Translation: They lied and will continue to lie

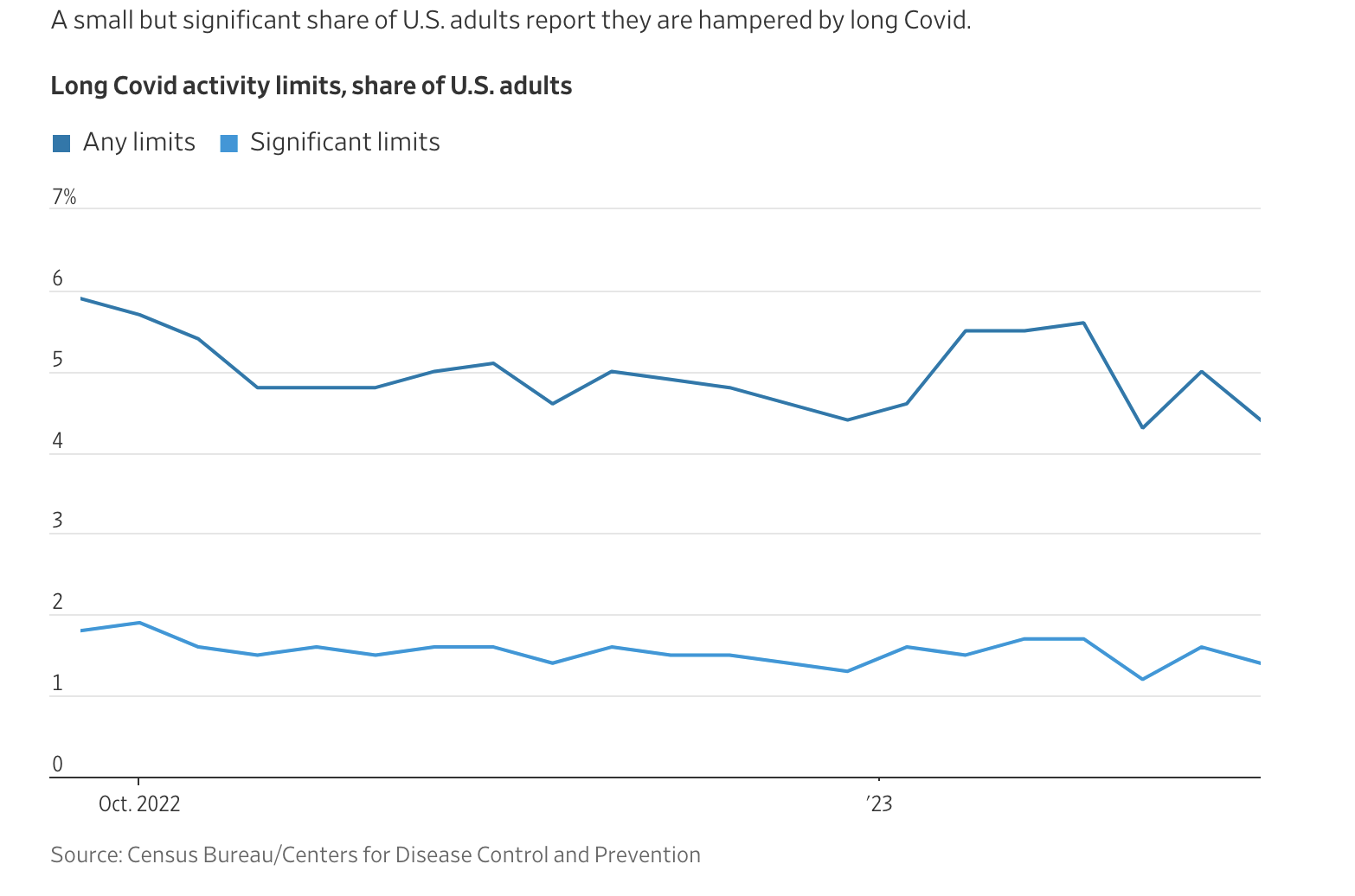

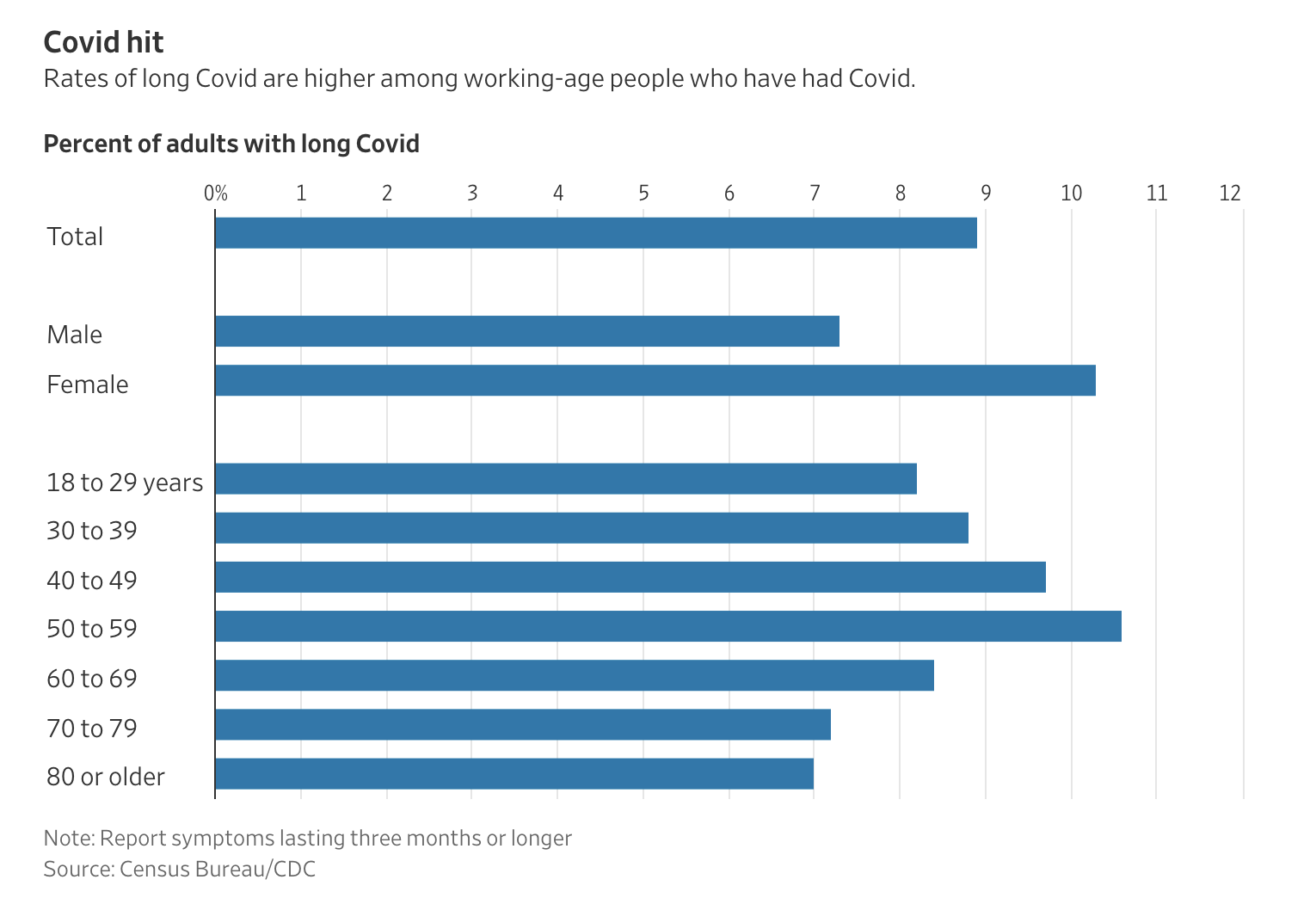

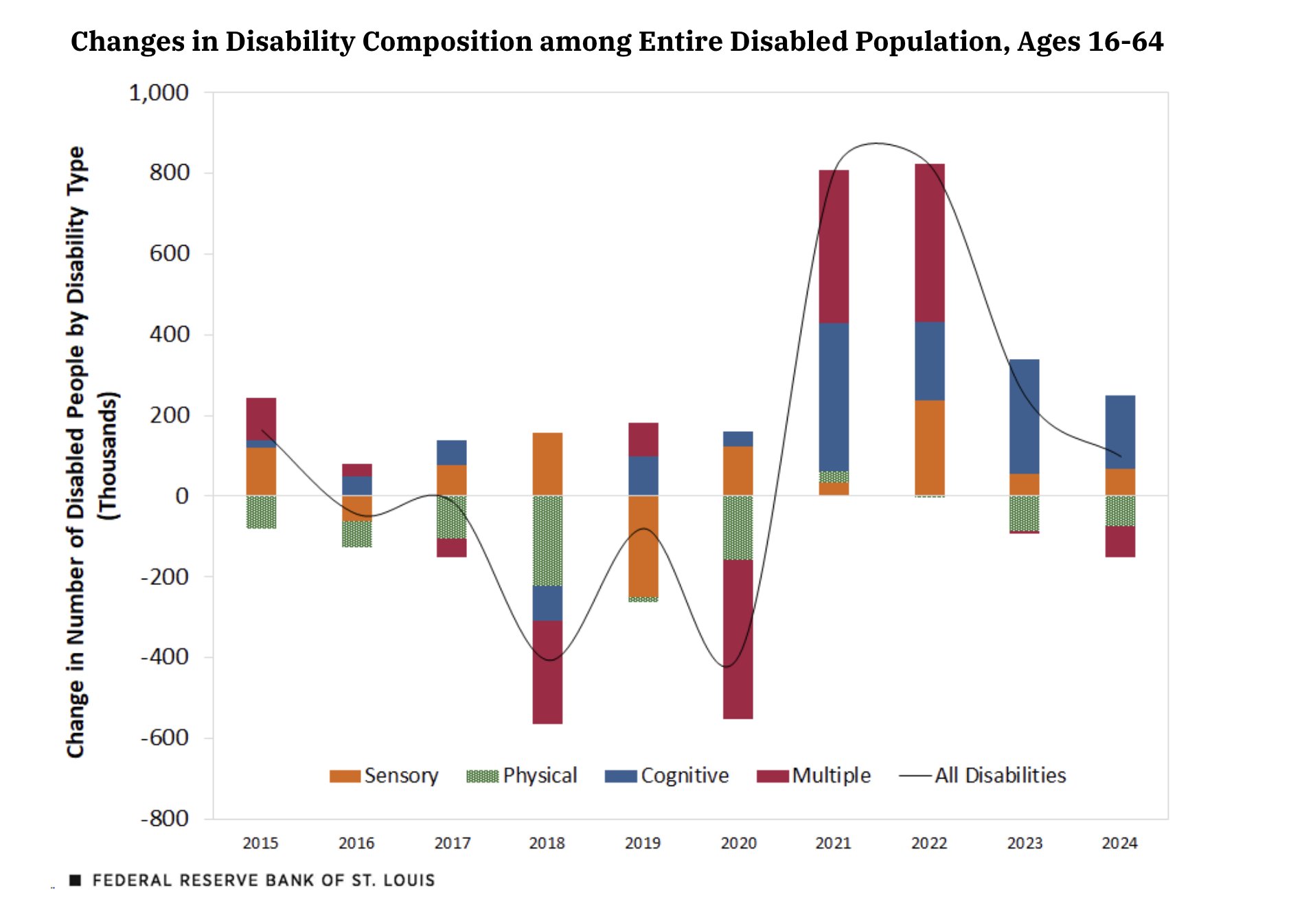

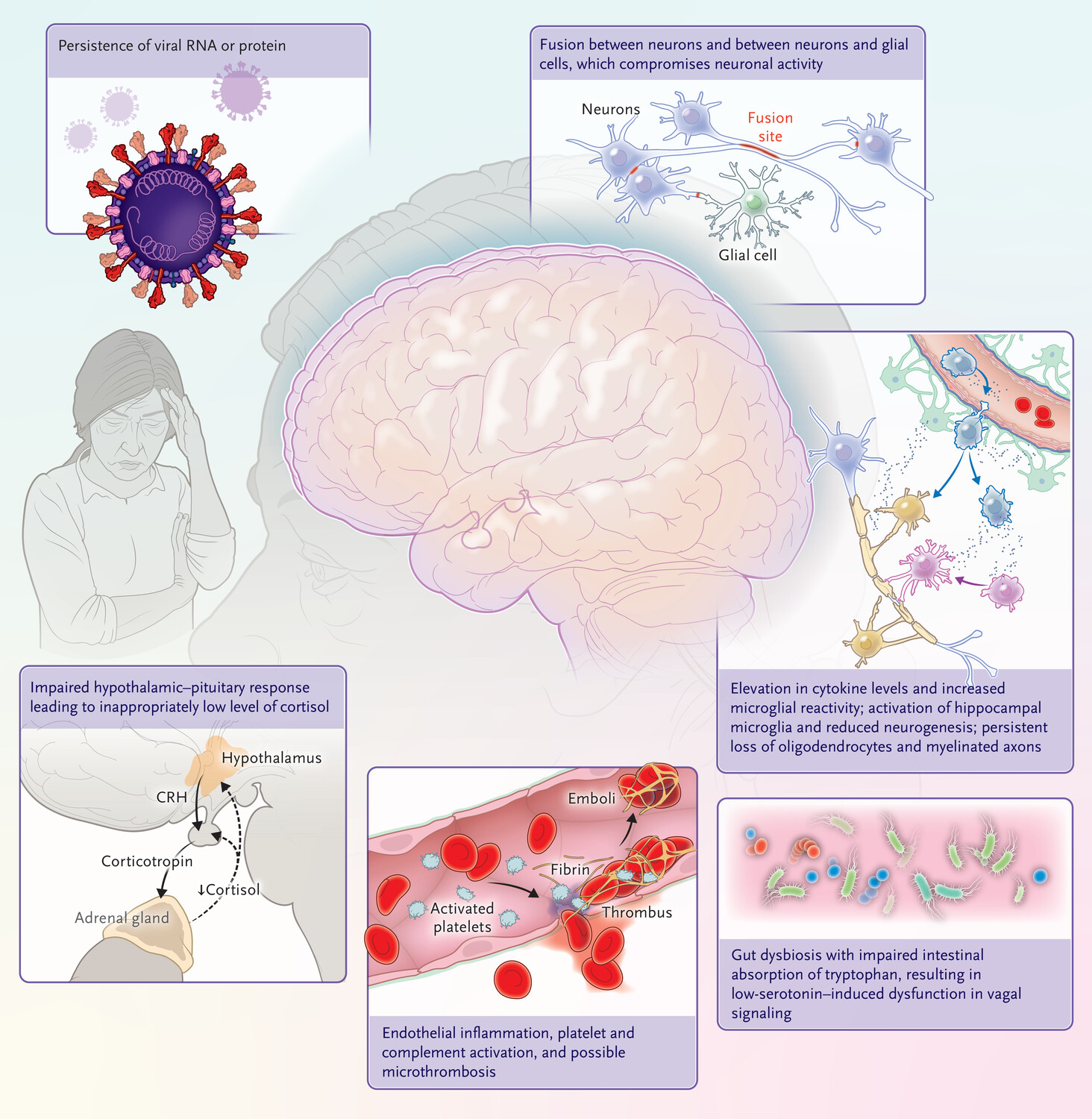

Long Covid has pushed around one million Americans out of the labor force, economists estimate. More than 5% of adults in the U.S. have long Covid, and it is most prevalent among Americans in their prime working years. About 3.6 million people reported significantly modifying their activities because of the illness in a recent survey by the Centers for Disease Control and Prevention.

OK, it is the no-longer-reliable WSJ – but really! Very few people in the 18-29 age range got “Covid” in the first place, and almost none got seriously ill. But now 8% of people in that age range have “Long Covid”? Something does not add up.

They should take H1 and H2 blockers like Zyrtec and Pepcid

Add:

Interesting. To what extent are the reported numbers consequences of changed medical definitions and improved medical diagnostic methods? My impression from living is that there have always been lots of idiots (cognitively impaired) people around.

Have to go back to 2006 with this data because it is common for disabilities to go up in a recession.

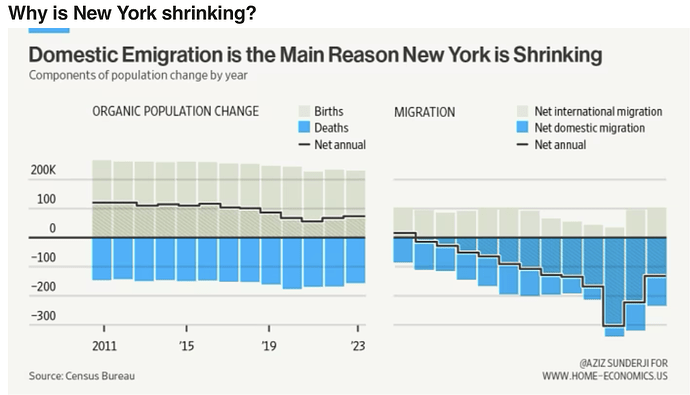

One may incorrectly assume that unemployment is very low. This is just another manipulation of data by the government to make things look better than they really are. This isn’t a democrat vs republicans thing. Both parties have used the various agencies to manipulate the definitions to make unemployment seem lower.

“Oops” — Joe Biden

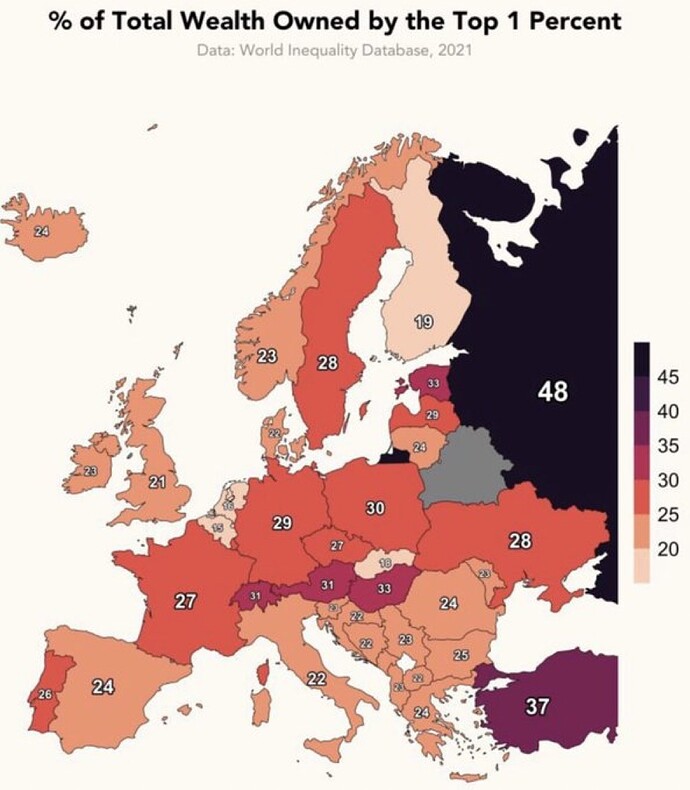

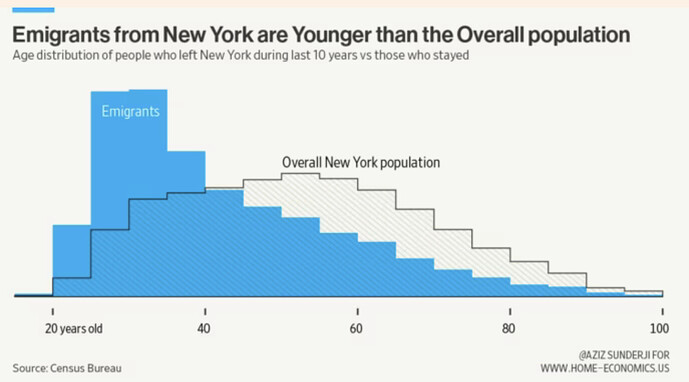

Regarding the 2nd graph, I’ll be trying to boost the right side of the emigration distribution… soon.

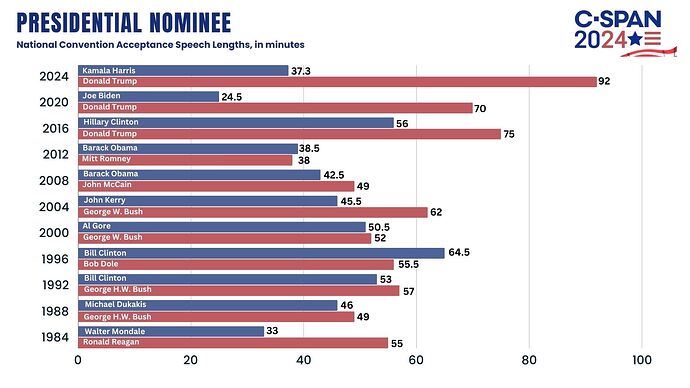

Trump needs a mute button in the debates. It benefitted him on June 27 and in 2020 (the second debate). His ‘interruptions’ in the first 2020 debate was a distraction (doesn’t matter if it was false).

His advisors are smart to keep the mute button because he gains when Kamala has to talk and improvise. W/o a muted mic, she can say, I’m speaking please, like she did to Pence numerous times in their debate

I’m speaking please: only black women say this

Even his kid said it benefited him. Hopefully he listened

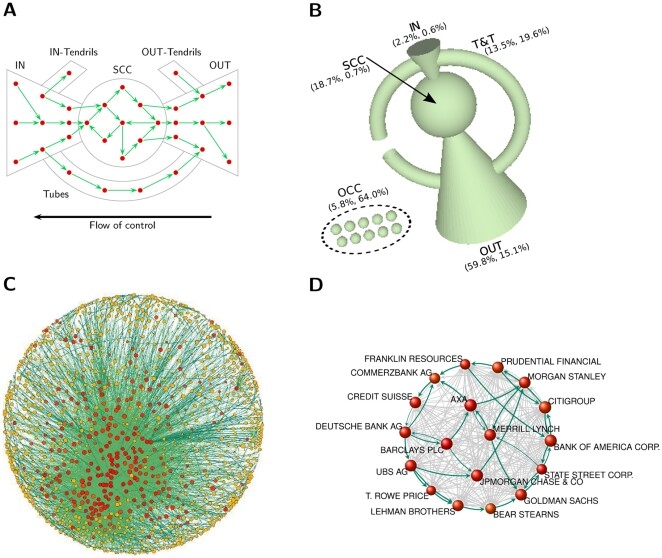

The Network of Global Corporate Control

Stefania Vitali, James B. Glattfelder, and Stefano Battiston

[Chairs of Systems Design, ETH Zurich, Zurich, Switzerland]

PLoS One. 2011; 6(10)

Abstract

The structure of the control network of transnational corporations affects global market competition and financial stability. So far, only small national samples were studied and there was no appropriate methodology to assess control globally. We present the first investigation of the architecture of the international ownership network, along with the computation of the control held by each global player. We find that transnational corporations form a giant bow-tie structure and that a large portion of control flows to a small tightly-knit core of financial institutions. This core can be seen as an economic “super-entity” that raises new important issues both for researchers and policy makers.

Methods

[…fun with matrices and graphs…]

Because of indirect links, control flows upstream from many firms and can result in some shareholders becoming very powerful. However, especially in graphs with many cycles (see Figures 1B and S4 in Appendix S1), the computation of c^net, in the basic formulation detailed above, severely overestimates the control assigned to actors in two cases: firms that are part of cycles (or cross-shareholding structures), and shareholders that are upstream of these structures. […] In this paper […] we develop a new methodology to overcome the problem of control overestimation, which can be employed to compute control in large networks.[The transnational corporate network’s] peculiarity is that the strongly connected component, or core, is very small compared to the other sections of the bow-tie […] about 3/4 of the ownership of firms in the core remains in the hands of firms of the core itself. In other words, this is a tightly-knit group of corporations that cumulatively hold the majority share of each other.

The authors buried the lede as deeply as they could, relegating the list of the most powerful companies to p. 17 of the supplementary material, then formatting it as a cumulative share rather than giving each company’s share. I recalculated and formatted the list to show each company’s share. Note that the underlying data is from 2007.

| Rank | Name | Country | Cumulative network control (%) | Network control (%) |

|---|---|---|---|---|

| 1 | BARCLAYS PLC | GB | 4.05% | 4.05% |

| 2 | CAPITAL GROUP COMPANIES INC, THE | US | 6.66% | 2.61% |

| 3 | FMR CORP | US | 8.94% | 2.28% |

| 4 | AXA | FR | 11.21% | 2.27% |

| 5 | STATE STREET CORPORATION | US | 13.02% | 1.81% |

| 6 | JPMORGAN CHASE & CO. | US | 14.55% | 1.53% |

| 7 | LEGAL & GENERAL GROUP PLC | GB | 16.02% | 1.47% |

| 8 | VANGUARD GROUP, INC., THE | US | 17.25% | 1.23% |

| 9 | UBS AG | CH | 18.46% | 1.21% |

| 10 | MERRILL LYNCH & CO., INC. | US | 19.45% | 0.99% |

| 11 | WELLINGTON MANAGEMENT CO. L.L.P. | US | 20.33% | 0.88% |

| 12 | DEUTSCHE BANK AG | DE | 21.17% | 0.84% |

| 13 | FRANKLIN RESOURCES, INC. | US | 21.99% | 0.82% |

| 14 | CREDIT SUISSE GROUP | CH | 22.81% | 0.82% |

| 15 | WALTON ENTERPRISES LLC | US | 23.56% | 0.75% |

| 16 | BANK OF NEW YORK MELLON CORP. | US | 24.28% | 0.72% |

| 17 | NATIXIS | FR | 24.98% | 0.70% |

| 18 | GOLDMAN SACHS GROUP, INC., THE | US | 25.64% | 0.66% |

| 19 | T. ROWE PRICE GROUP, INC. | US | 26.29% | 0.65% |

| 20 | LEGG MASON, INC. | US | 26.92% | 0.63% |

| 21 | MORGAN STANLEY | US | 27.56% | 0.64% |

| 22 | MITSUBISHI UFJ FINANCIAL GROUP, INC. | JP | 28.16% | 0.60% |

| 23 | NORTHERN TRUST CORPORATION | US | 28.72% | 0.56% |

| 24 | SOCIETE GENERALE | FR | 29.26% | 0.54% |

| 25 | BANK OF AMERICA CORPORATION | US | 29.79% | 0.53% |

| 26 | LLOYDS TSB GROUP PLC | GB | 30.30% | 0.51% |

| 27 | INVESCO PLC | GB | 30.82% | 0.52% |

| 28 | ALLIANZ SE | DE | 31.32% | 0.50% |

| 29 | TIAA | US | 32.24% | 0.92% |

| 30 | OLD MUTUAL PUBLIC LIMITED COMPANY | GB | 32.69% | 0.45% |

| 31 | AVIVA PLC | GB | 33.14% | 0.45% |

| 32 | SCHRODERS PLC | GB | 33.57% | 0.43% |

| 33 | DODGE & COX | US | 34.00% | 0.43% |

| 34 | LEHMAN BROTHERS HOLDINGS, INC. | US | 34.43% | 0.43% |

| 35 | SUN LIFE FINANCIAL, INC. | CA | 34.82% | 0.39% |

| 36 | STANDARD LIFE PLC | GB | 35.20% | 0.38% |

| 37 | CNCE | FR | 35.57% | 0.37% |

| 38 | NOMURA HOLDINGS, INC. | JP | 35.92% | 0.35% |

| 39 | THE DEPOSITORY TRUST COMPANY | US | 36.28% | 0.36% |

| 40 | MASSACHUSETTS MUTUAL LIFE INSURANCE | US | 36.63% | 0.35% |

| 41 | ING GROEP N.V. | NL | 36.96% | 0.33% |

| 42 | BRANDES INVESTMENT PARTNERS, L.P. | US | 37.29% | 0.33% |

| 43 | UNICREDITO ITALIANO SPA | IT | 37.61% | 0.32% |

| 44 | DEPOSIT INSURANCE CORPORATION OF JP | JP | 37.93% | 0.32% |

| 45 | VERENIGING AEGON | NL | 38.25% | 0.32% |

| 46 | BNP PARIBAS | FR | 38.56% | 0.31% |

| 47 | AFFILIATED MANAGERS GROUP, INC. | US | 38.88% | 0.32% |

| 48 | RESONA HOLDINGS, INC. | JP | 39.18% | 0.30% |

| 49 | CAPITAL GROUP INTERNATIONAL, INC. | US | 39.48% | 0.30% |

| 50 | CHINA PETROCHEMICAL GROUP CO. | CN | 39.78% | 0.30% |

As of 2007, the Quaker-origin banks, Barclays and Lloyds, had

4.56% control of the worlds publicly traded corporations, vs.

4.35% for J.P. Morgan-Chase, Merrill Lynch, Goldman Sachs, Morgan Stanley, and Bank of America combined.

France had 4.19%, the rest of Britain had 3.7%.

This despite there likely being fewer than half a million silent-meeting Quakers in the US and Britain in history, peaking at 80,000 in the late 1600s, with about 50,000 or so today, of whom only a very small fraction have long Quaker ancestry.

Fascinating summary – thanks, because I have not read the paper. Some random thoughts on the control of the world by a bunch of financiers (plus China Petrochemical Group):

-

There seems to be a lot of financing for wars & military, even if Quakers were the origin of the largest financiers.

-

The financiers are mostly handling Other People’s Money – a very large number of customers, who can shift their funds easily if dissatisfied. Perhaps it would be fairer to say that the financiers have influence rather than control?

-

To make something happen would probably require about 20% control – which would require at least getting the Top 10 financiers all to agree. Getting 10 organizations to agree to almost anything is presumably quite a tough challenge.

-

Maybe the real control lies with those (often non-financiers) who create the culture? Thus we see oil companies spending huge sums on “Global Warming” and media companies committing suicide over DIE.

There seems to be a lot of financing for wars & military, even if Quakers were the origin of the largest financiers.

Control has long since passed out of Quaker hands, but even early on the supposed pacifism of the Quakers was somewhat flexible, for example: they restarted lead mining in Britain, which also yielded some silver, which was pretty much the only domestic source of currency. Lead has lots of non-munitions applications, but supplying lead to the market certainly made military applications cheaper. Quaker banking success had more to do with being honest, being seen to be honest, and not wasting money on ostentatious displays than anything else. Barclay’s was the main factor of commercial paper early on, which was a much bigger business than dealing in specie. Lloyd’s Bank (not to be confused with the insurance market) started as a Birmingham iron warehouse, often dealing in the iron made by the Quaker Darbys of Coalbrookdale, then offering it on credit and financing the Industrial Revolution. There were many other Quaker banks, forming a cartel which merged into Barclay’s in 1896.

The financiers are mostly handling Other People’s Money – a very large number of customers, who can shift their funds easily if dissatisfied. Perhaps it would be fairer to say that the financiers have influence rather than control?

Fair enough, though the distinction is slight if the control is low-key. Quakers are used to doing everything through consensus, you can’t tick off anyone in Meeting and expect to get anything done. The principal competing old financial cartel, the HSBC nexus (which doesn’t appear on the list), tends to operate in a quite different way, more “overtly covert”, less scrupulous, and using power more bluntly:

Rothschild / (too many interests / partners / cutouts to list) but particularly Keswick / Jardine Matheson ( the only outside shareholders in the Rothschild Bank until a few years ago) and the Sassoons. The foundation of the Rothschild fortune was financing (and being financed by) European monarchs and their wars, the “first floor” was having the best commercial intelligence network in Europe, and the rest of the skyscraper is mostly shrouded by clouds. It’s questionable how important HSBC would be without intelligence agencies and opium profits. Ian Fleming managed to get his job in Naval Intelligence through his family connections to the Keswicks, as well as Schiff, Kuhn & Loeb.

The Quakers might shun you, but the HSBC network guys play hardball. (See James Bond and the Killer Bag Lady, published in Salon in 2012. Nick Deak, an old school OSS banker, got careless with some very scary Other People’s Money. The story traces the wind-up assassin back to her psychiatrist and beyond.)

To make something happen would probably require about 20% control – which would require at least getting the Top 10 financiers all to agree. Getting 10 organizations to agree to almost anything is presumably quite a tough challenge.

There are two ways of dealing with this for Cabal: first, you have a community of people who all think the same way and come to the same decisions without needing to coordinate; second, if that isn’t sufficient, you have blackmail and hit-men. There’s some intermediate steps, but that’s the gist.

Maybe the real control lies with those (often non-financiers) who create the culture? Thus we see oil companies spending huge sums on “Global Warming” and media companies committing suicide over DIE.

Everybody needs money, especially the people who create the culture. How much happens without “donations”, “philanthropy”, endowed chairs, grants, book deals … It may seem that both sides get funding in the “culture wars”, admittedly far more for the winning, “progressive” side, but that’s just basic dialectic engineering – to control the outcome, the synthesis, you have to control both the opposing forces, the thesis and the antithesis, so that they are almost equal – but the little variations in their relative strength are where all the control is achieved, like two chopsticks pushing against one another to convey the morsel to the mouth, or the hammer against the anvil to forge, say, a sickle.

Incidentally, in James Clavell’s novels Tai-Pan and Noble House, among others, Jardine Matheson served as the inspiration for Struan and Company, and HSBC for Victoria Bank. For sheer entertainment and story development, I consider Noble House one of the best novels I’ve ever read.