profits, landlords raise the rents to adjust for the new ability to pay. As a result, these additional wages are neither reinvested, nor reflected in the disposable income of employees. This is the dynamic behind the mystery of stagnant wages. When workers in a particularly well-paid sector begin pouring into a city, landlords likewise raise the rent to absorb these incomes. It isn’t gentrification, but absorption through monopoly power.

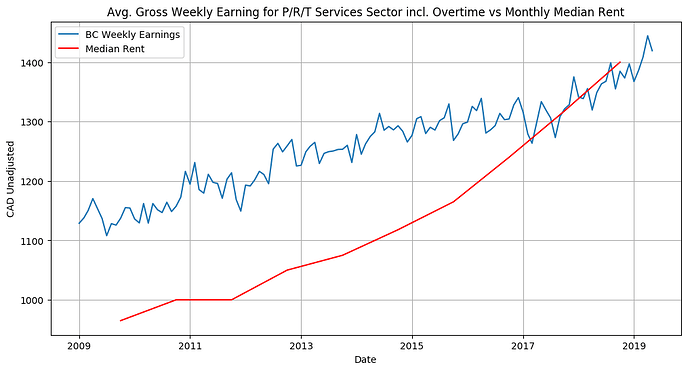

With this framework, we can begin to understand the effects that Canada’s out-of-control housing market has on innovation and productivity. Using data from StatsCanada and the CMHC, I’ve overlayed historical rents in Vancouver to average weekly earnings (pre-tax) of workers in British Columbia in the professional, scientific, and technical services sector, which gives us something like this:

Avetis Muradyan/StatsCan

Rent is rising with income, even slightly faster, absorbing much of the gains, as landlords are extracting an increasingly significant percentage of wealth generated by workers. As this trend drags into the new decade, it means being a productive worker pays increasingly less than speculating on the real estate market. It means that more and more people are pushing out of the productive sectors of the economy and into the unproductive, with the rentiers leveraging their assets and historically low interest rates to acquire even more rent-seeking opportunities. As the price of real estate inches ever upward, more and more people are left in the dust and at the mercy of the landlords.

It also means that real wealth creation is endangered. The sectors of the economy where goods and services are made and know-how is created shrink relative to our productive capacity as more capital, human and otherwise, becomes tied up in this real estate inflation. The rationale behind this asset inflation is the oft-repeated claim that the Canadian economy is undergoing profound technological change and that the influx of jobs in the transition will sustain demand for real estate in the decades to come. With the backing of major U.S. tech companies and urban transformation projects such as Sidewalk Toronto mushrooming in Canada’s top cities—-Toronto, Vancouver, Calgary, Waterloo—the word in everyone’s mouth is Silicon Valley North.

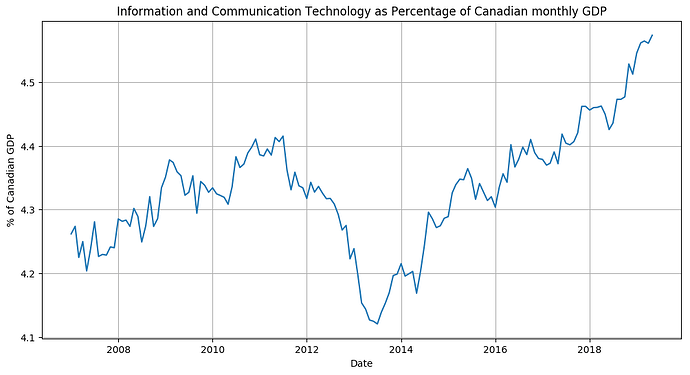

But a quick glance at sector data from StatsCanada dispels the idea of a Silicon Valley North:

Avetis Muradyan/StatsCan

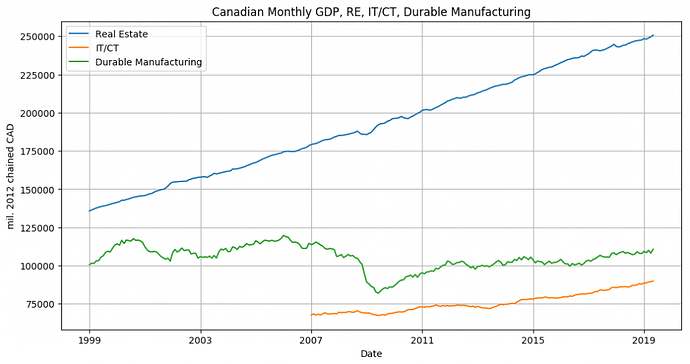

From 2009 to 2019, this supposedly prodigal sector has gone from occupying about 4.3% of production to about 4.6%. Hardly the much-touted silver bullet to Canada’s economic woes. The Canadian economy remains solidly stuck in a resource trap; the only sector actually delivering tangible growth is the one driven by asset inflation. To illustrate the point of Canadian real estate compared to Canadian innovation, the following chart is instructive:

Avetis Muradyan/StatsCan

How did real estate, the most low-tech asset class in existence, become more sought after than shares in the most bleeding-edge tech companies? Which came first? Did Canadian innovation fail because all the capital became tied up in real estate, or more uncomfortably, did real estate absorb all the capital because Canadian innovation could no longer deliver on its promises? Whatever the answer may be, it’s clear that Canadian innovation needs a new start as the threat of Brezhnevite failure looms on the horizon. A country that has a housing shortage when it is a net exporter of construction material, has nearly unlimited land, and has an oversupply of human capital, is stuck in the same rut as a country that has a shortage of toilet paper, just as it exports massive quantities of processed timber.

Don’t ignore the effect of regulations – imposed by your friends in Big Law and their running dogs in government.

In principle, increased demand for housing as new workers move in should indeed create higher rents for the ownership class. The additional profits from that imbalance in demand & supply is what signals the opportunity to provide more supply. Those higher profits should attract investors to build additional housing to compete for that attractive market. Over a reasonable span of time, profits from rentals will drop back to the same lower level of other investments. All well and good.

So what goes wrong? Increasingly strict regulations are imposed by the Political Class (bought & paid for). It becomes very difficult & expensive for new housing to get built. Those higher costs maintain the excess profits of existing landlords.

Solution is simple – fix the self-serving over-regulation problem. The question is how to wrest that power from the Political Class and their bureaucrats without an armed revolution.

Absolutely.

Right, so, the question I ask myself is this: Under those conditions, Is it ethical or moral for a landlord to keep the excess profits? I think the answer is probably “no”. Is there a (legal?) term for “benefiting from a crime that one did not commit”? The terms “accessory to a crime” or “complicit in a crime” don’t quite seem to fit.

Yup…I got nothing. ![]()

Maybe I’m missing something, but the squatting referenced in the OP had nothing to do with leases or rental markets. It was where legitimate owners were turned out of their own properties by thieving invaders. It had nothing to do with rentals or leases. If these were mentioned at all, they were lies told by the thieves. Yes, much said about rent seeking is true, but not really the subject of the OP.

You’re quite right, CW…I guess the conversation kind of evolved (or devolved) in another direction. My apologies for aiding in the hijacking of your OP.

I think your post was adding relevant context from the other side of the argument, one that squatters could invoke in their defense.

Also, @civilwestman’s comment was also on point: showing how this argument would not have been applicable.

Great article - I read the whole thing, copying sections to notepad, before I saw you had already quoted the core section.

Some other bits I liked:

“What happened? How can corporate leadership be so lacking in thumos?”

[…]

That was T———’s main frustration with these apparatchiks: mediocre at best and woefully incompetent at worst.T———’s apparatchiks aren’t very different from their Soviet predecessors: frail old men in buffoonishly baggy suits from the 1990s, complete with black (Volga-like) sedans and dachas in the countryside. When they aren’t vacationing in said dachas, their main occupation is making sure that things are as stable as possible, which realistically means making sure nothing new ever happens.

[…]

But Canada is, and has always been, an oligarchy where the ruling families—the Saputos, Demarais, Reichmans, etc.—have relied on their own Brezhnevites to preserve their wealth by shielding them not just from competition, but from any kind of change.

[…]

The key to acquiring wealth in this country is creating bottlenecks by saturating public and private institutions with members of this class. Thanks to their valiant efforts, the Canadian economic model is a madhouse where apparent opposites are simultaneously true.

The key to acquiring wealth in this country is creating bottlenecks by saturating public and private institutions with members of this class.

[…]

Debt spiraled out of control and by 1989, the Soviet Union traded 17 submarines, a frigate, a cruiser, and a destroyer for Pepsi bottles, making Pepsi the 6th-largest navy for a brief period of time.

[…]

[…]

In 1957, we still knew how to build things. We had the young, motivated engineers to push forward. ,…

In 1959, the CF-105 Arrow hit Mach 1.52 at 50,000 ft. For a brief moment, a future Canada as aeronautical titan was within grasp. The Arrow program generated significant know-how. Engineers achieved many aerospace ‘firsts.’The program was gradually shut down by the new Diefenbaker government, which was determined to rein in “rampant liberal spending” and shift to a new missile-centric defense posture. This amounted to buying missiles from the United States.

When the program was shut down, it permanently shut the door on large-scale Canadian technological ambitions. The demoralizing effect on the army of innovators that Avro Canada had assembled was devastating. […]

The vast majority of the young men and the British family men who were given the opportunity of a lifetime, only to see it bitterly yanked away, never worked in aerospace again. The lucky ones ended up as small-time civil servants and construction consultants.

In 2019, many of the 6,000 yearly engineering graduates relive this story in a loop. The software engineers, in high demand at U.S. companies, migrate south. Others leave the profession for safer, better-paying careers. The human capital spoilage is astounding. Young people who are trained in moving mountains, in catapulting to space, in foraging the seas are then put on conveyor belts to cubicles to pump out PowerPoints. Canada spends enormous resources to train these people, only to deny them the opportunity to practice their profession.

[…]

How do you do capitalism without capital? Answering this question has been the fundamental economic struggle for the vast majority of countries since the 18th century.

[…]

Shunning risks or avoiding planning is the surest way to rent-seeking and stagnation, as you cannibalize the successes of previous generations of innovators.But risky experimentation requires optimism and confidence in the future. This is one of the greatest assets any country can have. An investment of any kind—time, money, effort, emotional commitment—is about belief in an upside. The larger the potential upside, the larger the acceptable risk. Optimism is the belief in upsides.

It’s become fashionable in some circles to ask how people can be made optimistic again, and speak of optimism directly as a variable influenced by culture and propaganda. It’s true that beliefs like optimism can be socially influenced. It’s clearly an important input to progress, so why not try to influence it? But beliefs also reflect reality, and cannot deviate too blatantly, except to the detriment of sanity.

Optimism isn’t just about what people believe is possible; it’s about what actually is possible. If some bright-eyed, young engineer graduates from his training, full of optimism and big ideas, and sets out to find the opportunities, what does he actually find? Does he find and solve real world problems, build confidence in his skills, and learn how he can do amazing things? Does he strike the jackpot of opportunity and then put his less optimistic classmates to shame? Or do his more conservative classmates who followed the tracks and took no risks put him to shame? Like T———, are his dreams progressively crushed down further year after year as he finds no willing comrades in adventure, and no dynamism or potential in the system? This is what decides whether the culture is permeated by an ambient optimism and dynamism, or the stagnation of Brezhnevism.

To some extent, if only others were also optimistic, our imagined young engineer might have found some comrades or willing capital. But the simple collective action problem is only part of the story. The problem of possibility isn’t just in everyone being optimistic. It’s in complex social organization. Networks need to be organized around finding, discussing, and taking advantage of ideas. Capital investors need expertise in evaluating risky opportunities. Material capabilities in hardware, space, and logistics need to be easily available to new projects. Young engineers need expert mentors to help them distinguish the real potential opportunities from wastes of time and resources. A workforce of experienced engineers needs to be available. Barriers to entry need to be low and key bureaucratic bottlenecks kept open. Without these fundamentals, any episode of mass optimism will soon be crushed by the inevitable failure of the future to materialize.

With economic pessimism, we’re dealing with a much larger collective-action problem than just belief in the future—-the kind of problem that has only ever been solved by a bold, coordinated, development-oriented elite. But where to get one of those is a whole different problem.

T——— isn’t the only one asking the question: if you can’t build anything else for lack of real leadership, then how do you build real leadership? I run into an increasing number of young, would-be innovators like T———, surprised and frustrated by the lack of possibility in Western economies, who are turning their attention towards this challenge.

The problem is not just over-regulation (regulation which in reality is largely paid for by corrupt business interests to disadvantage competitors), but that there is really no law at all – no one can tell what a judge might do in any given case, but it’s a far more reliable guide to predicting who will win in court to look at the relative status of the parties than to look at statutes. “Who, whom?” as Stalin quoted Lenin. Not that the status hierarchy as one can infer it from court decisions corresponds to any just judgment of merit; the managerial class usurped the place of their betters, the natural aristocracy of Jefferson and Adams, and replaced it with a kakistocracy having neither ability nor nobility.

I could go on for books about the problems of the legal system – the illegitimacy of administrative law, case law, and judicial immunity, the unknowability of statute (or any other) law, the pervasive fictions and contradictions, ignorance and viciousness of the law … let me say at this point that I’m a born lawyer – living my first three years with four law students (aunts and uncles), with a Supreme Court clerk as babysitter … I could go on quite a bit in that vein – but I’ve tried to do something productive with my life instead, and though that hasn’t worked out as well as I had hoped, I have no regrets. But it seems like I may be forced to go back into it, there being no place in the economy for inventors. As you say, the alternative is armed revolution.

What everyone needs to understand is that the political class decides nothing of importance. Everything is under the control of the interlocking financial and intelligence agency interests who pull their strings with donations and blackmail. Below them are just endless layers of Rotarian grifters, overstuffed apparatchiks, clueless managers, fruits, nuts and exploited losers who keep the whole charade running.

Returning to the point at hand, the main reason for high housing prices is the banking system. They won’t lend for any more productive purpose, the money they lend is fictitious, created as it is loaned, and the increase in the money supply drives up the cost of housing first, then everything. (Cantillion effect.)

I liked those bits too! I agree, the whole article was gold…lots of food for thought!

But why are there squatters? They are the media-designated objects of today’s two-minute hate, certainly, but everyone should doubt the probity and even-handedness of the media.

Are the “owners” really owners, or did they borrow the money from an above-the-law bank that didn’t have the money in the first place, didn’t record the mortgage to save a few bucks, sold off the note immediately after which it was fraudulently securitized … ? Even if not, the “owners” can have their property seized for not paying property taxes, or $0.79 of unpaid water bills, or not mowing the grass, or just because a big developer wants the property. Did the “owners” really leave for a week, or is the house uninhabited (by far the more common target of squatters)? Is the “owner” really a front for drug money or a bank (or both, HSBC, I’m looking at you) or investment fund such as Blackrock?

Yes, squatting is illegal, it is criminal, yes police which won’t treat it as such aren’t doing their jobs. But they do the same thing no matter what the case, try reporting to the police any crime which could by any stretch also be the basis of a lawsuit, they won’t even take a report.