I have written here earlier about the potential consequences of central banks freezing the foreign exchange reserves of the Russian central bank, an unprecedented event since the origin of the current international monetary system in the aftermath of World War II. More recently, I noted that volatility in Credit Default Swaps (CDS) indicated a growing perception of instability in the ability of sovereign debtors to meet their obligations.

On 2022-03-07, Zoltan Pozsar, a New York based investment strategist at Swiss bank Credit Suisse, issued a report, prominently labeled by the bank “THIS IS NOT RESEARCH”, titled “Bretton Woods III” [PDF], in which he contends:

We are witnessing the birth of Bretton Woods III – a new world (monetary) order centered around commodity-based currencies in the East that will likely weaken the Eurodollar system and also contribute to inflationary forces in the West.

A crisis is unfolding. A crisis of commodities. Commodities are collateral, and collateral is money, and this crisis is about the rising allure of outside money over inside money. Bretton Woods II was built on inside money, and its foundations crumbled a week ago when the G7 seized Russia’s FX reserves…

The beautiful paradox of linear rates (the stuff you trade and I write about) is that you need to think linear to find relative value most of the time, but you have to think non-linear to recognize and survive regime shifts. We are seeing a regime shift unfold in funding markets currently (which, as always, will pass), and a sea change in inflation dynamics and FX reserve management practices.

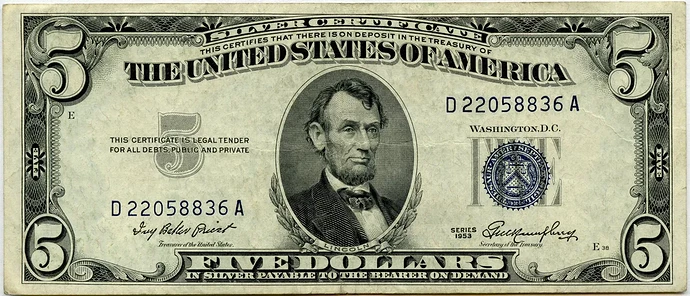

“Bretton Woods” refers to the international monetary system put in place after World War II by the victors at a conference held in that New Hampshire resort town, and described in Benn Steil’s 2013 book, The Battle of Bretton Woods (link is to my review). That system was based upon a hybrid reserve standard of gold and the U.S. dollar, and was destroyed in August 1971 when U.S. president Richard Nixon unilaterally renounced the link between the U.S. dollar and gold and defaulted on the U.S. obligation under Bretton Woods to exchange dollars held by other central banks for gold at a fixed exchange rate.

Pozsar calls the system of floating exchange rates among fiat currencies not backed by gold, which was largely in place by 1973, “Bretton Woods II” (although it was not the result of a formal agreement like the system it replaced). This system, with tweaks and occasional speed bumps, persisted for almost half a century until, in Pozsar’s view, it was blown up in March 2022 by the decision of the U.S. and other large central banks to freeze the foreign exchange reserves deposited with them by the Russian central bank.

This crisis is not like anything we have seen since President Nixon took the U.S. dollar off gold in 1971 – the end of the era of commodity-based money.

The “Bretton Woods II“ era was based upon “inside money”: fiat currency reserves held by and at central banks, and the belief that these assets were as good and as safe as physical gold held in central bank vaults under the original Bretton Woods regime. Overnight, with the freezing of Russia’s central bank reserves, this confidence has been destroyed, and, once lost, is not likely to be restored.

At the end of a lengthy and detailed analysis, considering in particular the risks and opportunities this situation presents to China, Pozsar concludes,

When this crisis (and war) is over, the U.S. dollar should be much weaker and,on the flipside, the renminbi much stronger, backed by a basket of commodities.

From the Bretton Woods era backed by gold bullion, to Bretton Woods II backed by inside money (Treasuries with un-hedgeable confiscation risks), to Bretton Woods III backed by outside money (gold bullion and other commodities).

After this war is over, “money” will never be the same again…and Bitcoin (if it still exists then) will probably benefit from all this.

This is detailed analysis by financial geeks for financial geeks, written in financial geek-speak, with enough jargon and acronyms to “land a man on the Moon and return him safely to the Earth”. Here is a brief glossary with links.

- FX Foreign exchange

- FRA-OIS spread The difference between the rate on Forward Rate Agreements (FRA) and Overnight Index Swaps (OIS) between banks, taken as an indication of stress in the banking system, as banks consider lending to one another more risky.

- bps Basis points: 100 basis points are one percent.

- CCP Central counterparty clearing: an institution, such as a commodity exchange, that manages payments for contracts which it trades

- CDS Credit default swap: essentially, insurance against a debtor failing to pay interest or repay principal on a loan

- bond RV Fixed-income relative-value investing, a strategy made famous by Long-Term Capital Management

- CDO Collateralized debt obligation, the brilliant idea behind the 2008 financial crash

- SIV Structured investment vehicle, another financial innovation that brought on the 2008 excitement

- QE Quantitative easing (money printing)

- SRF Standing Repo Facility (money printing)

- PBoC People’s Bank of China; Chinese central bank

- G-SIB Globally Systemically Important Banks (too big to fail)

This is a complex and detailed analysis, but it is the first I’ve seen that takes seriously the consequences of what has happened in the last few days: the demolition of the foundation of the international financial system which has been in place for half a century. It is impossible to forecast all of the eventual consequences of this or to foresee what new order (or disorder) may replace it, but the risks and opportunities in such a period of instability are likely to be very large indeed.