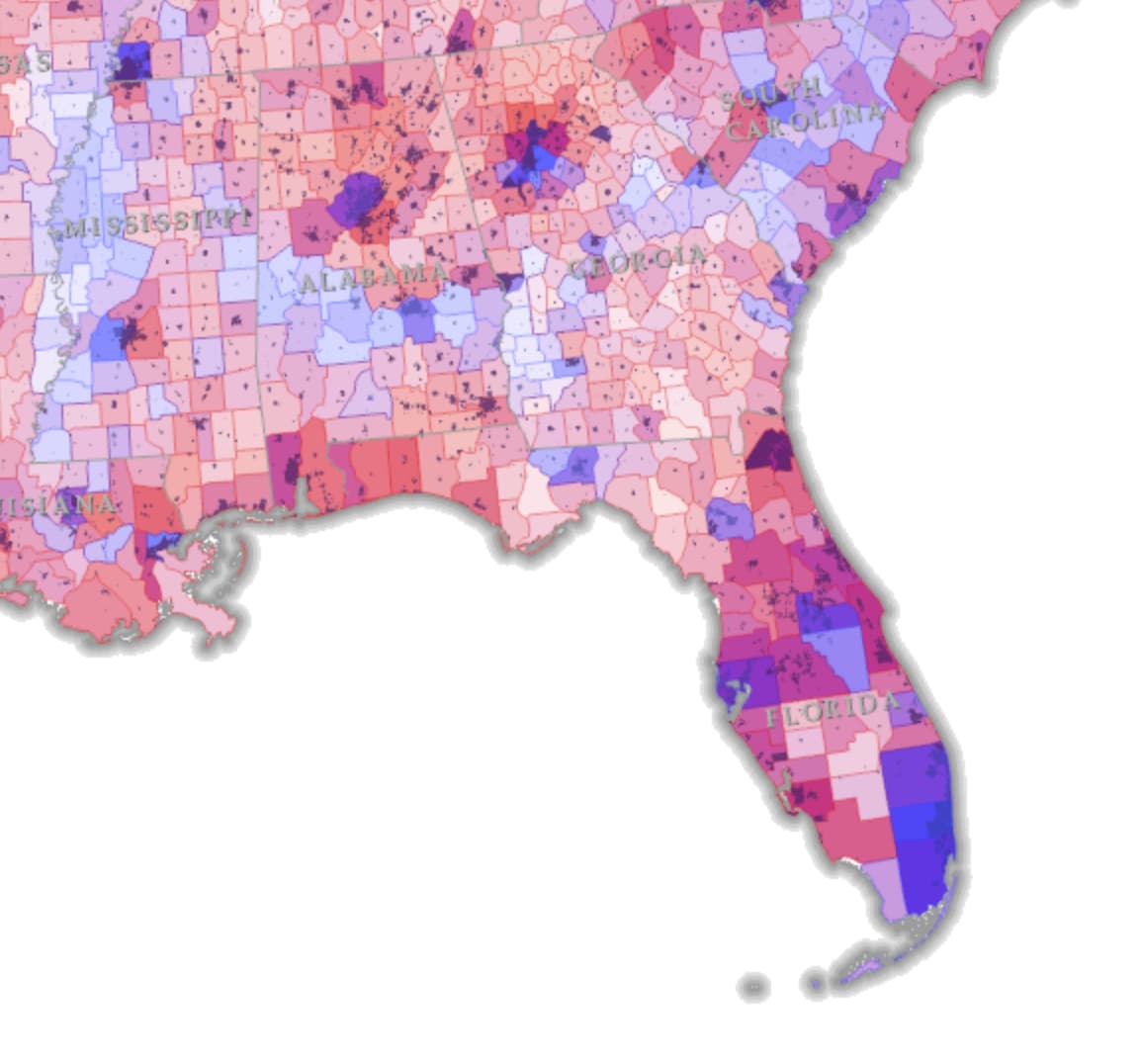

Heh. Floridians hate Florida. Not sure about that data point, but maybe.

Florida has a lot of immigrants who have little opinion of other states.

Internal migrants, being from many states, will self-dilute their hatred for their former states or the adversaries of their former states.

And may of those internal migrants are retirees coming for the weather.

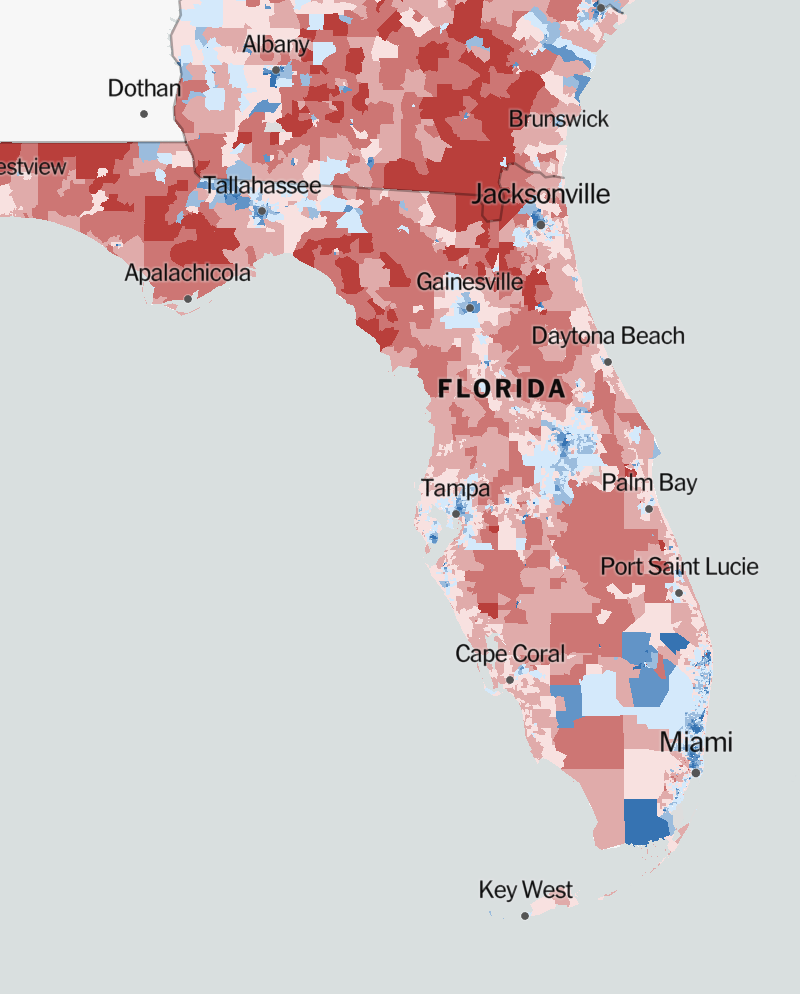

From what I hear, Florida has a lot of internal polarization, with very Red and very Blue areas.

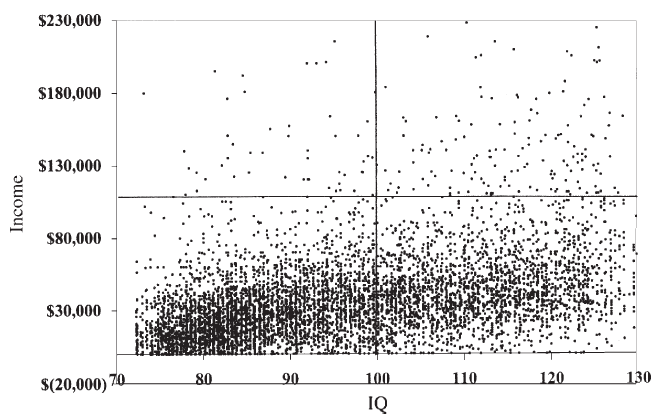

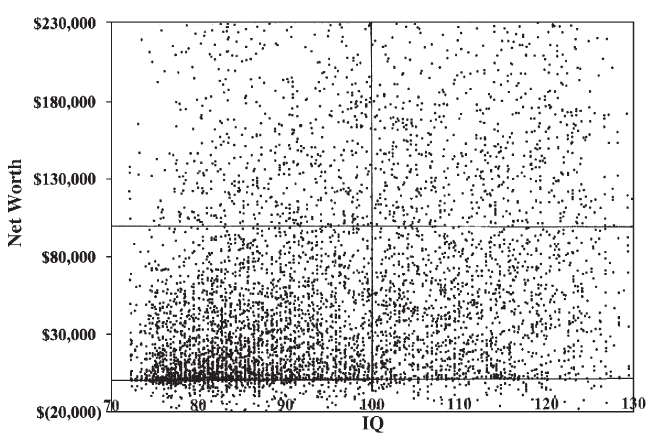

Zagorsky, J. L. Do you have to be smart to be rich? The impact of IQ on wealth, income and financial distress. Intelligence (2007), PDF.

From the NLSY79 dataset, one of the largest. The data is for Boomers in 2004

Fig. 2, which tracks net worth, is quite different. Here

the upper right quadrant (623 respondents) has almost

the same number as the upper left (517). The ratios show

people with above-average IQ scores are only 1.2 times

as likely as individuals with below-average IQ scores to

have a comparatively high net worth. Simply put, there

are few individuals with below-average IQ scores who

have high income but there are relatively large numbers

who are wealthy… In 2004 the typical young baby boomer had an overall

median net worth of $55,250 and a median income of

$35,918.

The IQ-income correlation was 0.3, IQ-net worth correlation was 0.16 (and essentially 0 for IQs above 100.) Income-net worth correlation was 0.39, and the other roughly 30 correlations with net worth were very low, e.g 0.17 for education, 0.18 for amount inherited, -0.09 Black.

Since intelligence scores indicate the probability of being right on a given question and the difficulty of questions one can answer at any given rate of success, it is VERY odd, even sinister, that there is no correlation between intelligence and wealth. There is something really wrong with the US and maybe the world, something that, I think, hasn’t yet been identified.

Very sinister

It would be interesting to see the NW distribution above $230k – there may be notable outliers. If this was 2007, it is a little scary to think what it might be today, even when adjusted for inflation.

BTW, the link to PDF did not work for me. This one did work:

Not surprising. A big element of “Net Worth” is inheritance. History clearly demonstrates that the children of highly intelligent (& successful) people often revert to the mean – or below the mean. Hence we would not expect to see a strong correlation between intelligence and Net Worth.

The PDF didn’t work for me.

The charts might back the hypothesis that you can get rich without high IQ or be poor with high IQ. None of us needed a study to know this. If that was the purpose, J.L. wasted a lot of time and probably taxpayer money to show something everyone already knows (unless they live in an elite bubble).

I have seen this or something similar tweeted by Nassim Taleb backing his claim that those that talk about IQ are racist.

I take exception to this used as an argument by Nassim.

I believe in the US people associate money with intelligence and money with being “good”. I don’t believe either. The people I want to be associated with have good values and these are not associated with the amount of money or intelligence they do or don’t possess.

However, intelligence is important to the advancement of humankind. Therefore, the question is whether intelligence is important to the invention of things like the integrated circuit or nuclear energy.

I remember hearing that there are more professional-level basketball players on playgrounds than there are actual professional basketball players. I don’t know if that is true, but I wouldn’t doubt it. Thus, there may not be a correlation between having professional level skills in basketball and level of competition reached. The important thing is whether you can have a professional level basketball player that has low skill.

You don’t necessarily have to do a study to know. Does anyone believe that the integrated circuit could have been invented by a person with an IQ of 90? Does anyone believe that you could take a random selection of IQ 80 and they would do as well as a random group of with IQ 120 on any problem solving area?

William Shockley understood the effects of low IQ

Thanks, the original link still works for me, copying the link from Google Scholar with or without site tracking gives the same link I used.

The correlation between amount inherited and net worth is only 0.18, explaining only 3.24% of the variance, which is only 0.68% more than is explained by IQ. Nothing correlates highly or even moderately with net worth, which is deeply weird. For instance, number of inheritances received correlates much better with IQ (0.32) than it does with net worth (0.2). The psychological measures (locus of control, self-esteem and mastery) correlate 0.24-0.31 with IQ, but only 0.07-0.12 with net worth.

The reversion-to-the-mean argument doesn’t make any sense, even if inheritance were driving net worth, which it isn’t. Reversion is a statistical illusion, related to measurement error – below-average parents can expect their kids to score higher (closer to the mean) than they did, but can also expect that their own parents also scored higher, and even that they themselves scored higher in the past and will score higher in the future. The same is true if one replaces “below-average” and “higher” with “above-average” and “lower”.

Tests don’t correlate perfectly with each other, even retesting the same person with a different version or form of the same test will not correlate 1.0. Correlation typically is not constant across the range, it generally falls in the tails, particularly the upper range, where ceiling effects come into play and single-question raw score differences translate into large scaled-score differences. For instance, Grady Towers calculated that if the correlation in the 160 IQ (top 1 in 30,000) range between two tests is 0.7, then the chance that a person who scored 160 on one test will do so on the other test is only 8.7%.

Here’s a visual explanation:

(The example should show about a third of Mensans having scored at the 133 IQ / 1-in-50 level would do so on the next attempt, again assuming a 0.7 correlation.)

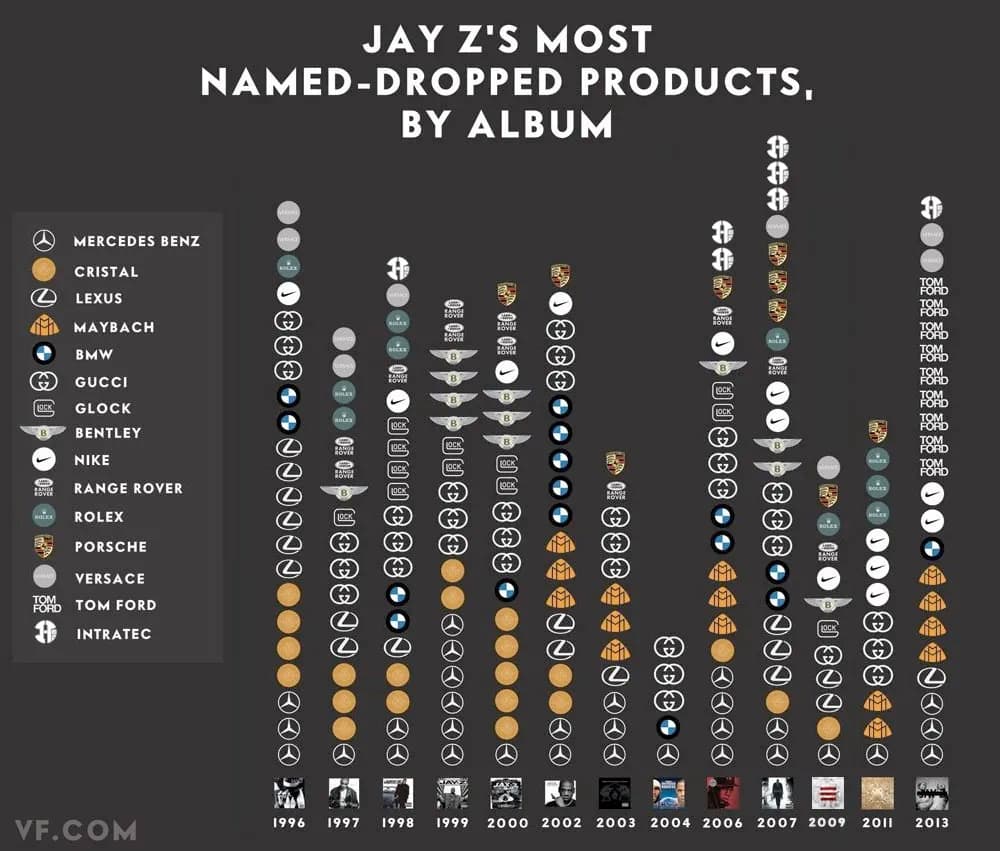

Also see The Crazy Years - #4229 by eggspurt and Song lyrics have become simpler and more repetitive over the last five decades | Scientific Reports :

We find that pop music lyrics have become simpler and easier to comprehend over time: not only does the lexical complexity of lyrics decrease (for instance, captured by vocabulary richness or readability of lyrics), but we also observe that the structural complexity (for instance, the repetitiveness of lyrics) has decreased. In addition, we confirm previous analyses showing that the emotion described by lyrics has become more negative and that lyrics have become more personal over the last five decades.

“The charts might back the hypothesis that you can get rich without high IQ or be poor with high IQ.”

Not just that, it shows that being chronically right (smart) is not economically rewarded over being chronically wrong. It also shows that intelligence is of no more aid in investing than a horoscope or a dartboard. It shows that deciding where and how the whole nation’s capital is invested is being done by unintelligent people. It shows that the vaunted intelligence of markets is entirely mythical; as a society, we’re using random number generators to allocate our capital to members of society.

Moral reasoning tests are strongly associated with intelligence.

(In the Know / Debunking 35 Myths about Human Intelligence, Warne, p.74)

Indeed! Deeply weird. The only ways to get recorded Net Worth are:

to earn it (eg Musk),

to inherit it (e.g Rockefeller descendants),

to get it corruptly (eg Biden),

or to lie about having it (or to lie about not having it).

If nothing correlates, then that suggests the data is not what the data analyst thought it was. The definition used for Net Worth might be worth a closer look.

If net worth came mostly from chance, such as getting lucky from gambling, financial speculation, getting hired to a Boomer job (easy with high pay), etc. or just not getting unlucky, that would match the data. Even with poker, though, intelligence counts for a lot more than is seen in real-world net worth.

Something is systematically suppressing the wealth-accumulating capabilities of intelligent people exactly in proportion to their intelligence. I don’t see any way it can happen naturally or unintentionally, which doesn’t quite prove a vast plot – but it certainly gives a wink and a nudge, particularly when combined with other oddities, such as the question of why, despite IQ being the best predictor of job performance, much better than experience and education combined, intelligence is hardly used in hiring. The school / bank credit / HR hivemind, when backed by gov’t and commercial information-gathering operations could exert that kind of semi-covert control. There are innumerable other indications of a community of corrupt interests having infiltrated all large, influential or powerful institutions and of covert coordination, planning and action of this cabal or community of cabals. That’s the reasonable, materialist explanation – but sometimes the coordination seems practically supernatural, as with net-worth-IQ, and one wonders whether something our ancestors would have denoted “demonic” is behind it.

I have a friend who works in private equity. He told me that a lot of smart people are terrible investors

On the other hand if you are a good investor, net positive ROI, then you must be doing something right, it can’t all be luck ![]()

For financial or business success, you need to have deep knowledge of a field or industry that few people understand or I should have simply called it insider knowledge. I don’t mean insider as in insider trading but it’s the same principle: knowledge is power, invest with an edge.

Financial literacy, is it correlated with regular literacy or IQ? Maybe financial literacy is about knowledge not intelligence?

I have dabbled in real estate in the recent past. What do realtors say? The mantra is location location location! Before you buy a house or investment property, you have to ascertain the quality of the location or neighborhood. Will this neighborhood be more desirable 10 years from now? For an investment property, are rents trending up or down?

Austin has had a major oversupply in housing in the last 12 months. I asked a friend who lives there and recently negotiated his rent down to reflect new market conditions in Austin. What is going on in Austin? Why are vacancies increasing?

His answer: a lot of Airbnb vacancies in Austin. Some neighborhoods and HOA are finally cracking down on Airbnb excesses.

FYI you don’t need high IQ to be an effective landlord. The most important task is to find high quality tenants.

Personal disclosure: I will eventually divest my family real estate holdings.

Apologies for the digression

TLDR you don’t need a 150 IQ to be a profitable investor. A lot of smart people suck at investing

Income is correlated with education and or IQ

Education is not IQ and vice versa.

Income is correlated with net worth?

It should be but so many high income earners live paycheck to paycheck!!!

Isn’t quality of life correlated with IQ?

We know low IQ is correlated with crime and violence

The main cause is the anti merit agenda.

Another reason is the hiring process is flawed. People should use IQ to vet candidates. I think test scores like SAT GMAT GRE etc can be effective for vetting too. I ignore LSAT for obvious reasons.

A good network is essential for finding new jobs for career advancement. The best way to get hired is if your friend already works there and can give you glowing references.

Does networking require high IQ?

Salespeople are not brainiacs but a good one can collect bonuses every quarter. In fact being smart can be a detriment for sales men. Salesmen have to be resilient because they will get rejections. They need to have a short memory like a baseball pitcher who lost a game or blew a lead. New game tomorrow, you have to focus on the present and future and forget about the past rejections.

What I wrote above, successful salesmen do automatically without thinking. A thinking salesman will end up like Willy Loman