Did you happen to see Peter Schiff’s comment with regard to Saylor’s proposal for the government to sell all of its gold to buy Bitcoin?

Peter said the government could save money by making its own cryptocurrency, limit its supply just like BTC and declare that it could be used as a currency.

I would add that they could do a number of things:

-They could set the value to the same as BTC initially.

-They could hold a large reserve and then divvy up the remainder equally amongst US citizens.

He wasn’t actually proposing it as if he supported the idea. It was Peter taking a shot at BTC.

I think it was a good jab. It points out that there is nothing technically unique about BTC. It points out that BTC supporters like Saylor have strayed a long way away from the original reasons for BTC. It points out the pit Saylor stepped into by pointing out that the government could just issue its own crypto and if your a supporter of governments owning Bitcoin what is your argument against the government creating its own crypto. If there is a government backed coin that is technically equivalent and implements a better technology than Bitcoin, what is the value of Bitcoin.

I consider Saylor a pumper. Even when I watched the interview with Lex, he struck me as a pumper. Lex did a crappy job of challenging him on anything. Many of the original arguments for Bitcoin that I found compelling have truly faded.

The original intent of bitcoin was to be a purely peer-to-peer version of electronic cash that would allow online payments to be sent directly from one party to another without going through a financial institution. It would be anonymous. It would use cryptography instead of third parties as verification. It would be limited in the number of bitcoins produced to prevent inflation.

There are always people that just regurgitate whatever they believe, but does anyone truly knowledgeable about BTC believe it will be a means of exchange as originally intended? It seems to me that it is now being positioned as digital gold. That the means of exchange will be “built on top” of BTC.

I think the built in assumption is that BTC will be the base money similar to gold and the monetary system would function like it did on a gold standard.

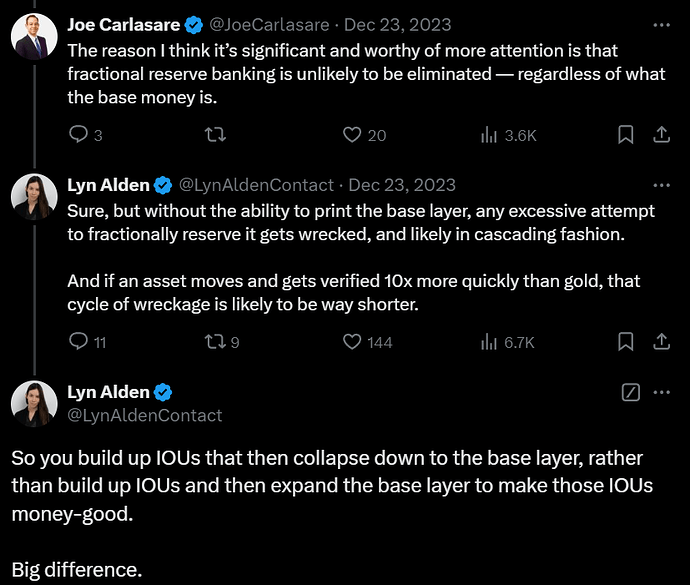

Below is a snippet of an exchange that includes Lyn Alden. It started with Joe stating the fact that banks create money whenever they create a loan and this expands the money supply.

She is pointing out that today the Fed steps in and papers over issues when credit bubbles collapse by expanding base money. She is correct that there is a big difference, but this does not answer the question of what happens then? When IOUs collapse down to base money and the base money cannot expand… sounds to me like what happened at the start of the great depression. Maybe she is saying it would collapse before it got this big. Ok, but we also know historically that inadequate money supply has created problems.

It also sounds like the monetary system based on Bitcoin that Lyn is advocating looks almost identical to the gold backed system except somehow the system will be better because it will detect problems sooner before they get too big. That assumes the system knows how many IOUs is too many IOUs.

It also ignores how the gold backed system went belly up. Magically governments will stop overspending by having wars like WW1 or racking up 37 trillion in debt without a war. BTC will fix this because it is faster?